Question: 1) Consider a no-interest loan with current rating BB, maturity of 3 years and amount to be repaid at maturity of $100 million. The

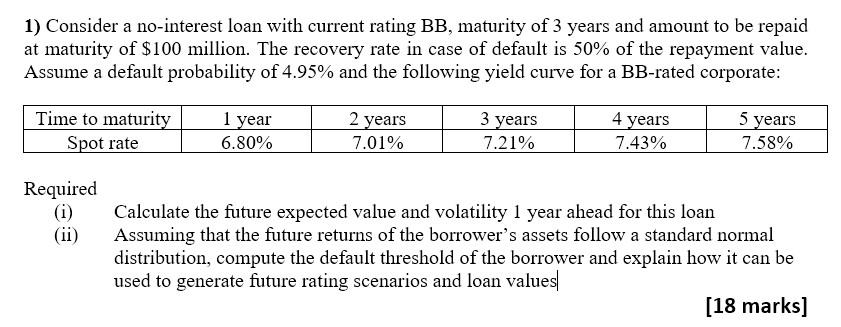

1) Consider a no-interest loan with current rating BB, maturity of 3 years and amount to be repaid at maturity of $100 million. The recovery rate in case of default is 50% of the repayment value. Assume a default probability of 4.95% and the following yield curve for a BB-rated corporate: Time to maturity Spot rate 1 year 6.80% Required (i) 2 years 7.01% 3 years 7.21% 4 years 5 years 7.43% 7.58% Calculate the future expected value and volatility 1 year ahead for this loan (ii) Assuming that the future returns of the borrower's assets follow a standard normal distribution, compute the default threshold of the borrower and explain how it can be used to generate future rating scenarios and loan values [18 marks]

Step by Step Solution

There are 3 Steps involved in it

Lets break down the calculation and explanation step by step 1 Future Expected Value and Volatility 1 Year Ahead i To calculate the future expected value well use the spot rates provided and the recov... View full answer

Get step-by-step solutions from verified subject matter experts