Question: 1 Bond Duration Project (Example) 2 Bonds are sensitive to interest rate risk, which means that when interest rates rise, the value of the bond

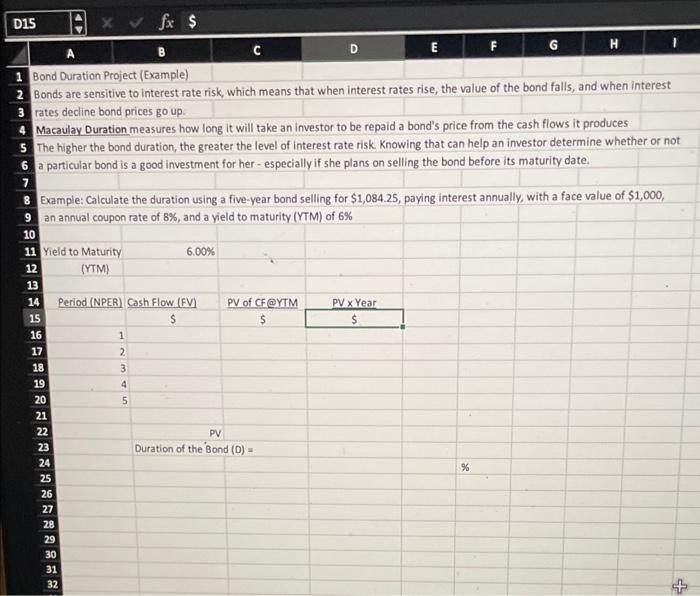

1 Bond Duration Project (Example) 2 Bonds are sensitive to interest rate risk, which means that when interest rates rise, the value of the bond falls, and when interest 3 rates decline bond prices go up. 4 Macaulay Duration measures how long it will take an investor to be repaid a bond's price from the cash flows it produces 5 The higher the bond duration, the greater the level of interest rate risk Knowing that can help an investor determine whether or not. 6 a particular bond is a good investment for her-especially if she plans on selling the bond before its maturity date. 7 8 Example: Calculate the duration using a five-year bond selling for $1,084.25, paying interest annually, with a face value of $1,000, 9 an annual coupon rate of 8%, and a vield to maturity (YTM) of 6% 11 Yield to Maturity 6.00% 12 (YTM) \begin{tabular}{|c|c|c|c|} \hline 14 & Period (NPER) & PVofCF@YTMCashFlow(FV) & PV Year \\ \hline 15 & $ & $ & $ \\ \hline 16 & 1 & & $ \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline 16 & 1 \\ \hline 17 & 2 \\ \hline 18 & 3 \\ \hline 19 & 4 \\ \hline 20 & 5 \\ \hline \end{tabular} Duration of the Bond (D)= %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts