Question: 2. Consider again the two step binomial tree model with the same parameters as in problem 1: St0=100,u=1.1,d=0.9,1+rt=1.02. This time, please find the no-arbitrage price

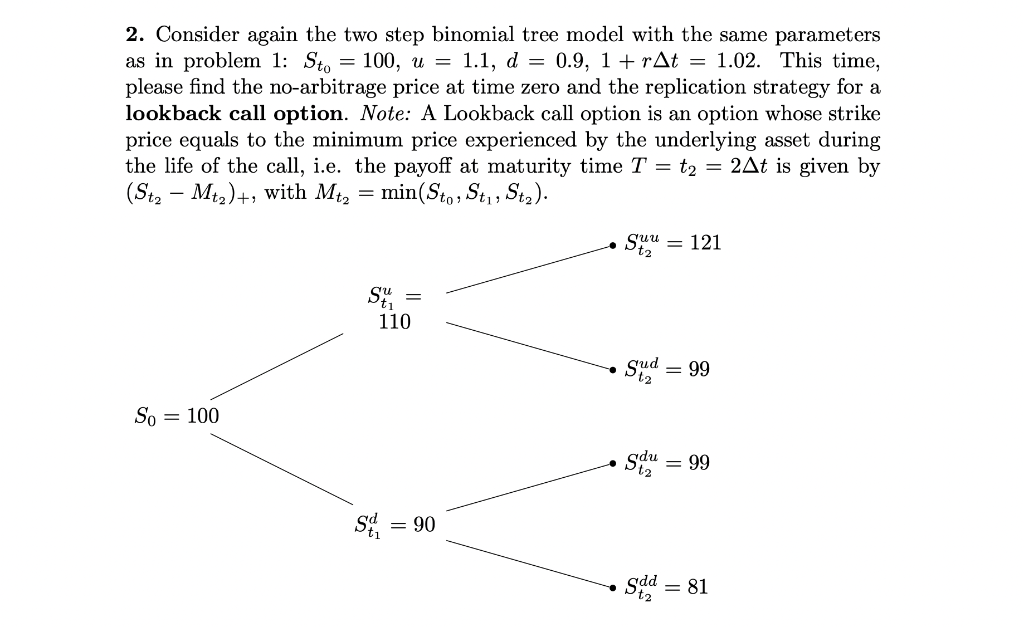

2. Consider again the two step binomial tree model with the same parameters as in problem 1: St0=100,u=1.1,d=0.9,1+rt=1.02. This time, please find the no-arbitrage price at time zero and the replication strategy for a lookback call option. Note: A Lookback call option is an option whose strike price equals to the minimum price experienced by the underlying asset during the life of the call, i.e. the payoff at maturity time T=t2=2t is given by (St2Mt2)+, with Mt2=min(St0,St1,St2) 2. Consider again the two step binomial tree model with the same parameters as in problem 1: St0=100,u=1.1,d=0.9,1+rt=1.02. This time, please find the no-arbitrage price at time zero and the replication strategy for a lookback call option. Note: A Lookback call option is an option whose strike price equals to the minimum price experienced by the underlying asset during the life of the call, i.e. the payoff at maturity time T=t2=2t is given by (St2Mt2)+, with Mt2=min(St0,St1,St2)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts