Question: 1 Bond pricing A 20-year maturity bond with par value $1.000 makes semiannual coupon payments at the coupon rate of 8%. replicate the example in

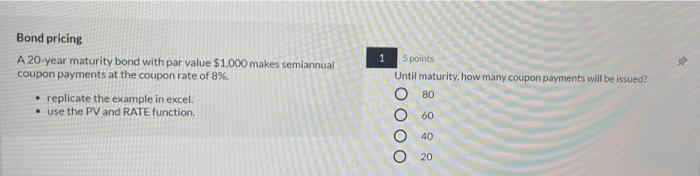

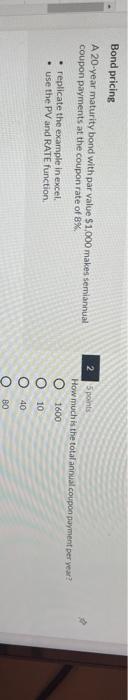

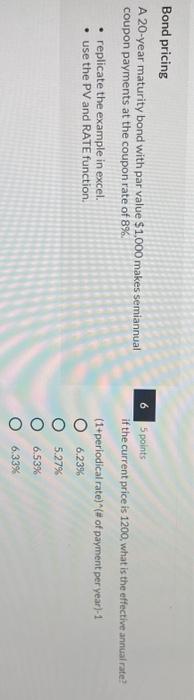

1 Bond pricing A 20-year maturity bond with par value $1.000 makes semiannual coupon payments at the coupon rate of 8%. replicate the example in excel. use the PV and RATE function 5 points Until maturity, how many coupon payments will be issued? 80 60 OOOO 40 20 Bond pricing A 20-year maturity bond with par value $1.000 makes semiannual coupon payments at the coupon rate of 8% 2 5 points How much is the total anual coupon payment per year? O 1600 replicate the example in excel. use the PV and RATE function 10 OOOO 40 8 Bond pricing A 20-year maturity bond with par value $1,000 makes semiannual coupon payments at the coupon rate of 8%. replicate the example in excel. use the PV and RATE function 6 points if the current price is 1200, what is the effective annual rate? (1+periodical rate)"(# of payment per year)-1 6.23% 5.2796 OOOO 6.53% 6.33%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts