Question: 1. Consider a 3-period binomial model with So = 8, u = 2, d = 1/u, r = 1/4. i) What is the price at

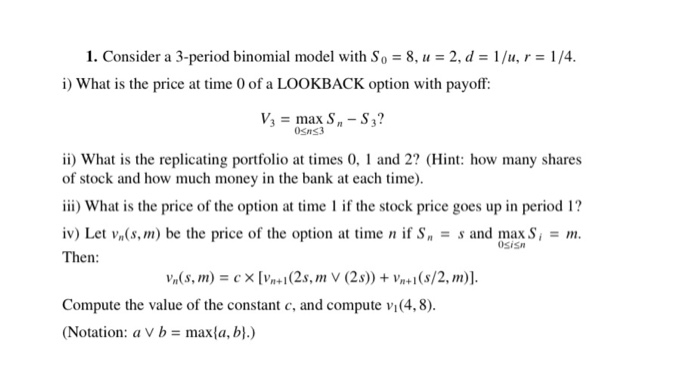

1. Consider a 3-period binomial model with So = 8, u = 2, d = 1/u, r = 1/4. i) What is the price at time 0 of a LOOKBACK option with payoff: V3 = max S.-S3? Osns3 ii) What is the replicating portfolio at times 0, 1 and 2? (Hint: how many shares of stock and how much money in the bank at each time). iii) What is the price of the option at time I if the stock price goes up in period 1? iv) Let v,(s, m) be the price of the option at time n if S, = s and max S; = m. Then: v,(s, m) = cx [Vn+(2s, m V (2S)) + Vn+1(8/2,m)]. Compute the value of the constant c, and compute vi(4,8). (Notation: a V b = max{a,b).) Osis 1. Consider a 3-period binomial model with So = 8, u = 2, d = 1/u, r = 1/4. i) What is the price at time 0 of a LOOKBACK option with payoff: V3 = max S.-S3? Osns3 ii) What is the replicating portfolio at times 0, 1 and 2? (Hint: how many shares of stock and how much money in the bank at each time). iii) What is the price of the option at time I if the stock price goes up in period 1? iv) Let v,(s, m) be the price of the option at time n if S, = s and max S; = m. Then: v,(s, m) = cx [Vn+(2s, m V (2S)) + Vn+1(8/2,m)]. Compute the value of the constant c, and compute vi(4,8). (Notation: a V b = max{a,b).) Osis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts