Question: 1. Complete that 1995 pro forms balance sheet listed in exhibit 3. Show work. 2. Complete the worse case cash flow projection for 1997 listed

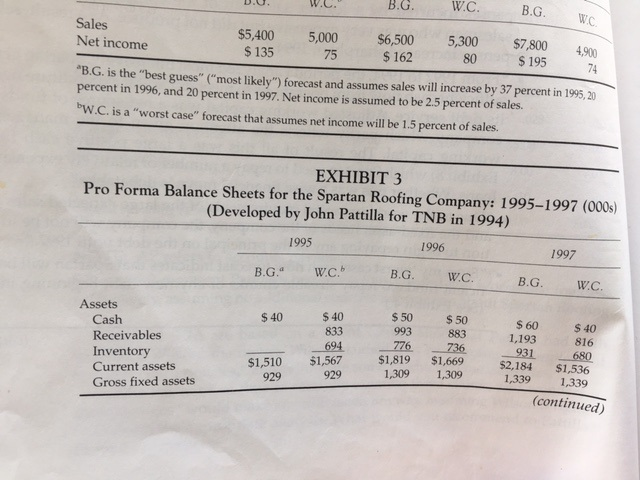

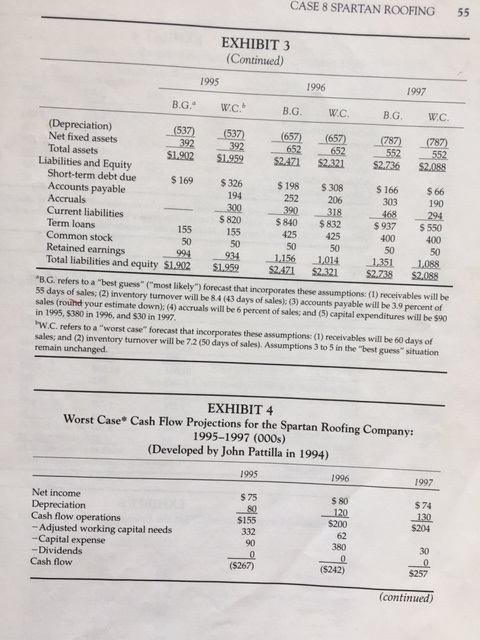

1. Complete that 1995 pro forms balance sheet listed in exhibit 3. Show work.

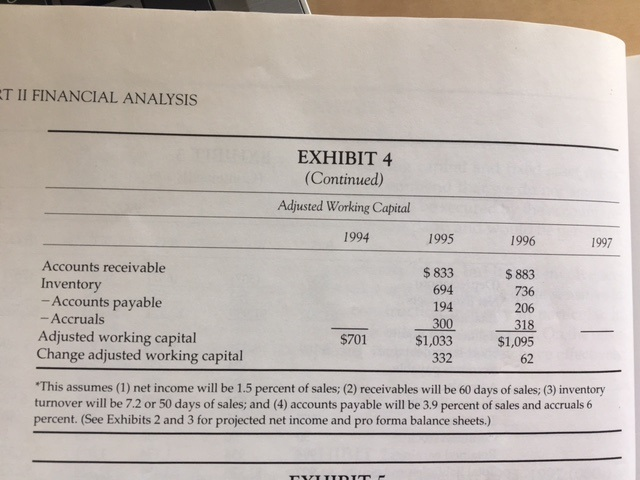

2. Complete the "worse case" cash flow projection for 1997 listed in exhibit 4. Show work.

1. Complete that 1995 pro forms balance sheet listed in exhibit 3. Show work.

2. Complete the "worse case" cash flow projection for 1997 listed in exhibit 4. Show work.

B.G. B.G WC Sales $5,400 5,000 $6,500 5,300 $7,800 4900 135 75 162 195 Net income "B.G. is the "best guess" ("most likely") forecast and assumes sales will increase by 37 percent in 1995, 20 percent in 1996, and 20 percent in 1997. Net income is assumed to be 2.5 percent of sales. bW.C. is a "worst case" forecast that assumes net income will be 1.5 percent of sales. EXHIBIT 3 Pro Forma Balance Sheets for the Spartan Roofing Company: 1995-1997 (000s (Developed by John Pattilla for TNB in 1994) 1996 1997 B.G C. B. G. WC. B. G. WC. Assets 40 40 50 50 60 40 993 1,193 51,567 $1,819 $1,669 931 680. 929 1,309 1,309 $2,184 $1,536 1,339 1,339 Cash Receivables Inventory $1,510 Current assets Gross fixed assets (continued)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts