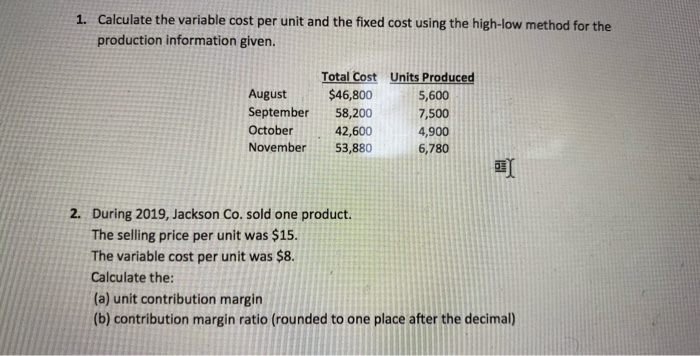

Question: 1. Calculate the variable cost per unit and the fixed cost using the high-low method for the production information given. August September October November Total

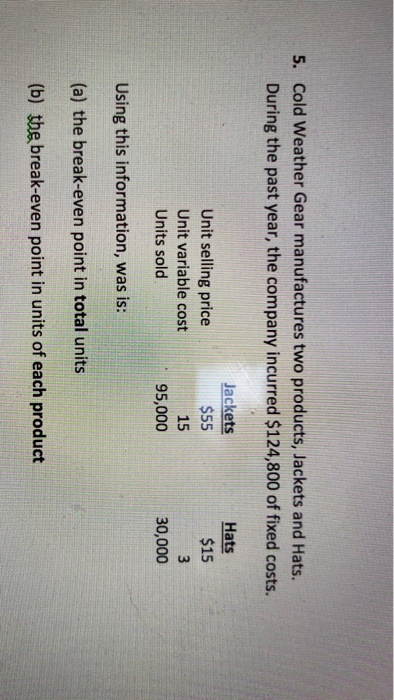

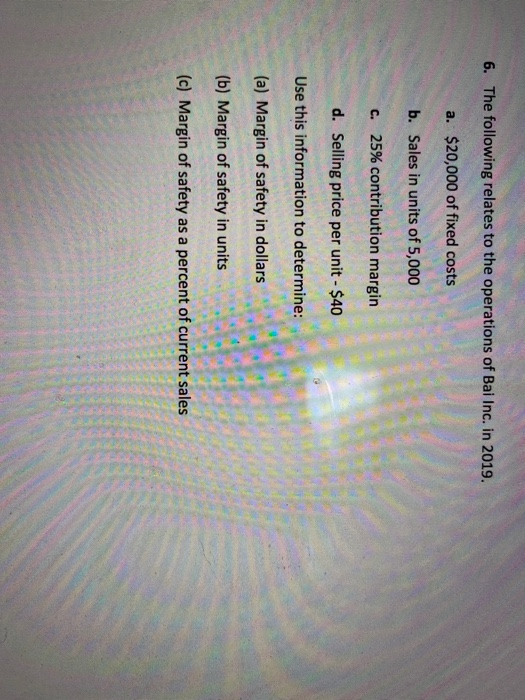

1. Calculate the variable cost per unit and the fixed cost using the high-low method for the production information given. August September October November Total Cost Units Produced $46,800 5,600 58,200 7,500 42,600 4,900 53,880 6,780 2. During 2019, Jackson Co. sold one product. The selling price per unit was $15. The variable cost per unit was $8. Calculate the: (a) unit contribution margin (b) contribution margin ratio (rounded to one place after the decimal) 5. Cold Weather Gear manufactures two products, Jackets and Hats. During the past year, the company incurred $124,800 of fixed costs. Unit selling price Unit variable cost Units sold Jackets $55 15 95,000 Hats $15 3 30,000 Using this information, was is: (a) the break-even point in total units (b) the break-even point in units of each product 6. The following relates to the operations of Bai Inc. in 2019. a. $20,000 of fixed costs b. Sales in units of 5,000 c. 25% contribution margin d. Selling price per unit - $40 Use this information to determine: (a) Margin of safety in dollars (b) Margin of safety in units (c) Margin of safety as a percent of current sales

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts