Question: 1.) Choose an industry with a higher EBITDA multiple to do business in. 2.) With $1 million dollars from investor's to invest in your

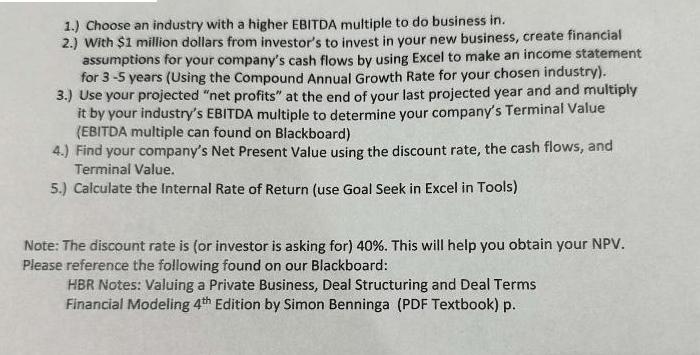

1.) Choose an industry with a higher EBITDA multiple to do business in. 2.) With $1 million dollars from investor's to invest in your new business, create financial assumptions for your company's cash flows by using Excel to make an income statement for 3-5 years (Using the Compound Annual Growth Rate for your chosen industry). 3.) Use your projected "net profits" at the end of your last projected year and and multiply it by your industry's EBITDA multiple to determine your company's Terminal Value (EBITDA multiple can found on Blackboard) 4.) Find your company's Net Present Value using the discount rate, the cash flows, and Terminal Value. 5.) Calculate the Internal Rate of Return (use Goal Seek in Excel in Tools) Note: The discount rate is (or investor is asking for) 40%. This will help you obtain your NPV. Please reference the following found on our Blackboard: HBR Notes: Valuing a Private Business, Deal Structuring and Deal Terms Financial Modeling 4th Edition by Simon Benninga (PDF Textbook) p.

Step by Step Solution

There are 3 Steps involved in it

Answer 1 Technology or software industry is one of the industries with a higher EBITDA multiple and would be a great choice for investing 2 Using Exce... View full answer

Get step-by-step solutions from verified subject matter experts