Question: Can someone please help me with this homework problem? Need to select 4 random government bonds and find duration and rebalance. All subquestions are in

Can someone please help me with this homework problem? Need to select 4 random government bonds and find duration and rebalance. All subquestions are in screenshot

Can someone please help me with this homework problem? Need to select 4 random government bonds and find duration and rebalance. All subquestions are in screenshot

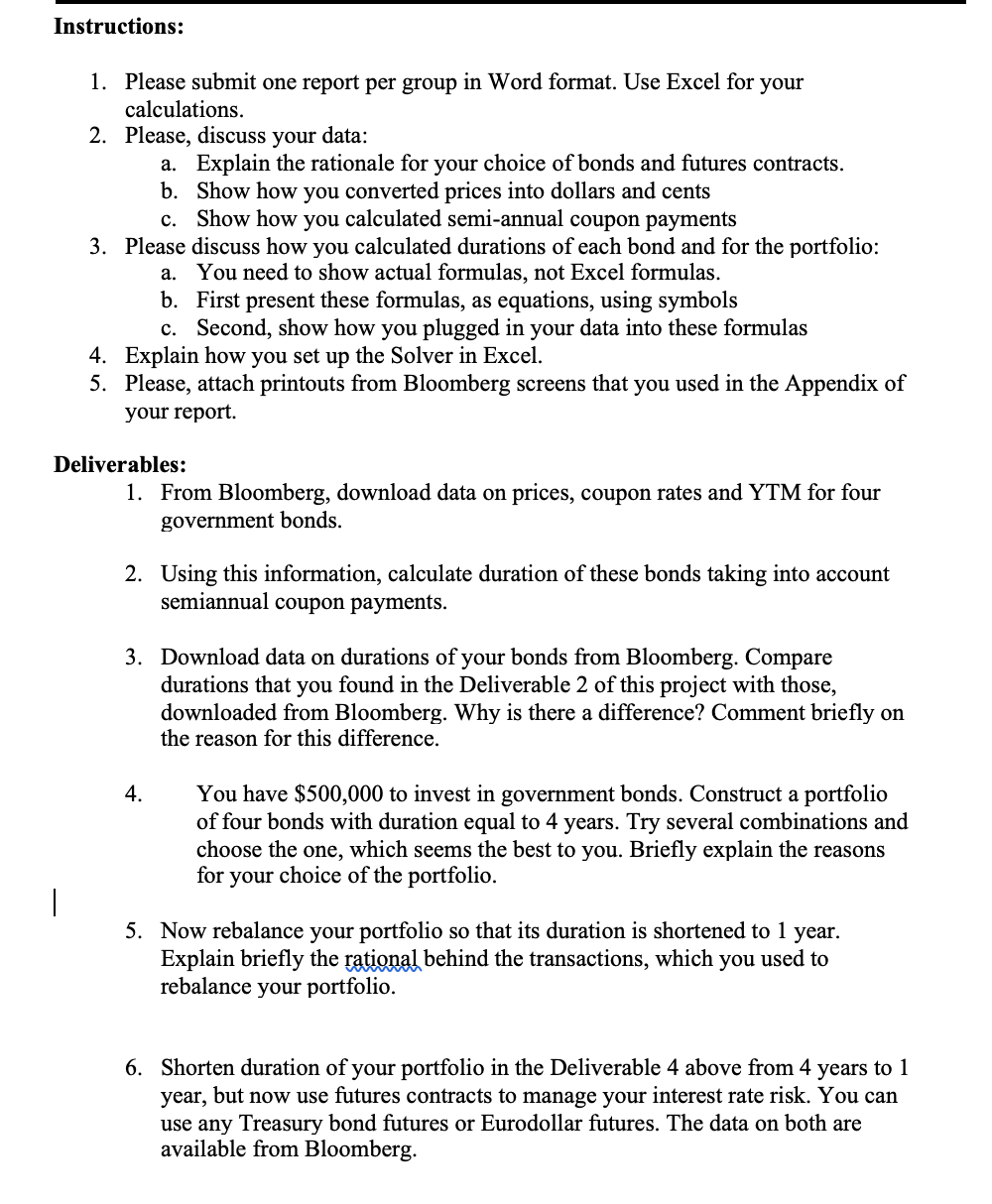

Instructions: 1. Please submit one report per group in Word format. Use Excel for your calculations. 2. Please, discuss your data: a. Explain the rationale for your choice of bonds and futures contracts. b. Show how you converted prices into dollars and cents c. Show how you calculated semi-annual coupon payments 3. Please discuss how you calculated durations of each bond and for the portfolio: a. You need to show actual formulas, not Excel formulas. b. First present these formulas, as equations, using symbols c. Second, show how you plugged in your data into these formulas 4. Explain how you set up the Solver in Excel. 5. Please, attach printouts from Bloomberg screens that you used in the Appendix of your report. Deliverables: 1. From Bloomberg, download data on prices, coupon rates and YTM for four government bonds. 2. Using this information, calculate duration of these bonds taking into account semiannual coupon payments. 3. Download data on durations of your bonds from Bloomberg. Compare durations that you found in the Deliverable 2 of this project with those, downloaded from Bloomberg. Why is there a difference? Comment briefly on the reason for this difference. You have $500,000 to invest in government bonds. Construct a portfolio of four bonds with duration equal to 4 years. Try several combinations and choose the one, which seems the best to you. Briefly explain the reasons for your choice of the portfolio. 5. Now rebalance your portfolio so that its duration is shortened to 1 year. Explain briefly the rational behind the transactions, which you used to rebalance your portfolio. 6. Shorten duration of your portfolio in the Deliverable 4 above from 4 years to 1 year, but now use futures contracts to manage your interest rate risk. You can use any Treasury bond futures or Eurodollar futures. The data on both are available from Bloomberg. Instructions: 1. Please submit one report per group in Word format. Use Excel for your calculations. 2. Please, discuss your data: a. Explain the rationale for your choice of bonds and futures contracts. b. Show how you converted prices into dollars and cents c. Show how you calculated semi-annual coupon payments 3. Please discuss how you calculated durations of each bond and for the portfolio: a. You need to show actual formulas, not Excel formulas. b. First present these formulas, as equations, using symbols c. Second, show how you plugged in your data into these formulas 4. Explain how you set up the Solver in Excel. 5. Please, attach printouts from Bloomberg screens that you used in the Appendix of your report. Deliverables: 1. From Bloomberg, download data on prices, coupon rates and YTM for four government bonds. 2. Using this information, calculate duration of these bonds taking into account semiannual coupon payments. 3. Download data on durations of your bonds from Bloomberg. Compare durations that you found in the Deliverable 2 of this project with those, downloaded from Bloomberg. Why is there a difference? Comment briefly on the reason for this difference. You have $500,000 to invest in government bonds. Construct a portfolio of four bonds with duration equal to 4 years. Try several combinations and choose the one, which seems the best to you. Briefly explain the reasons for your choice of the portfolio. 5. Now rebalance your portfolio so that its duration is shortened to 1 year. Explain briefly the rational behind the transactions, which you used to rebalance your portfolio. 6. Shorten duration of your portfolio in the Deliverable 4 above from 4 years to 1 year, but now use futures contracts to manage your interest rate risk. You can use any Treasury bond futures or Eurodollar futures. The data on both are available from Bloomberg

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts