Question: 1 Consider a one period binomial model, where S(0) = 4, u = 2, d = 1/2. The risk free interest rate is r =

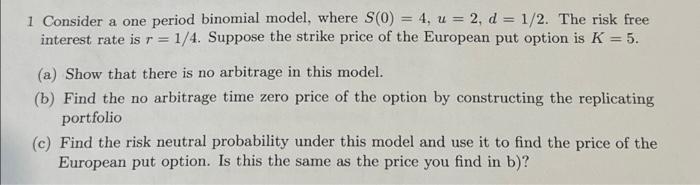

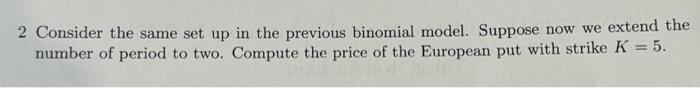

1 Consider a one period binomial model, where S(0)=4,u=2,d=1/2. The risk free interest rate is r=1/4. Suppose the strike price of the European put option is K=5. (a) Show that there is no arbitrage in this model. (b) Find the no arbitrage time zero price of the option by constructing the replicating portfolio (c) Find the risk neutral probability under this model and use it to find the price of the European put option. Is this the same as the price you find in b)? 2 Consider the same set up in the previous binomial model. Suppose now we extend the number of period to two. Compute the price of the European put with strike K=5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts