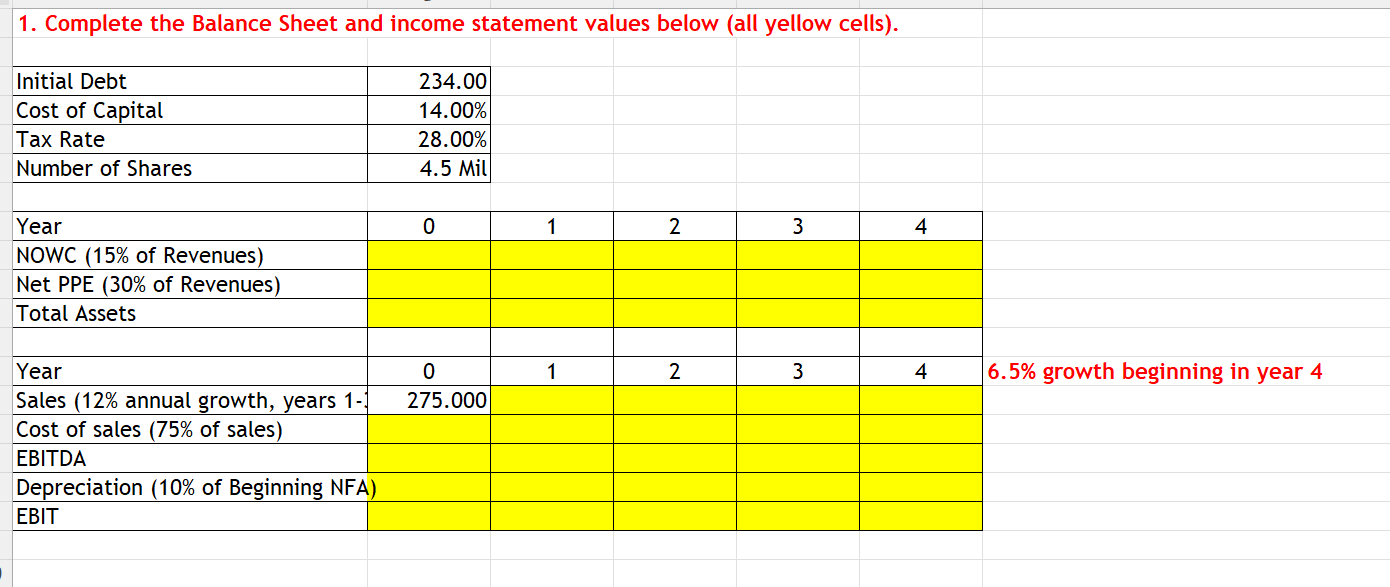

Question: 1. Complete the Balance Sheet and income statement values below (all yellow cells). begin{tabular}{|l|r|} hline Initial Debt & 234.00 hline Cost of Capital &

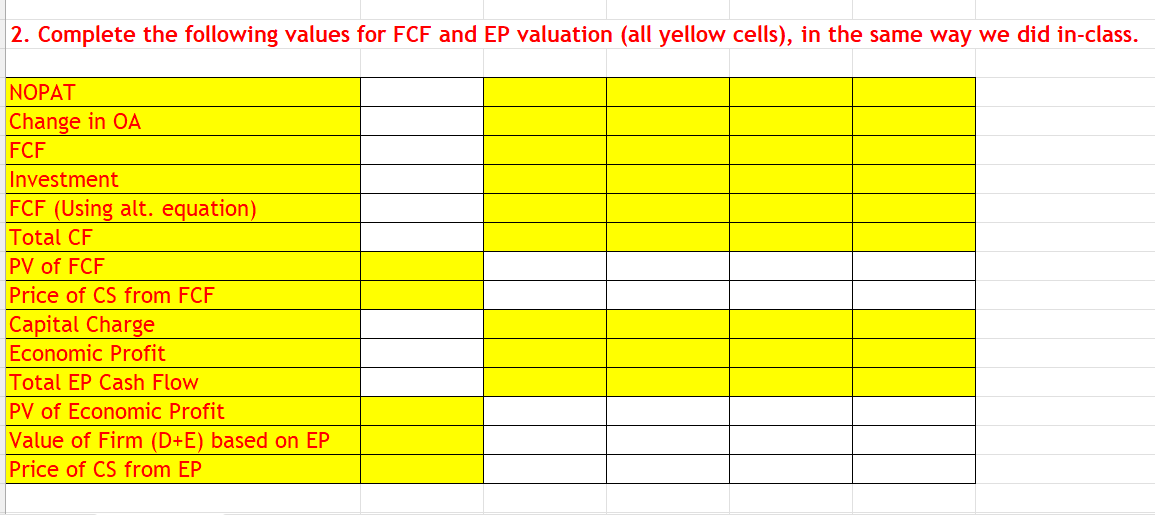

1. Complete the Balance Sheet and income statement values below (all yellow cells). \begin{tabular}{|l|r|} \hline Initial Debt & 234.00 \\ \hline Cost of Capital & 14.00% \\ \hline Tax Rate & 28.00% \\ \hline Number of Shares & 4.5Mil \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|c|} \hline Year & 0 & 1 & 2 & 3 & 4 \\ \hline NOWC (15\% of Revenues) & & & & & \\ \hline Net PPE (30\% of Revenues) & & & & & \\ \hline Total Assets & & & & & \\ \hline & & & & & \\ \hline Year & 0 & 1 & 2 & 3 & 4 \\ \hline Sales (12\% annual growth, years 1- & 275.000 & & & & \\ \hline Cost of sales (75\% of sales) & & & & & \\ \hline EBITDA & & & & & \\ \hline Depreciation (10\% of Beginning NFA) & & & & \\ \hline EBIT & & & & \\ \hline \end{tabular} 2. Complete the following values for FCF and EP valuation (all yellow cells), in the same way we did in-class. 1. Complete the Balance Sheet and income statement values below (all yellow cells). \begin{tabular}{|l|r|} \hline Initial Debt & 234.00 \\ \hline Cost of Capital & 14.00% \\ \hline Tax Rate & 28.00% \\ \hline Number of Shares & 4.5Mil \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|c|} \hline Year & 0 & 1 & 2 & 3 & 4 \\ \hline NOWC (15\% of Revenues) & & & & & \\ \hline Net PPE (30\% of Revenues) & & & & & \\ \hline Total Assets & & & & & \\ \hline & & & & & \\ \hline Year & 0 & 1 & 2 & 3 & 4 \\ \hline Sales (12\% annual growth, years 1- & 275.000 & & & & \\ \hline Cost of sales (75\% of sales) & & & & & \\ \hline EBITDA & & & & & \\ \hline Depreciation (10\% of Beginning NFA) & & & & \\ \hline EBIT & & & & \\ \hline \end{tabular} 2. Complete the following values for FCF and EP valuation (all yellow cells), in the same way we did in-class

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts