Question: 1. Consider a firm owning assets whose value one year from now will depend on the state of the market as described in the table

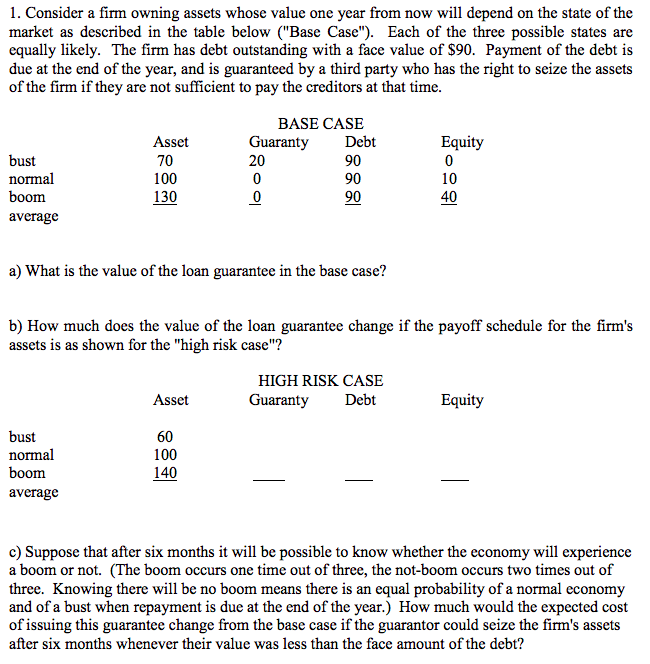

1. Consider a firm owning assets whose value one year from now will depend on the state of the market as described in the table below ("Base Case"). Each of the three possible states are equally likely. The firm has debt outstanding with a face value of S90. Payment of the debt is due at the end of the year, and is guaranteed by a third party who has the right to seize the assets of the firm if they are not sufficient to pay the creditors at that time BASE CASE Debt 90 90 90 Equity Asset 70 100 130 Guaranty 20 bust 10 40 average a) What is the value of the loan guarantee in the base case? b) How much does the value of the loan guarantee change if the payoff schedule for the firm's assets is as shown for the "high risk case"? HIGH RISK CASE Guaranty Debt Asset Equity bust normal 60 100 140 average c) Suppose that after six months it will be possible to know whether the economy will experience a boom or not. (The boom occurs one time out of three, the not-boom occurs two times out of three. Knowing there will be no boom means there is an equal probability of a normal economy and of a bust when repayment is due at the end of the year.) How much would the expected cost of issuing this guarantee change from the base case if the guarantor could seize the firm's assets after six months whenever their value was less than the face amount of the debt 1. Consider a firm owning assets whose value one year from now will depend on the state of the market as described in the table below ("Base Case"). Each of the three possible states are equally likely. The firm has debt outstanding with a face value of S90. Payment of the debt is due at the end of the year, and is guaranteed by a third party who has the right to seize the assets of the firm if they are not sufficient to pay the creditors at that time BASE CASE Debt 90 90 90 Equity Asset 70 100 130 Guaranty 20 bust 10 40 average a) What is the value of the loan guarantee in the base case? b) How much does the value of the loan guarantee change if the payoff schedule for the firm's assets is as shown for the "high risk case"? HIGH RISK CASE Guaranty Debt Asset Equity bust normal 60 100 140 average c) Suppose that after six months it will be possible to know whether the economy will experience a boom or not. (The boom occurs one time out of three, the not-boom occurs two times out of three. Knowing there will be no boom means there is an equal probability of a normal economy and of a bust when repayment is due at the end of the year.) How much would the expected cost of issuing this guarantee change from the base case if the guarantor could seize the firm's assets after six months whenever their value was less than the face amount of the debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts