Question: 1. Compute Seminole Equipment's (a) quick ratio, (b) current ratio, and (c) accounts receivable turnover for 2018. 2. Evaluate each ratio value as strong or

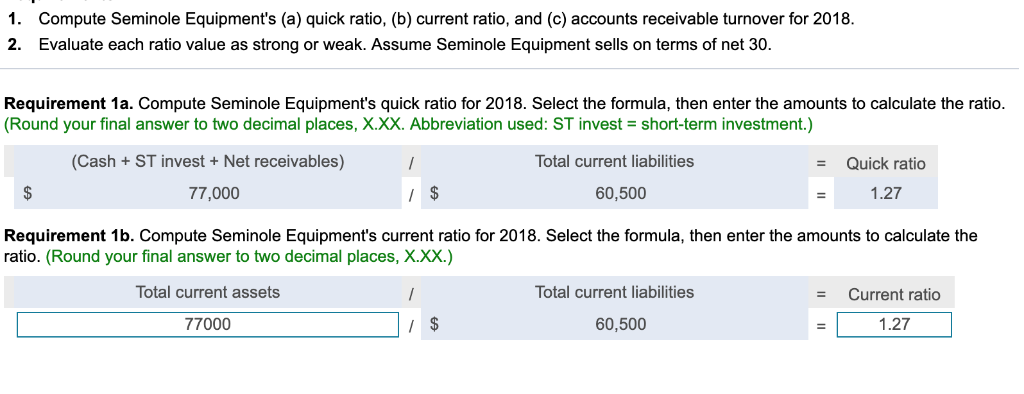

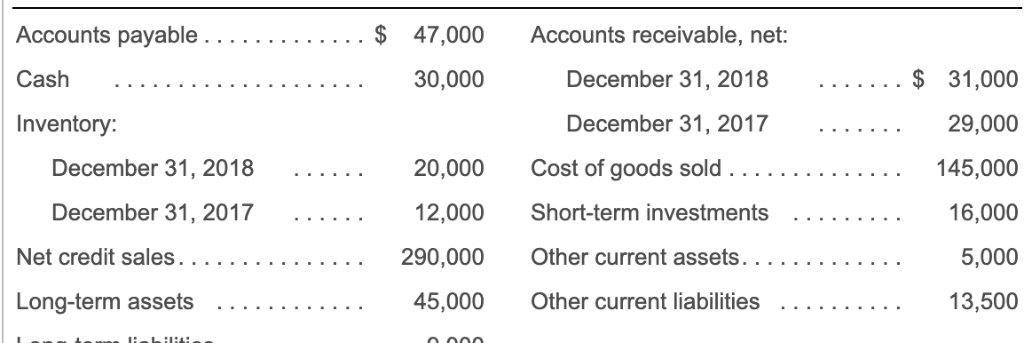

1. Compute Seminole Equipment's (a) quick ratio, (b) current ratio, and (c) accounts receivable turnover for 2018. 2. Evaluate each ratio value as strong or weak. Assume Seminole Equipment sells on terms of net 30. Requirement 1a. Compute Seminole Equipment's quick ratio for 2018. Select the formula, then enter the amounts to calculate the ratio. (Round your final answer to two decimal places, X.XX. Abbreviation used: ST invest = short-term investment.) (Cash ST invest+ Net receivables) Total current liabilities Quick ratio / $ 60,500 77,000 1.27 Requirement 1b. Compute Seminole Equipment's current ratio for 2018. Select the formula, then enter the amounts to calculate the ratio. (Round your final answer to two decimal places, X.XX.) Total current assets Total current liabilities / Current ratio $ 77000 60,500 1.27 Accounts payable $ 47,000 Accounts receivable, net: 30,000 $31,000 Cash December 31, 2018 Inventory: December 31, 2017 29,000 Cost of goods sold . . 20,000 December 31, 2018 145,000 December 31, 2017 12,000 Short-term investments 16,000 Net credit sales. 290,000 Other current assets. 5,000 Long-term assets 45,000 Other current liabilities 13,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts