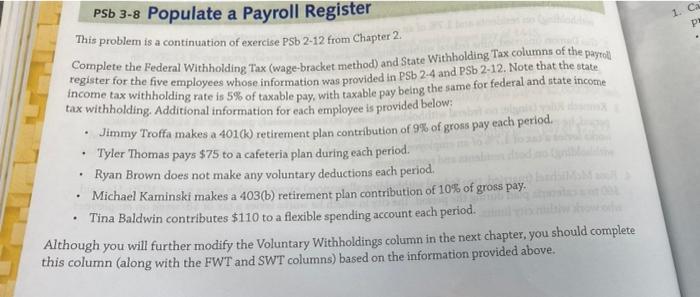

Question: 1. Ca pl . PSb 3-8 Populate a Payroll Register This problem is a continuation of exercise PSb 2-12 from Chapter 2. Complete the Federal

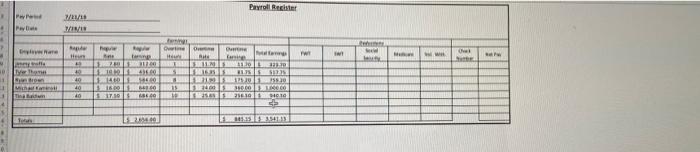

1. Ca pl . PSb 3-8 Populate a Payroll Register This problem is a continuation of exercise PSb 2-12 from Chapter 2. Complete the Federal Withholding Tax (wage-bracket method) and State Withholding Tax columns of the payroll tax withholding. Additional information for each employee is provided below: income tax withholding rate is 5% of taxable pay, with taxable pay belng the same for federal and state income Jimmy Troffa makes a 401(k) retirement plan contribution of 9% of gross pay each period. Tyler Thomas pays $75 to a cafeteria plan during each period. Ryan Brown does not make any voluntary deductions each period. Michael Kaminski makes a 403(b) retirement plan contribution of 10% of gross pay. Tina Baldwin contributes $110 to a flexible spending account each period. Although you will further modify the Voluntary Withholdings column in the next chapter, you should complete this column (along with the FWT and SWT columns) based on the information provided above. . . . Payroll Recher 72/ Pw w . he ware W! w w ly 0 1 GELIG TO 40 1 14.00 546 BLO S 17101 40 40 10 HE ME 100 16 ILS 10.15.20 TO 25 21101010 21 TE that by 1 CO3 103.35.354113

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts