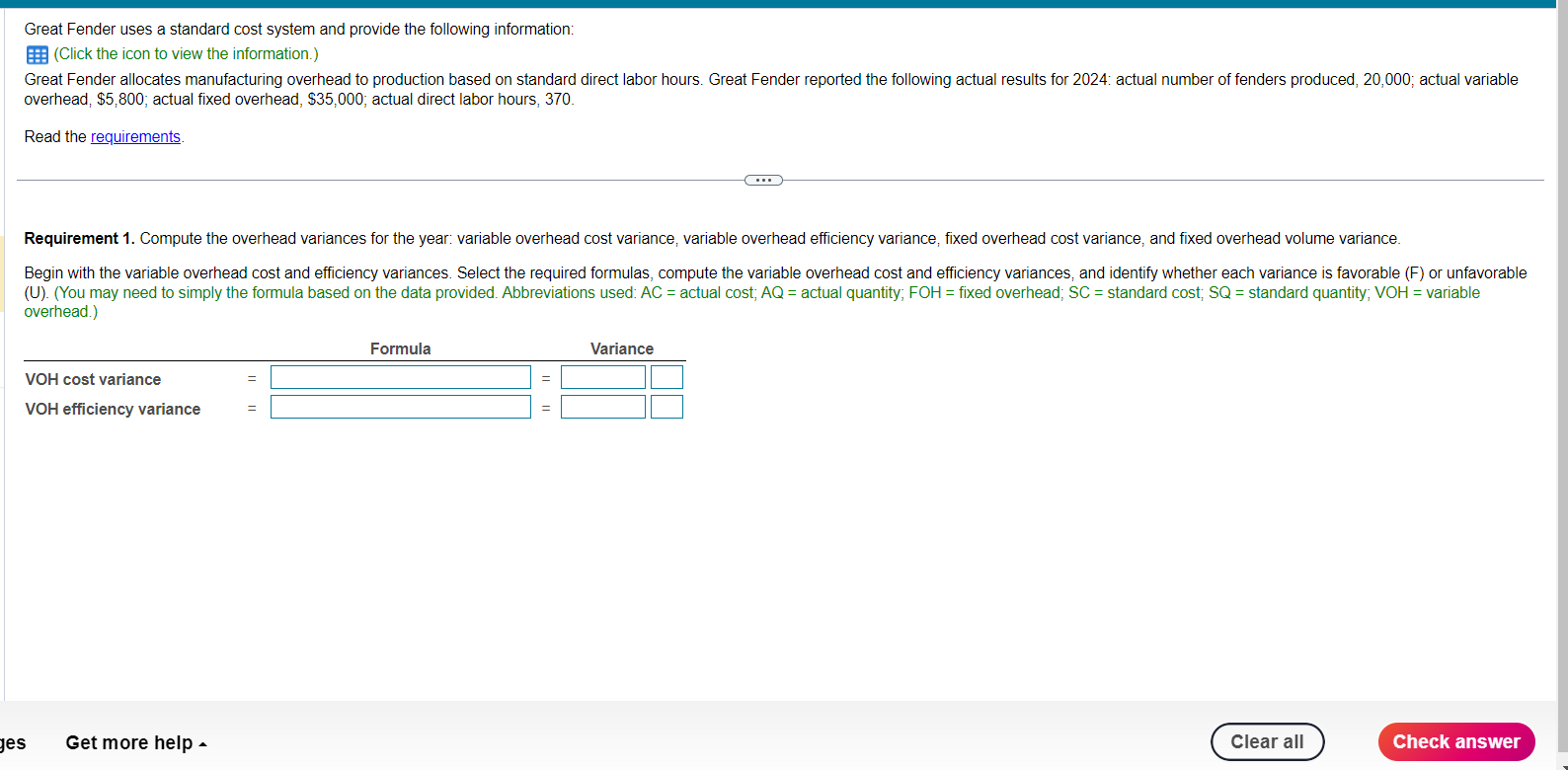

Question: 1. Compute the overhead variances for the year: variable overhead cost variance, variable overhead efficiency variance, fixed overhead cost variance, and fixed overhead volume variance.

1. Compute the overhead variances for the year: variable overhead cost variance, variable overhead efficiency variance, fixed overhead cost variance, and fixed overhead volume variance. 2. Explain why the variances are favorable or unfavorable.

1. Compute the overhead variances for the year: variable overhead cost variance, variable overhead efficiency variance, fixed overhead cost variance, and fixed overhead volume variance. 2. Explain why the variances are favorable or unfavorable.

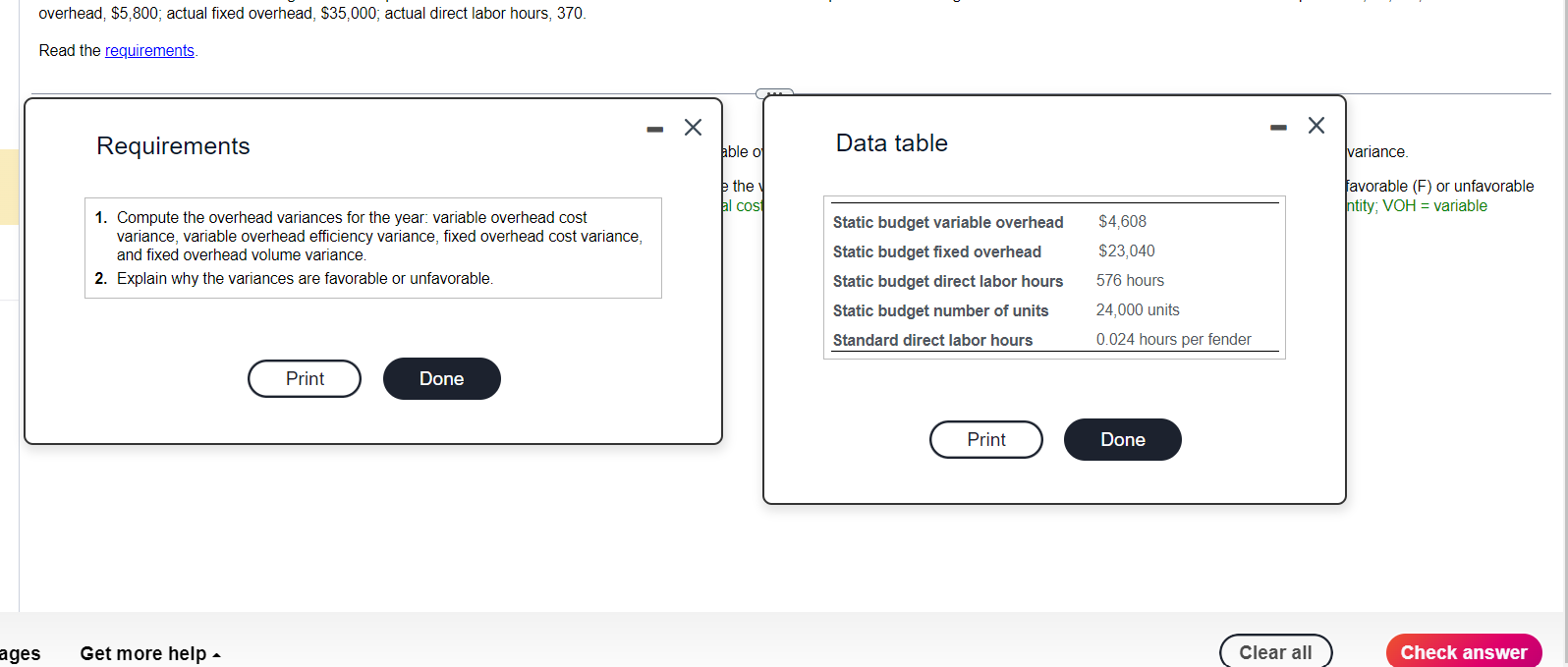

Great Fender uses a standard cost system and provide the following information: (Click the icon to view the information.) overhead, $5,800; actual fixed overhead, $35,000; actual direct labor hours, 370 . Read the requirements. overhead.) overhead, $5,800; actual fixed overhead, $35,000; actual direct labor hours, 370 . Read the Requirements Data table 1. Compute the overhead variances for the year: variable overhead cost variance, variable overhead efficiency variance, fixed overhead cost variance, and fixed overhead volume variance. 2. Explain why the variances are favorable or unfavorable. Great Fender uses a standard cost system and provide the following information: (Click the icon to view the information.) overhead, $5,800; actual fixed overhead, $35,000; actual direct labor hours, 370 . Read the requirements. overhead.) overhead, $5,800; actual fixed overhead, $35,000; actual direct labor hours, 370 . Read the Requirements Data table 1. Compute the overhead variances for the year: variable overhead cost variance, variable overhead efficiency variance, fixed overhead cost variance, and fixed overhead volume variance. 2. Explain why the variances are favorable or unfavorable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts