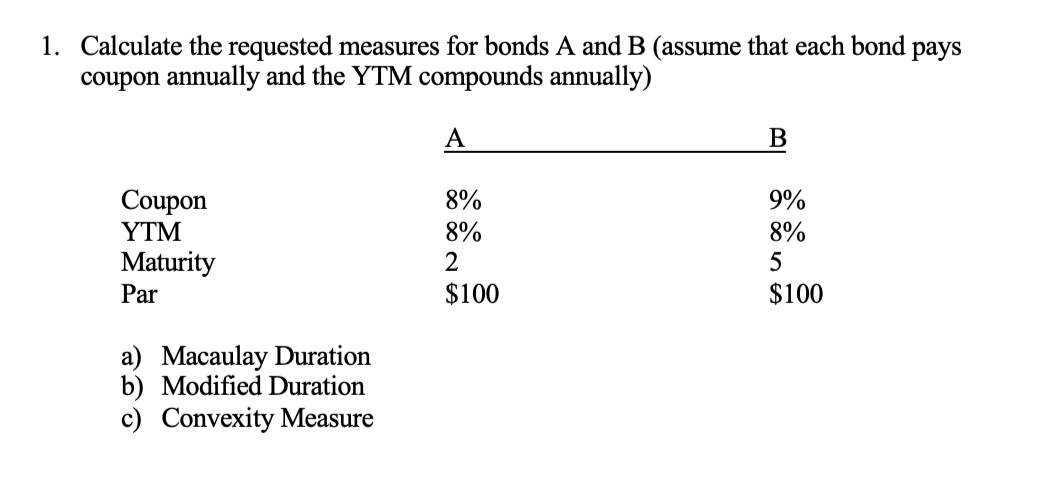

Question: 1 . Calculate the requested measures for bonds A and B ( assume that each bond pays coupon annually and the YTM compounds annually )

Calculate the requested measures for bonds A and B assume that each bond pays coupon annually and the YTM compounds annually A B Coupon YTM Maturity Par $ $ a Macaulay Duration b Modified Duration c Convexity Measure Calculate the requested measures for bonds A and B assume that each bond pays coupon annually and the YTM compounds annually

a Macaulay Duration

b Modified Duration

c Convexity Measure For bond A and B in the previous question:

a Calculate the actual price of the bonds for a increase in interest rates.

b Using modified duration, estimate the price of the bonds for a increase in the interest rates

c Using both modified duration and convexity measure, estimate the price of the bonds for a increase in the interest rates

d Comment on the accuracy of your results in parts b and c and state why one approximation is closer to the actual price than the other

e Without working through calculations, indicate whether the duration of the two bonds would be higher or lower if the yield to maturity is rather than

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock