Question: 1. compound, real, simple 2. smallest, largest 3. declines, increases 4. smallest, largest 5. declines, increases Time Value of Money: Amortized Loans An extremely important

1. compound, real, simple

2. smallest, largest

3. declines, increases

4. smallest, largest

5. declines, increases

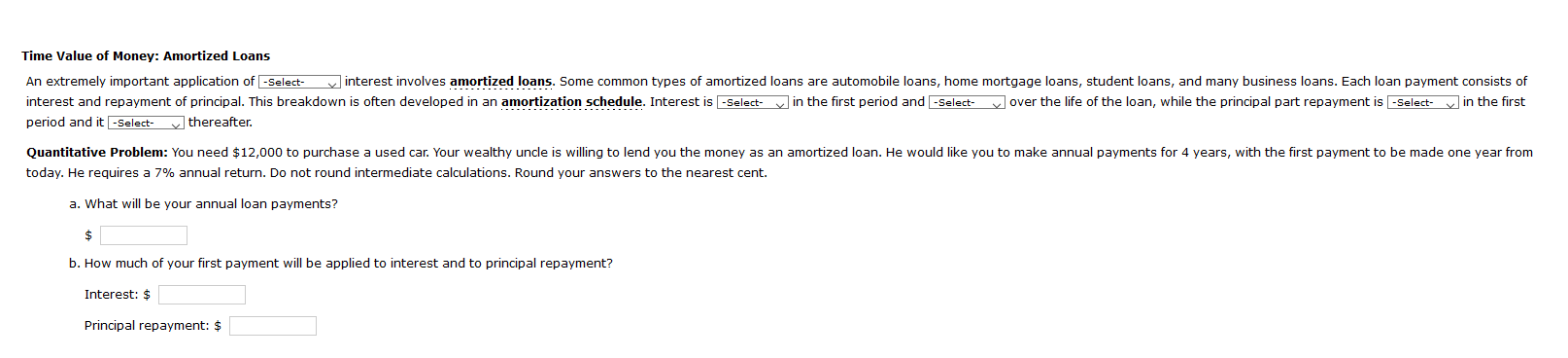

Time Value of Money: Amortized Loans An extremely important application of -Select- interest involves amortized loans. Some common types of amortized loans are automobile loans, home mortgage loans, student loans, and many business loans. Each loan payment consists of interest and repayment of principal. This breakdown is often developed in an amortization schedule. Interest is - Select y in the first period and -Select- over the life of the loan, while the principal part repayment is -Select- in the first period and it -Select- thereafter. Quantitative Problem: You need $12,000 to purchase a used car. Your wealthy uncle is willing to lend you the money as an amortized loan. He would like you to make annual payments for 4 years, with the first payment to be made one year from today. He requires a 7% annual return. Do not round intermediate calculations. Round your answers to the nearest cent. a. What will be your annual loan payments? b. How much of your first payment will be applied to interest and to principal repayment? Interest: $ Principal repayment: $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts