Question: 1. Calculate the projected profit margin, operating profit margin, basic earning power (BEP), return on assets (ROA), and return on equity (ROE). What can you

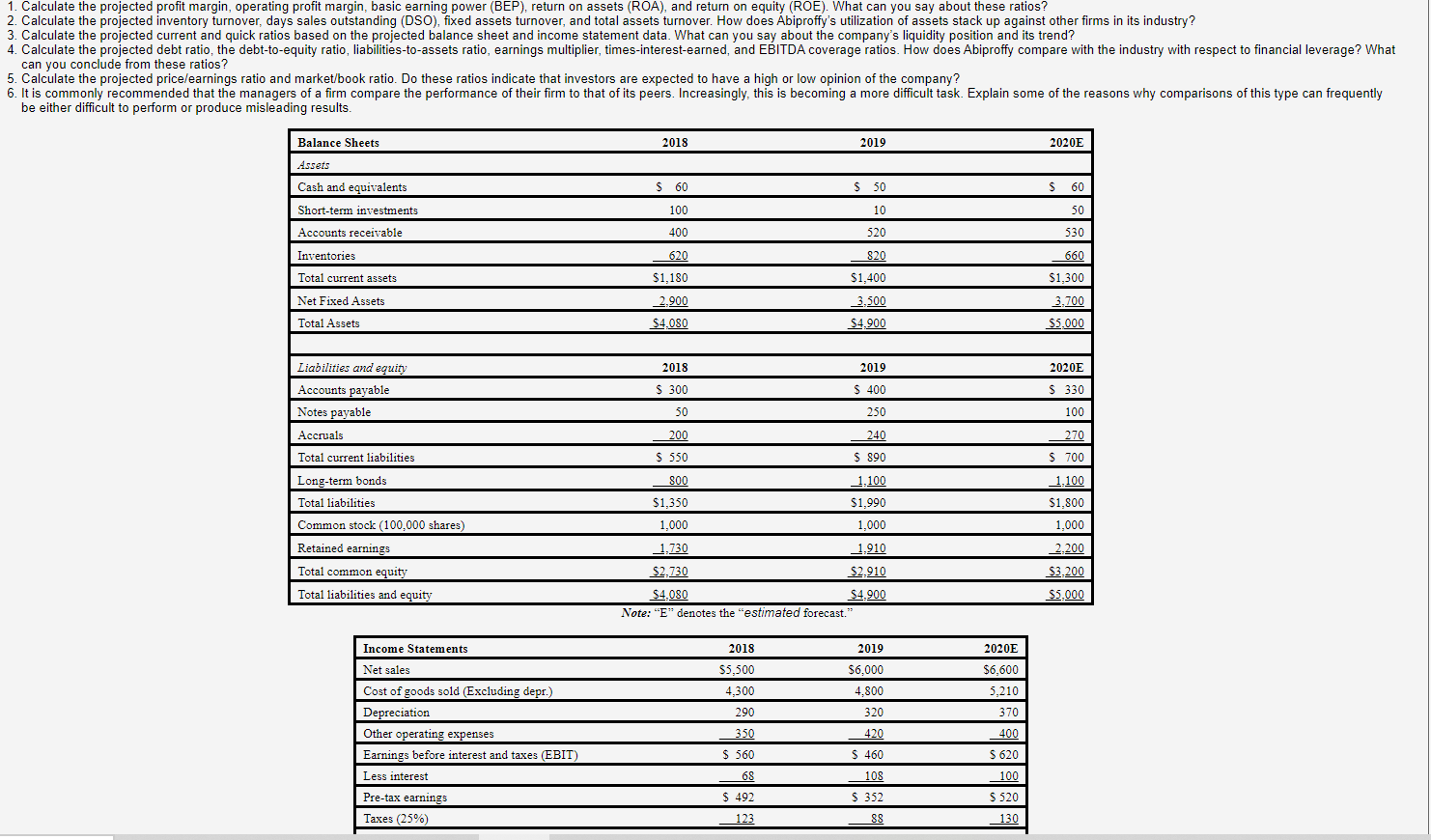

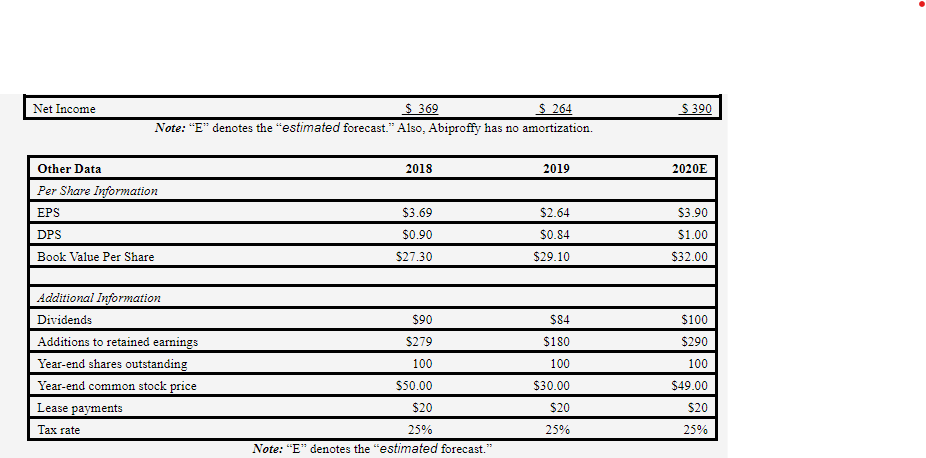

1. Calculate the projected profit margin, operating profit margin, basic earning power (BEP), return on assets (ROA), and return on equity (ROE). What can you say about these ratios? 2. Calculate the projected inventory turnover, days sales outstanding (DSO), fixed assets turnover, and total assets turnover. How does Abiproffy's utilization of assets stack up against other firms in its industry? 3. Calculate the projected current and quick ratios based on the projected balance sheet and income statement data. What can you say about the company's liquidity position and its trend? can you conclude from these ratios? 5. Calculate the projected price/earnings ratio and market/book ratio. Do these ratios indicate that investors are expected to have a high or low opinion of the company? be either difficult to perform or produce misleading results

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts