Question: Please help with #1-2 1. Olin Transmissions, Inc., has the following estimates for its new gear assembly project: price = $12 per unit; variable costs

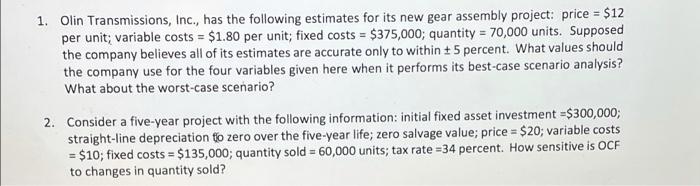

1. Olin Transmissions, Inc., has the following estimates for its new gear assembly project: price = $12 per unit; variable costs = $1.80 per unit; fixed costs = $375,000; quantity = 70,000 units. Supposed the company believes all of its estimates are accurate only to within 5 percent. What values should the company use for the four variables given here when it performs its best-case scenario analysis? What about the worst-case scenario? 2. Consider a five-year project with the following information: initial fixed asset investment =$300,000; straight-line depreciation to zero over the five-year life; zero salvage value; price = $20; variable costs = $10; fixed costs = $135,000; quantity sold = 60,000 units; tax rate=34 percent. How sensitive is OCF to changes in quantity sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts