Question: 1. Consider an $8000 Face Value coupon bond with a Coupon Rate of 5% and a 6-year maturity a) If you purchase this bond

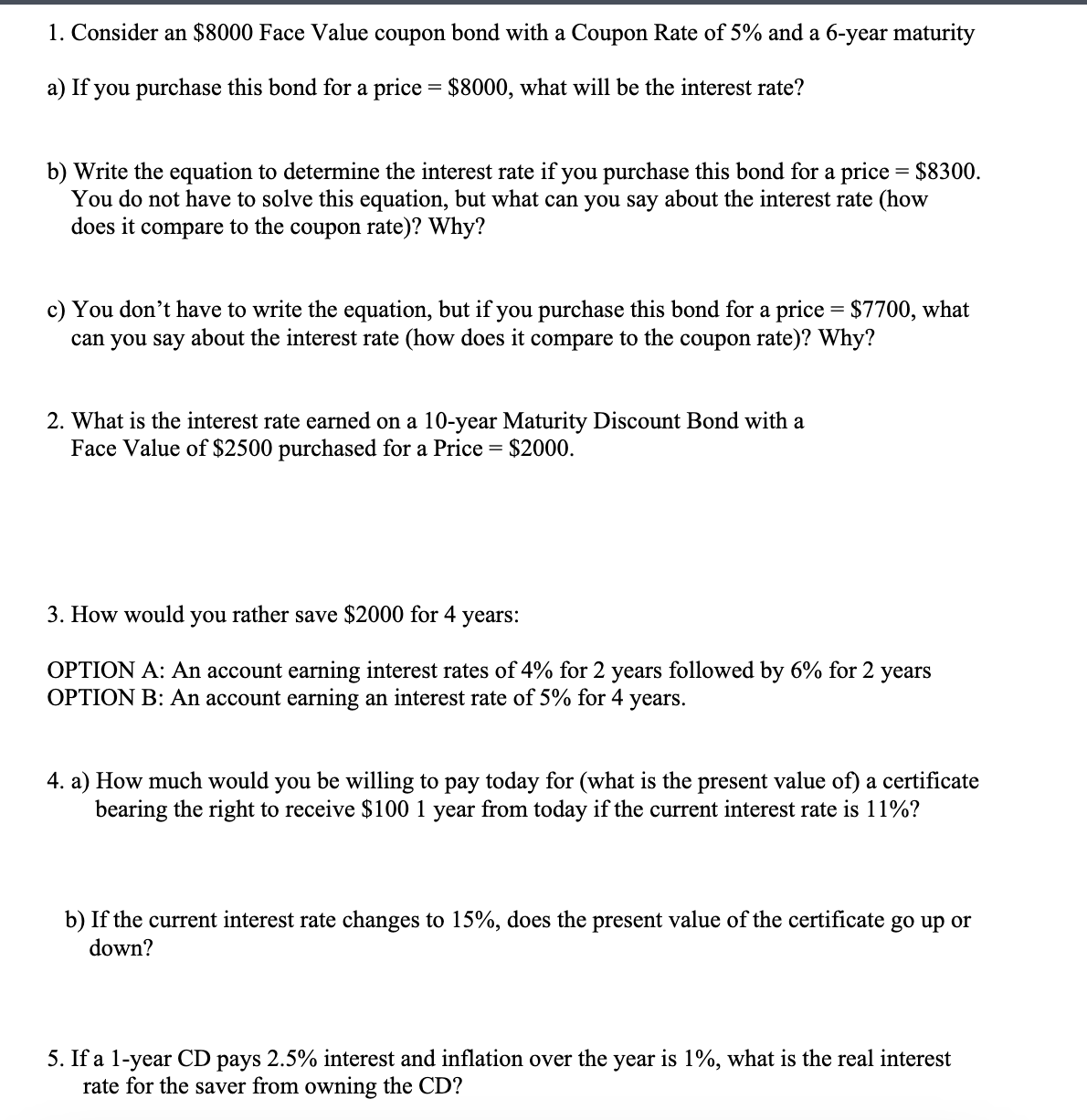

1. Consider an $8000 Face Value coupon bond with a Coupon Rate of 5% and a 6-year maturity a) If you purchase this bond for a price = $8000, what will be the interest rate? b) Write the equation to determine the interest rate if you purchase this bond for a price = $8300. You do not have to solve this equation, but what can you say about the interest rate (how does it compare to the coupon rate)? Why? c) You don't have to write the equation, but if you purchase this bond for a price = $7700, what can you say about the interest rate (how does it compare to the coupon rate)? Why? 2. What is the interest rate earned on a 10-year Maturity Discount Bond with a Face Value of $2500 purchased for a Price = $2000. 3. How would you rather save $2000 for 4 years: OPTION A: An account earning interest rates of 4% for 2 years followed by 6% for 2 OPTION B: An account earning an interest rate of 5% for 4 years. years 4. a) How much would you be willing to pay today for (what is the present value of) a certificate bearing the right to receive $100 1 year from today if the current interest rate is 11%? b) If the current interest rate changes to 15%, does the present value of the certificate go up or down? 5. If a 1-year CD pays 2.5% interest and inflation over the year is 1%, what is the real interest rate for the saver from owning the CD?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts