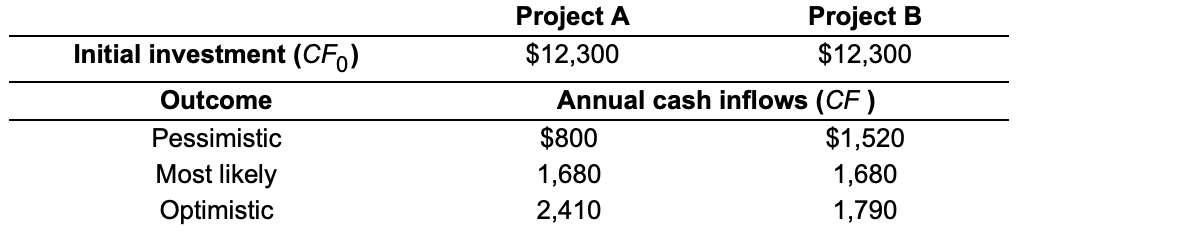

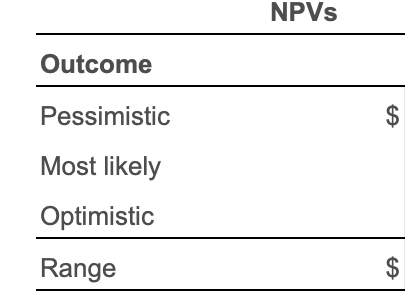

Question: 1. Basic scenario analysis Prime Paints is in the process of evaluating two mutually exclusive additions to its processing capacity. Thefirm's financial analysts have developedpessimistic,

1. Basic scenario analysis Prime Paints is in the process of evaluating two mutually exclusive additions to its processing capacity. Thefirm's financial analysts have developedpessimistic, mostlikely, and optimistic estimates of the annual cash inflows associated with each project. These estimates are shown in the following table.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts