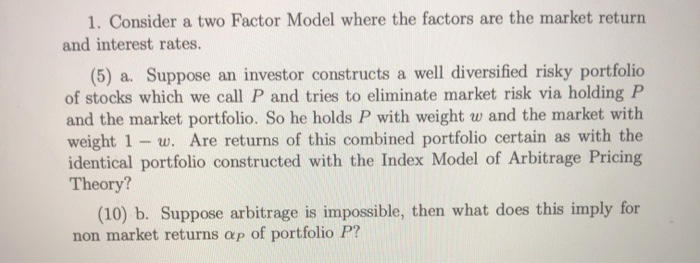

Question: 1. Consider a two Factor Model where the factors are the market return and interest rates. (5) a. Suppose an investor constructs a well diversified

1. Consider a two Factor Model where the factors are the market return and interest rates. (5) a. Suppose an investor constructs a well diversified risky portfolio of stocks which we call P and tries to eliminate market risk via holding P and the market portfolio. So he holds P with weight w and the market with weight 1 - w. Are returns of this combined portfolio certain as with the identical portfolio constructed with the Index Model of Arbitrage Pricing Theory? (10) b. Suppose arbitrage is impossible, then what does this imply for non market returns ap of portfolio P

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts