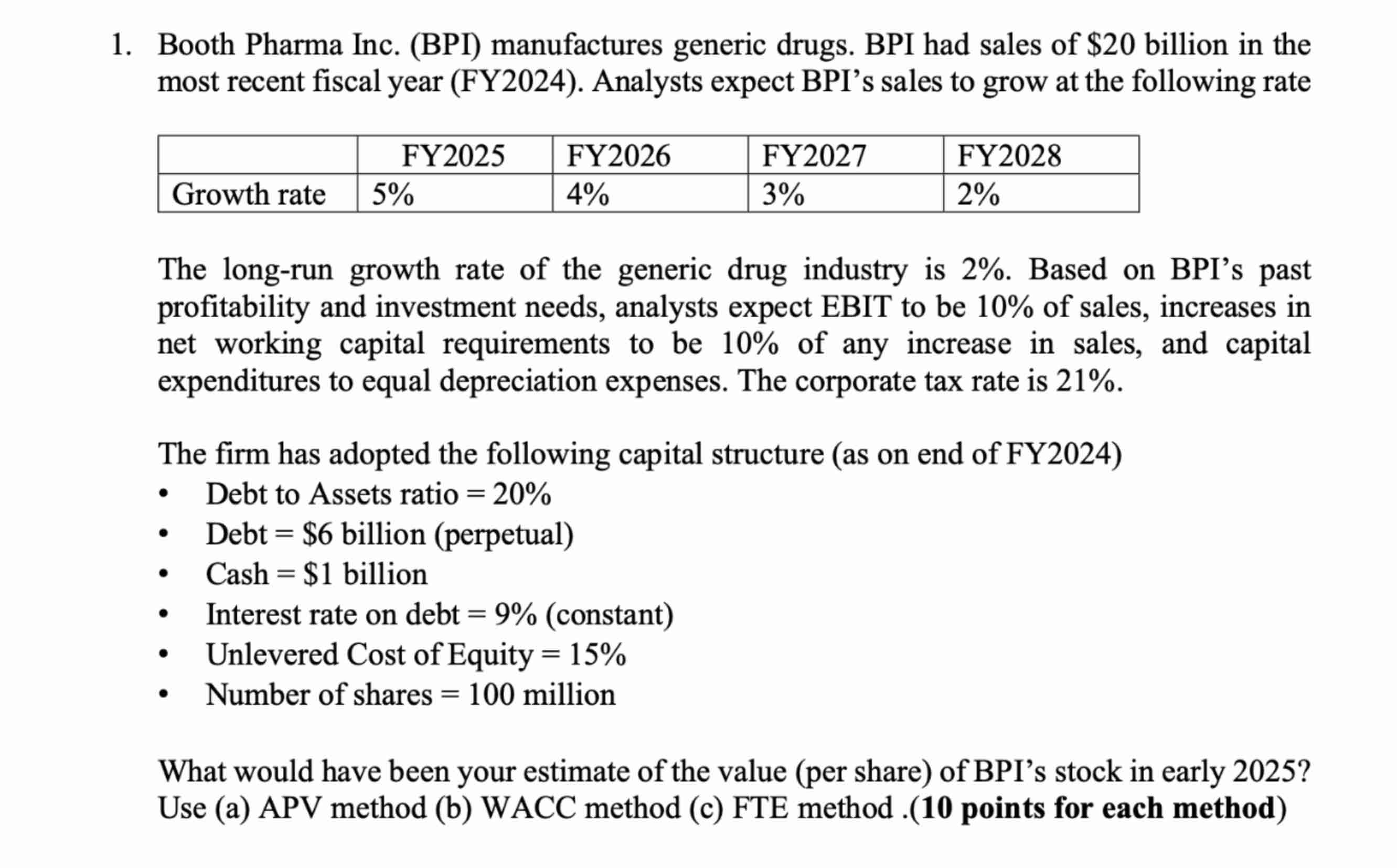

Question: 1 . Booth Pharma Inc. ( BPI ) manufactures generic drugs. BPI had sales of ( $ 2 0 ) billion in

Booth Pharma Inc. BPI manufactures generic drugs. BPI had sales of $ billion in the most recent fiscal year FY Analysts expect BPI's sales to grow at the following rate The longrun growth rate of the generic drug industry is Based on BPI's past profitability and investment needs, analysts expect EBIT to be of sales, increases in net working capital requirements to be of any increase in sales, and capital expenditures to equal depreciation expenses. The corporate tax rate is The firm has adopted the following capital structure as on end of FY Debt to Assets ratio Debt $ billion perpetual Cash $ billion Interest rate on debt constant Unlevered Cost of Equity Number of shares million What would have been your estimate of the value per share of BPI's stock in early Use a APV method b WACC method c FTE method points for each method

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock