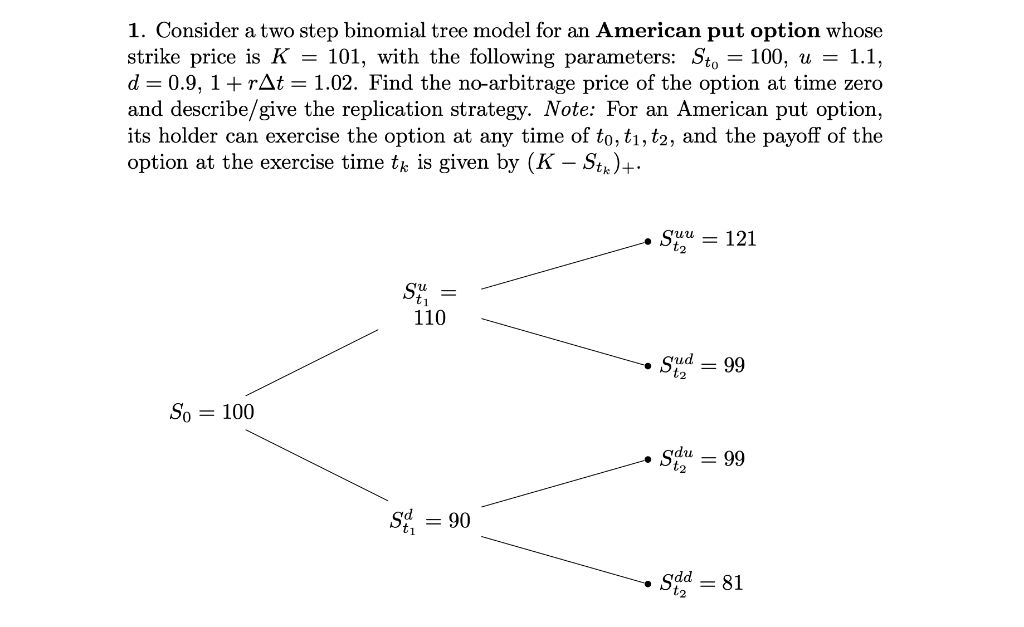

Question: 1. Consider a two step binomial tree model for an American put option whose strike price is K=101, with the following parameters: St0=100,u=1.1, d=0.9,1+rt=1.02. Find

1. Consider a two step binomial tree model for an American put option whose strike price is K=101, with the following parameters: St0=100,u=1.1, d=0.9,1+rt=1.02. Find the no-arbitrage price of the option at time zero and describe/give the replication strategy. Note: For an American put option, its holder can exercise the option at any time of t0,t1,t2, and the payoff of the option at the exercise time tk is given by (KStk)+. 1. Consider a two step binomial tree model for an American put option whose strike price is K=101, with the following parameters: St0=100,u=1.1, d=0.9,1+rt=1.02. Find the no-arbitrage price of the option at time zero and describe/give the replication strategy. Note: For an American put option, its holder can exercise the option at any time of t0,t1,t2, and the payoff of the option at the exercise time tk is given by (KStk)+

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts