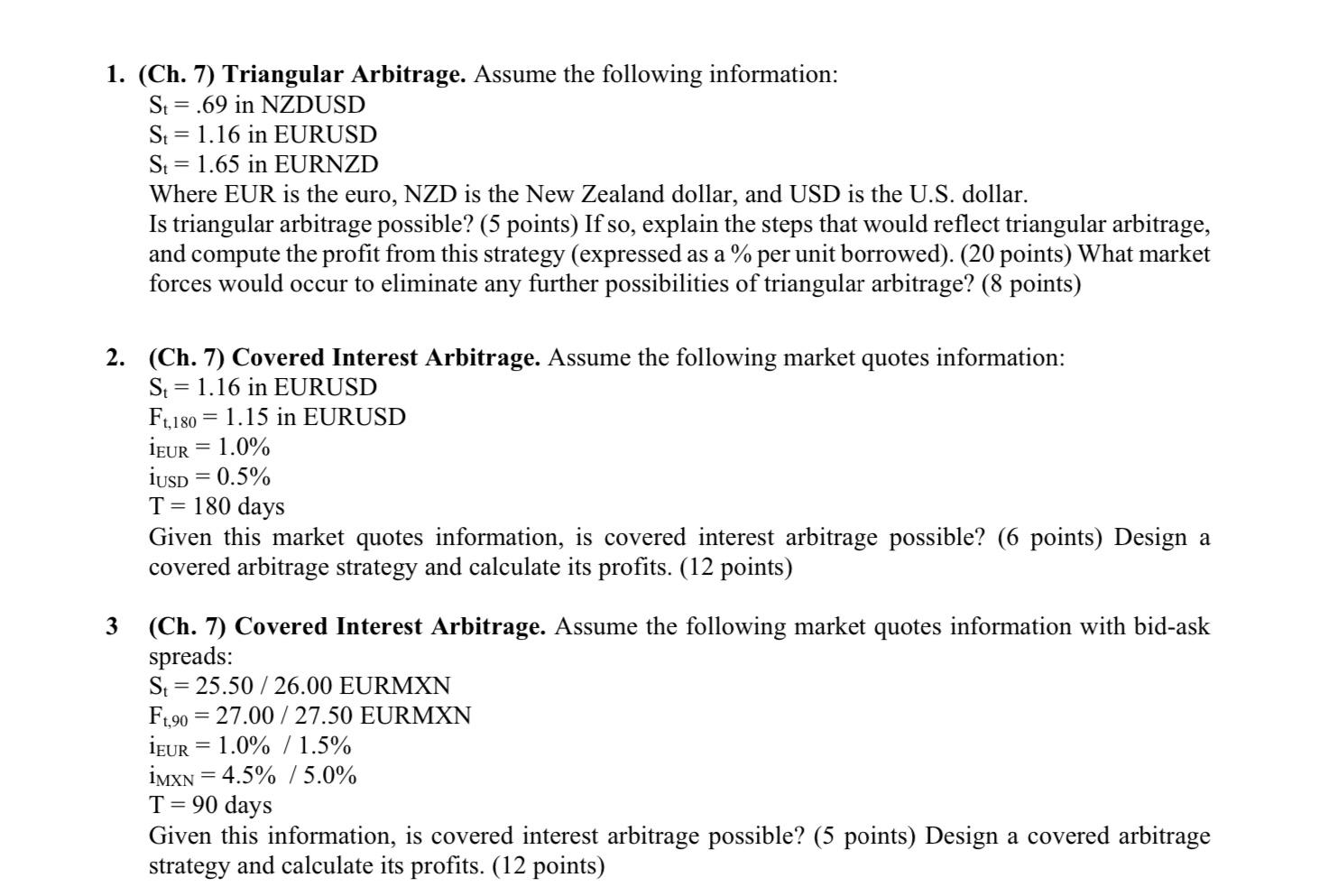

Question: 1. (Ch. 7) Triangular Arbitrage. Assume the following information: St = .69 in NZDUSD Si = 1.16 in EURUSD St = 1.65 in EURNZD Where

1. (Ch. 7) Triangular Arbitrage. Assume the following information: St = .69 in NZDUSD Si = 1.16 in EURUSD St = 1.65 in EURNZD Where EUR is the euro, NZD is the New Zealand dollar, and USD is the U.S. dollar. Is triangular arbitrage possible? (5 points) If so, explain the steps that would reflect triangular arbitrage, and compute the profit from this strategy (expressed as a % per unit borrowed). (20 points) What market forces would occur to eliminate any further possibilities of triangular arbitrage? (8 points) = 2. (Ch. 7) Covered Interest Arbitrage. Assume the following market quotes information: Si = 1.16 in EURUSD F1,180 = 1.15 in EURUSD iEUR = 1.0% iUSD = 0.5% T= 180 days Given this market quotes information, is covered interest arbitrage possible? (6 points) Design a covered arbitrage strategy and calculate its profits. (12 points) = = 3 (Ch. 7) Covered Interest Arbitrage. Assume the following market quotes information with bid-ask spreads: St = 25.50 / 26.00 EURMXN F1,90 = 27.00 / 27.50 EURMXN IEUR = 1.0% / 1.5% imxn = 4.5% / 5.0% T= 90 days Given this information, is covered interest arbitrage possible? (5 points) Design a covered arbitrage strategy and calculate its profits. (12 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts