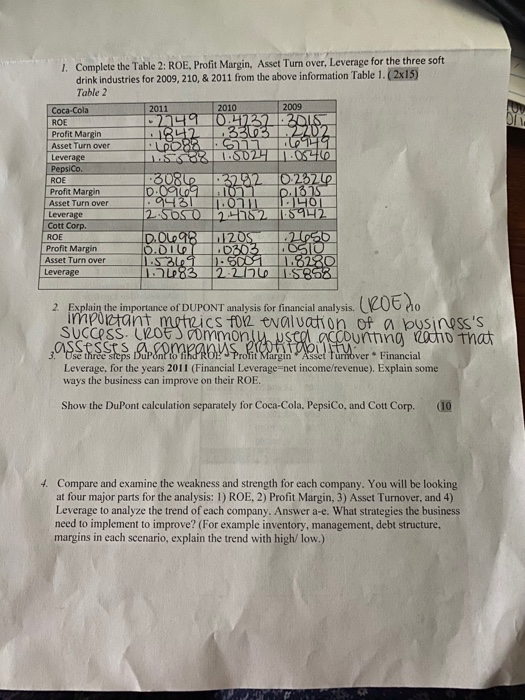

Question: 1. Complete the Table 2: ROE, Profit Margin, Asset Turn over. Leverage for the three soft drink industries for 2009, 210, & 2011 from the

1. Complete the Table 2: ROE, Profit Margin, Asset Turn over. Leverage for the three soft drink industries for 2009, 210, & 2011 from the above information Table 1. (2x15) Table 2 Coca-Cola 2011 2010 2009 ROE 0 2149 0.41232 DZDIS Profie Margin 1842 363.9202 Asset Turn over LORS 1 191 Leverage 0.5 582 802 1.064 PepsiCo ROE 3086 3202 0.252 Profit Margin 0.09109 11011 0.1815 Asset Turn over 9431 0. 0 1 L4101 2.SOS 24782 1892 ROE D.O98 1205 2050 Profit Margin O.DIG D303 OSIO Asset Turn over 1.529.50091.8280 Leverage 183 2.210 ISB68 Leverage Cott Corp. 2 Explain the importance of DUPONT analysis for financial analysis. Un important metrics f012 evaluation of a business's SUCCESS (ROE) Commonly used accounting to that assesses p ara coloring flower Financial Leverage, for the years 2011 (Financial Leverage=net income/revenue). Explain some ways the business can improve on their ROE. Show the DuPont calculation separately for Coca-Cola, PepsiCo, and Cott Corp. (10 4. Compare and examine the weakness and strength for each company. You will be looking at four major parts for the analysis: 1) ROE, 2) Profit Margin, 3) Asset Turnover, and 4) Leverage to analyze the trend of each company. Answer a-e. What strategies the business need to implement to improve? (For example inventory, management, debt structure, margins in each scenario, explain the trend with high/low.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts