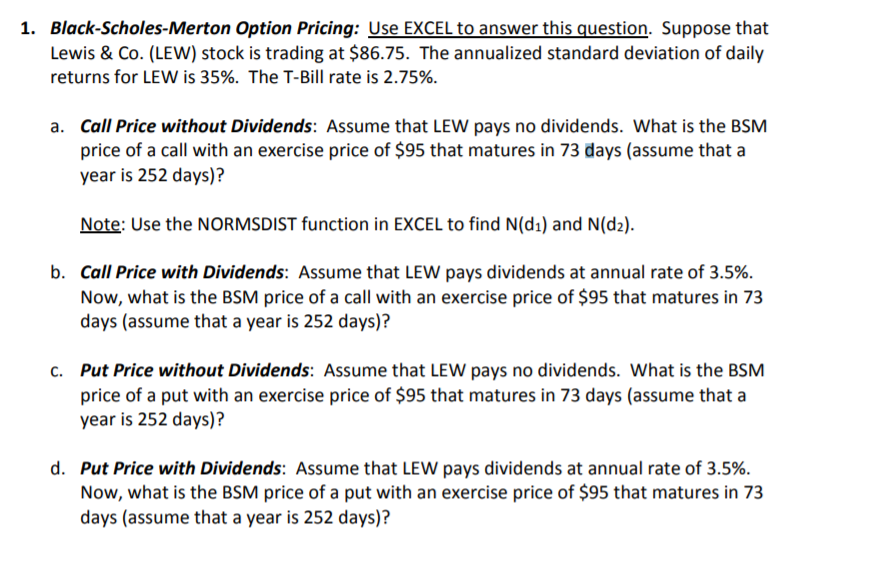

Question: 1. Black-Scholes-Merton Option Pricing: Use EXCEL to answer this question. Suppose that Lewis & Co. (LEW) stock is trading at $86.75. The annualized standard deviation

1. Black-Scholes-Merton Option Pricing: Use EXCEL to answer this question. Suppose that Lewis & Co. (LEW) stock is trading at $86.75. The annualized standard deviation of daily returns for LEW is 35%. The T-Bill rate is 2.75%. Call Price without Dividends: Assume that LEW pays no dividends. What is the BSM price of a call with an exercise price of $95 that matures in 73 days (assume that a year is 252 days)? a. Note: Use the NORMSDIST function in EXCEL to find N(d) and N(d2). Call Price with Dividends: Assume that LEW pays dividends at annual rate of 3.5%. Now, what is the BSM price of a call with an exercise price of $95 that matures in 73 days (assume that a year is 252 days)? b. Put Price without Dividends: Assume that LEW pays no dividends. What is the BSM price of a put with an exercise price of $95 that matures in 73 days (assume that a year is 252 days)? C. Put Price with Dividends: Assume that LEW pays dividends at annual rate of 3.5%. Now, what is the BSM price of a put with an exercise price of $95 that matures in 73 days (assume that a year is 252 days)? d. 1. Black-Scholes-Merton Option Pricing: Use EXCEL to answer this question. Suppose that Lewis & Co. (LEW) stock is trading at $86.75. The annualized standard deviation of daily returns for LEW is 35%. The T-Bill rate is 2.75%. Call Price without Dividends: Assume that LEW pays no dividends. What is the BSM price of a call with an exercise price of $95 that matures in 73 days (assume that a year is 252 days)? a. Note: Use the NORMSDIST function in EXCEL to find N(d) and N(d2). Call Price with Dividends: Assume that LEW pays dividends at annual rate of 3.5%. Now, what is the BSM price of a call with an exercise price of $95 that matures in 73 days (assume that a year is 252 days)? b. Put Price without Dividends: Assume that LEW pays no dividends. What is the BSM price of a put with an exercise price of $95 that matures in 73 days (assume that a year is 252 days)? C. Put Price with Dividends: Assume that LEW pays dividends at annual rate of 3.5%. Now, what is the BSM price of a put with an exercise price of $95 that matures in 73 days (assume that a year is 252 days)? d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts