Question: 1. Consider a five-year project with the following information: initial fixed asset investment = $490,000; straight-line depreciation to zero over the five-year life; zero salvage

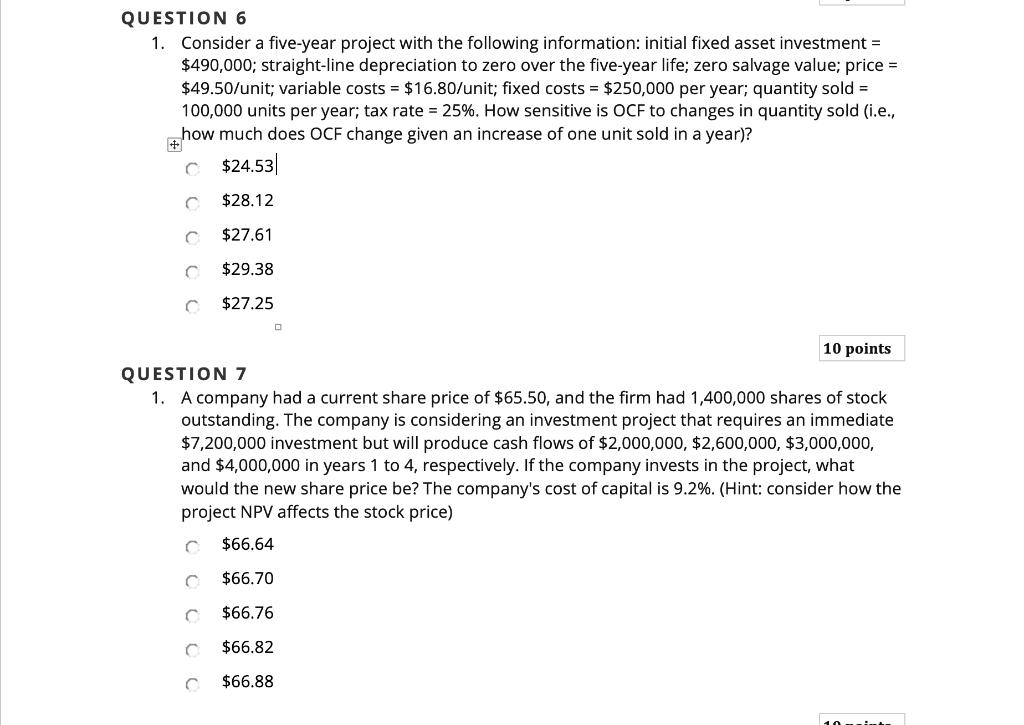

1. Consider a five-year project with the following information: initial fixed asset investment = $490,000; straight-line depreciation to zero over the five-year life; zero salvage value; price = $49.50 /unit; variable costs =$16.80/ unit; fixed costs =$250,000 per year; quantity sold = 100,000 units per year; tax rate =25%. How sensitive is OCF to changes in quantity sold (i.e., $24.53$28.12$27.61$29.38$27.25 QUESTION 7 1. A company had a current share price of $65.50, and the firm had 1,400,000 shares of stock outstanding. The company is considering an investment project that requires an immediate $7,200,000 investment but will produce cash flows of $2,000,000,$2,600,000,$3,000,000, and $4,000,000 in years 1 to 4 , respectively. If the company invests in the project, what would the new share price be? The company's cost of capital is 9.2%. (Hint: consider how the project NPV affects the stock price) $66.64$66.70$66.76$66.82$66.88

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts