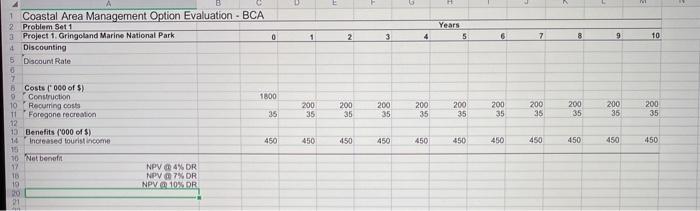

Question: 1 Coastal Area Management Option Evaluation - BCA 2 Problem Set 1 3 Project 1. Gringoland Marine National Park 4 Discounting 5 Discount Rate Years

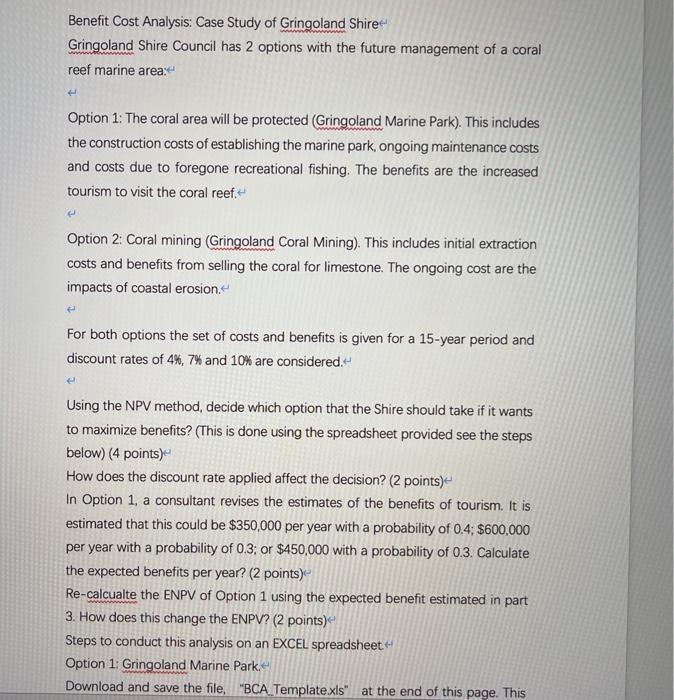

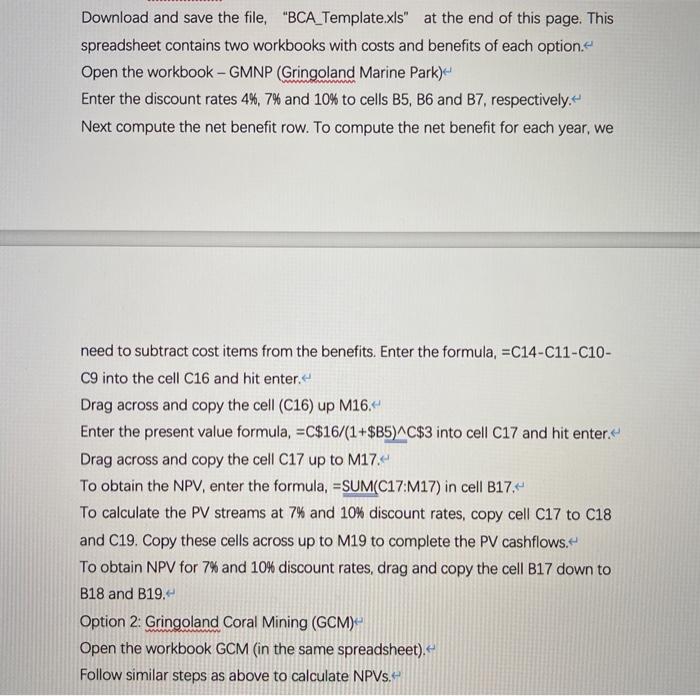

1 Coastal Area Management Option Evaluation - BCA 2 Problem Set 1 3 Project 1. Gringoland Marine National Park 4 Discounting 5 Discount Rate Years 5 0 1 2 3 4 6 7 9 8 10 1800 200 200 35 200 35 200 200 35 200 200 35 200 35 200 35 35 200 35 35 35 35 7 6 Costs (* 000 of 5) Construction 10 Recurring costs 11 Foregone recreation 12 13 Benefits ('000 of $) 14 Increased tourist income 10 Net beneta 17 16 450 450 450 450 450 $ 450 450 450 450 NPV 4% DR NPV 7% OR NPV 10% DR 230 Benefit Cost Analysis: Case Study of Gringoland Shire Gringoland Shire Council has 2 options with the future management of a coral reef marine area: Option 1: The coral area will be protected (Gringoland Marine Park). This includes the construction costs of establishing the marine park, ongoing maintenance costs and costs due to foregone recreational fishing. The benefits are the increased tourism to visit the coral reef- Option 2: Coral mining (Gringoland Coral Mining). This includes initial extraction costs and benefits from selling the coral for limestone. The ongoing cost are the impacts of coastal erosion For both options the set of costs and benefits is given for a 15-year period and discount rates of 44.7% and 10% are considered. Using the NPV method, decide which option that the Shire should take if it wants to maximize benefits? (This is done using the spreadsheet provided see the steps below) (4 points) How does the discount rate applied affect the decision? (2 points) In Option 1, a consultant revises the estimates of the benefits of tourism. It is estimated that this could be $350,000 per year with a probability of 0.4; $600,000 per year with a probability of 0.3; or $450,000 with a probability of 0.3. Calculate the expected benefits per year? (2 points) Re-calcualte the ENPV of Option 1 using the expected benefit estimated in part 3. How does this change the ENPV? (2 points) Steps to conduct this analysis on an EXCEL spreadsheet Option 1: Gringoland Marine Parke Download and save the file, "BCA Template.xls" at the end of this page. This Download and save the file, "BCA_Template.xls" at the end of this page. This spreadsheet contains two workbooks with costs and benefits of each option Open the workbook - GMNP (Gringoland Marine Park) Enter the discount rates 4%, 7% and 10% to cells B5, B6 and B7, respectively. Next compute the net benefit row. To compute the net benefit for each year, we need to subtract cost items from the benefits. Enter the formula, =C14-C11-C10- C9 into the cell C16 and hit enter- Drag across and copy the cell (C16) up M16.4 Enter the present value formula, EC$16/(1+$85) C$3 into cell C17 and hit enter Drag across and copy the cell C17 up to M17. To obtain the NPV, enter the formula, =SUM(C17:M17) in cell B17." To calculate the PV streams at 7% and 10% discount rates, copy cell C17 to 018 and C19. Copy these cells across up to M19 to complete the PV cashflows. To obtain NPV for 7% and 10% discount rates, drag and copy the cell B17 down to B18 and B19. Option 2: Gringoland Coral Mining (GCM) Open the workbook GCM (in the same spreadsheet). Follow similar steps as above to calculate NPVs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts