Question: 3 Bond pricing A 20-year maturity bond with par value $1.000 makes semiannual coupon payments at the coupon rate of 8%. replicate the example in

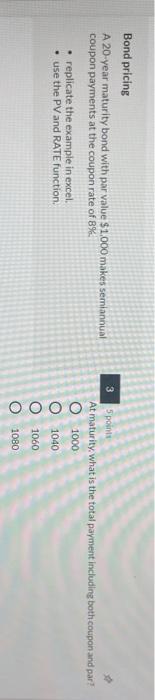

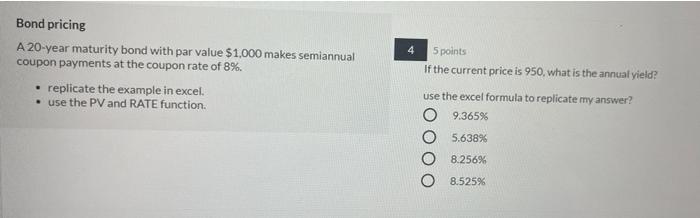

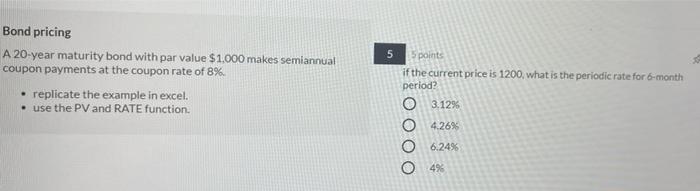

3 Bond pricing A 20-year maturity bond with par value $1.000 makes semiannual coupon payments at the coupon rate of 8%. replicate the example in excel. use the PV and RATE function 5 points At maturity, what is the total payment including both coupon and par? O 1000 01040 1060 1080 4 Bond pricing A 20-year maturity bond with par value $1,000 makes semiannual coupon payments at the coupon rate of 8%. replicate the example in excel. use the PV and RATE function. 5 points If the current price is 950, what is the annual yield? use the excel formula to replicate my answer? 9.365% O 5.638% 8.256% 8.525% 5 Bond pricing A 20-year maturity bond with par value $1.000 makes semiannual coupon payments at the coupon rate of 8% replicate the example in excel. . use the PV and RATE function. 5 points if the current price is 1200, what is the periodic rate for 6-month period? 03.12% 0 4.26% 6.249 4%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts