Question: 1. Calculate the following a. Return on equity b. Return on assets c. Asset utilization d. Equity multiplier e. Profit margin f. Net Interest Income

1. Calculate the following

a. Return on equity b. Return on assets c. Asset utilization d. Equity multiplier e. Profit margin f. Net Interest Income g. Net Noninterest Income

2. Due to the sudden increase in withdraw of demand deposit of $18,000, the bank decides to sell the investment securities to get cash. Assume the required reserve ratio is 0, the liquidity index of investment securities is 1, but due to the increase in the interest rate, the market value of investment securities is 50% of the book value.

Write the balance sheet of this bank after all the demand deposit are fully withdrawn.

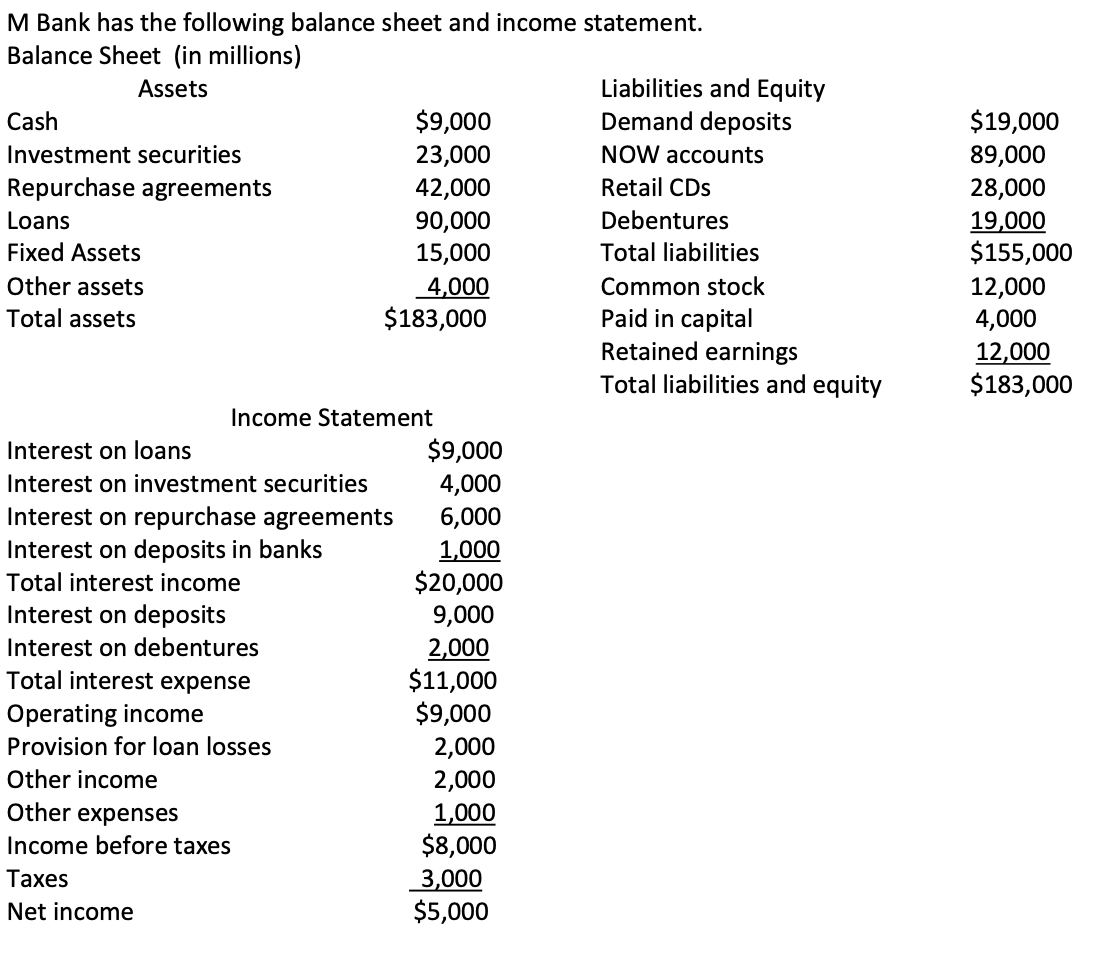

M Bank has the following balance sheet and income statement. Balance Sheet (in millions) \begin{tabular}{lrl} \multicolumn{1}{c}{ Assets } & & Liabilities a \\ Cash & $9,000 & Demand d \\ Investment securities & 23,000 & NOW acco \\ Repurchase agreements & 42,000 & Retail CDs \\ Loans & 90,000 & Debenture \\ Fixed Assets & 15,000 & Total liabili \\ Other assets & 4,000 & Common s \\ Total assets & $183,000 & Paid in cap \\ & & Retained e \\ & & Total liabili \end{tabular} M Bank has the following balance sheet and income statement. Balance Sheet (in millions) \begin{tabular}{lrl} \multicolumn{1}{c}{ Assets } & & Liabilities a \\ Cash & $9,000 & Demand d \\ Investment securities & 23,000 & NOW acco \\ Repurchase agreements & 42,000 & Retail CDs \\ Loans & 90,000 & Debenture \\ Fixed Assets & 15,000 & Total liabili \\ Other assets & 4,000 & Common s \\ Total assets & $183,000 & Paid in cap \\ & & Retained e \\ & & Total liabili \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts