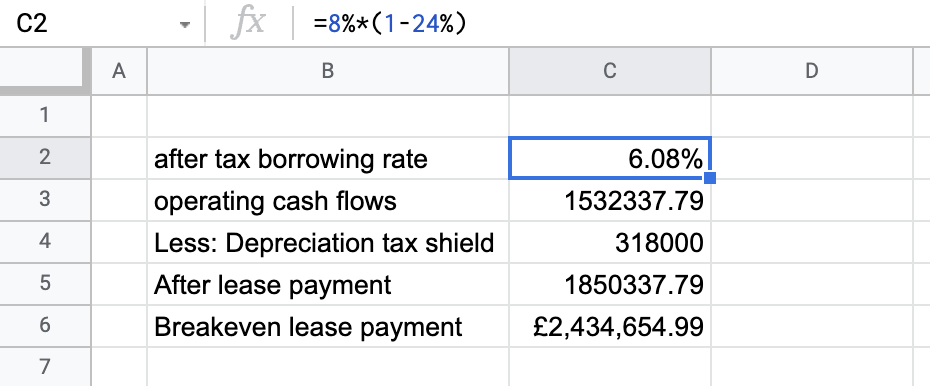

Question: 1 C2 fx =8%*(1-24%) A B D 1 2 6.08% 3 1532337.79 4 after tax borrowing rate operating cash flows Less: Depreciation tax shield After

1

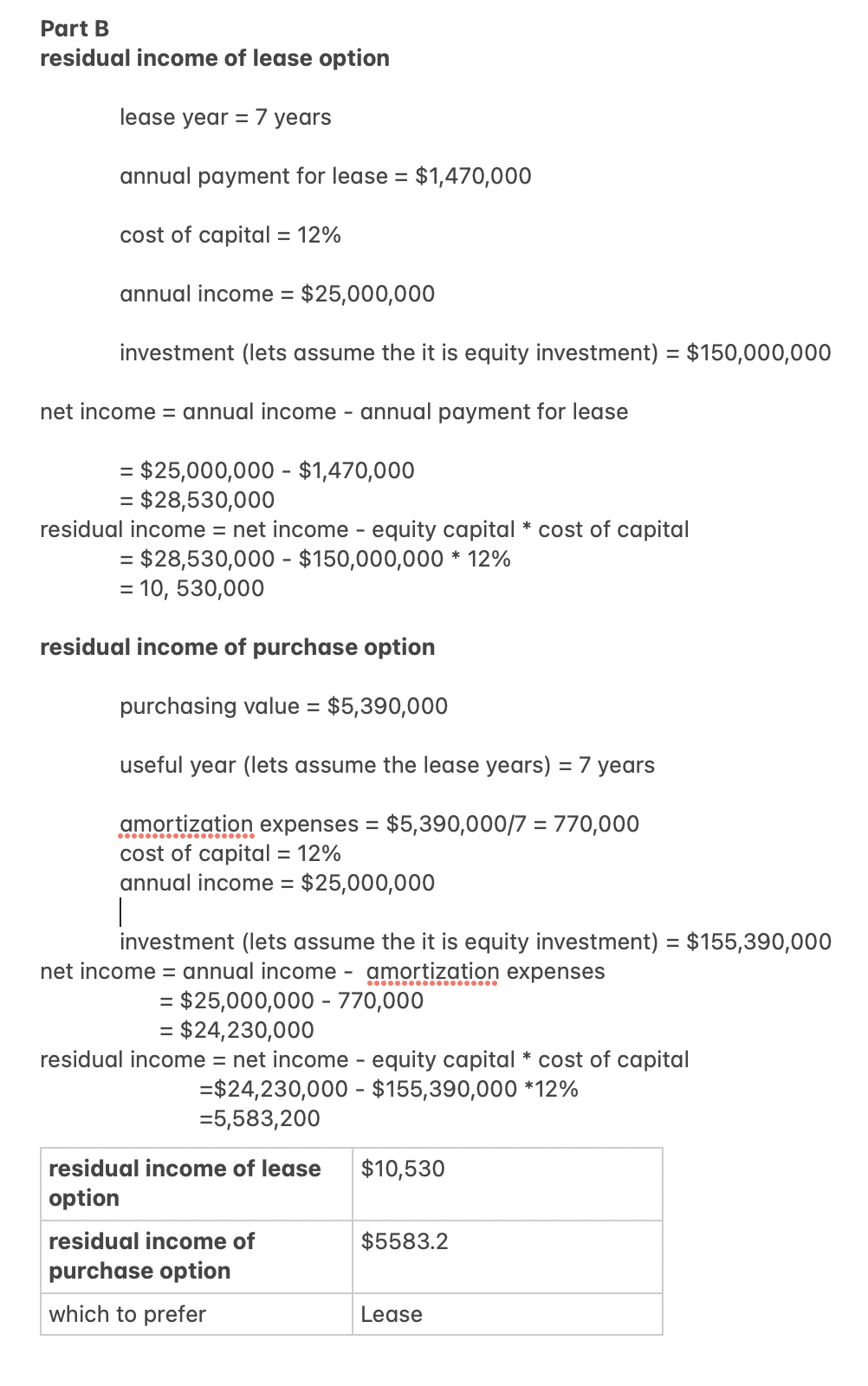

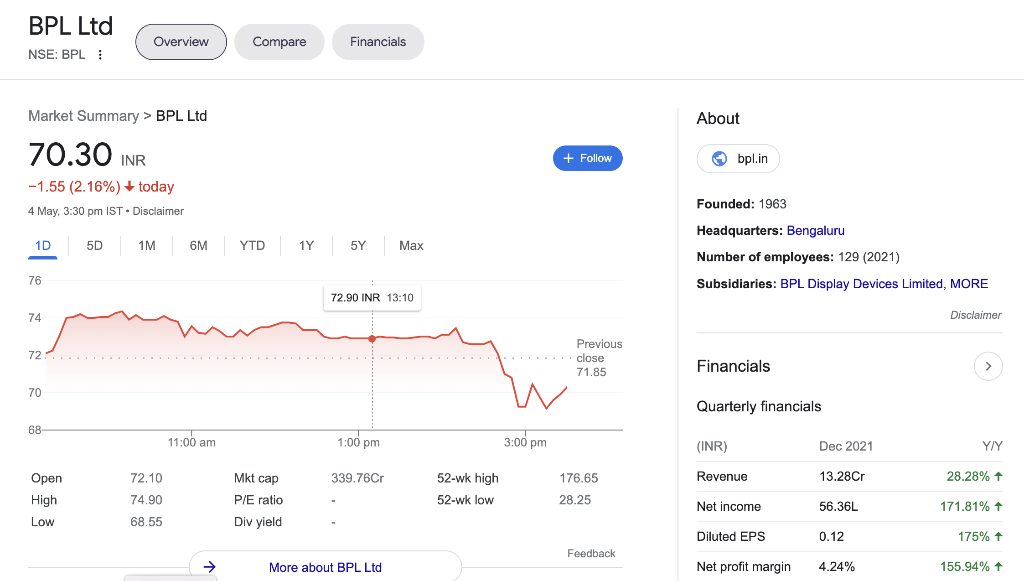

C2 fx =8%*(1-24%) A B D 1 2 6.08% 3 1532337.79 4 after tax borrowing rate operating cash flows Less: Depreciation tax shield After lease payment Breakeven lease payment 318000 5 1850337.79 6 2,434,654.99 7 Part B residual income of lease option lease year = 7 years annual payment for lease = $1,470,000 = cost of capital = 12% = annual income = $25,000,000 - investment (lets assume the it is equity investment) = $150,000,000 = net income = annual income - annual payment for lease = $25,000,000 - $1,470,000 = $28,530,000 residual income = net income - equity capital * cost of capital = $28,530,000 - $150,000,000 * 12% = 10, 530,000 residual income of purchase option purchasing value = $5,390,000 useful year (lets assume the lease years) = 7 years = amortization expenses = $5,390,000/7 = 770,000 cost of capital = 12% annual income = $25,000,000 | investment (lets assume the it is equity investment) = $155,390,000 net income = annual income - amortization expenses = $25,000,000 - 770,000 = $24,230,000 residual income = net income - equity capital * cost of capital =$24,230,000 - $155,390,000 *12% =5,583,200 = $10,530 residual income of lease option residual income of purchase option which to prefer $5583.2 Lease BPL Ltd Overview Compare Financials NSE: BPL Market Summary> BPL Ltd About 70.30 INR + Follow bpl.in -1.55 (2.16%) today 4 May, 3:30 pm IST Disclaimer Founded: 1963 . 1D 5D 1M 6M YTD 1Y 5Y Max Headquarters: Bengaluru Number of employees: 129 (2021) Subsidiaries: BPL Display Devices Limited, MORE 76 72.90 INR 13:10 74 Disclaimer 72 Previous close 71.85 Financials 70 Quarterly financials 68 11:00 am 1:00 pm 3:00 pm (INR) Dec 2021 YY Mkt cap 339.76CI Revenue 13.28Cr 28.28% + Open High 72.10 74.90 52-wk high 52-wk low 176.65 28.25 P/E ratio Net income 56.36L 171.81% + Low 68.55 Div yield Diluted EPS 0.12 175% 1 Feedback More about BPL Ltd Net profit margin 4.24% 155.94% + C2 fx =8%*(1-24%) A B D 1 2 6.08% 3 1532337.79 4 after tax borrowing rate operating cash flows Less: Depreciation tax shield After lease payment Breakeven lease payment 318000 5 1850337.79 6 2,434,654.99 7 Part B residual income of lease option lease year = 7 years annual payment for lease = $1,470,000 = cost of capital = 12% = annual income = $25,000,000 - investment (lets assume the it is equity investment) = $150,000,000 = net income = annual income - annual payment for lease = $25,000,000 - $1,470,000 = $28,530,000 residual income = net income - equity capital * cost of capital = $28,530,000 - $150,000,000 * 12% = 10, 530,000 residual income of purchase option purchasing value = $5,390,000 useful year (lets assume the lease years) = 7 years = amortization expenses = $5,390,000/7 = 770,000 cost of capital = 12% annual income = $25,000,000 | investment (lets assume the it is equity investment) = $155,390,000 net income = annual income - amortization expenses = $25,000,000 - 770,000 = $24,230,000 residual income = net income - equity capital * cost of capital =$24,230,000 - $155,390,000 *12% =5,583,200 = $10,530 residual income of lease option residual income of purchase option which to prefer $5583.2 Lease BPL Ltd Overview Compare Financials NSE: BPL Market Summary> BPL Ltd About 70.30 INR + Follow bpl.in -1.55 (2.16%) today 4 May, 3:30 pm IST Disclaimer Founded: 1963 . 1D 5D 1M 6M YTD 1Y 5Y Max Headquarters: Bengaluru Number of employees: 129 (2021) Subsidiaries: BPL Display Devices Limited, MORE 76 72.90 INR 13:10 74 Disclaimer 72 Previous close 71.85 Financials 70 Quarterly financials 68 11:00 am 1:00 pm 3:00 pm (INR) Dec 2021 YY Mkt cap 339.76CI Revenue 13.28Cr 28.28% + Open High 72.10 74.90 52-wk high 52-wk low 176.65 28.25 P/E ratio Net income 56.36L 171.81% + Low 68.55 Div yield Diluted EPS 0.12 175% 1 Feedback More about BPL Ltd Net profit margin 4.24% 155.94% +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts