Question: 1. Consider M assets whose return is a M-dimensional random vector r. The expected value of r is a M-dimensional column vector pl and the

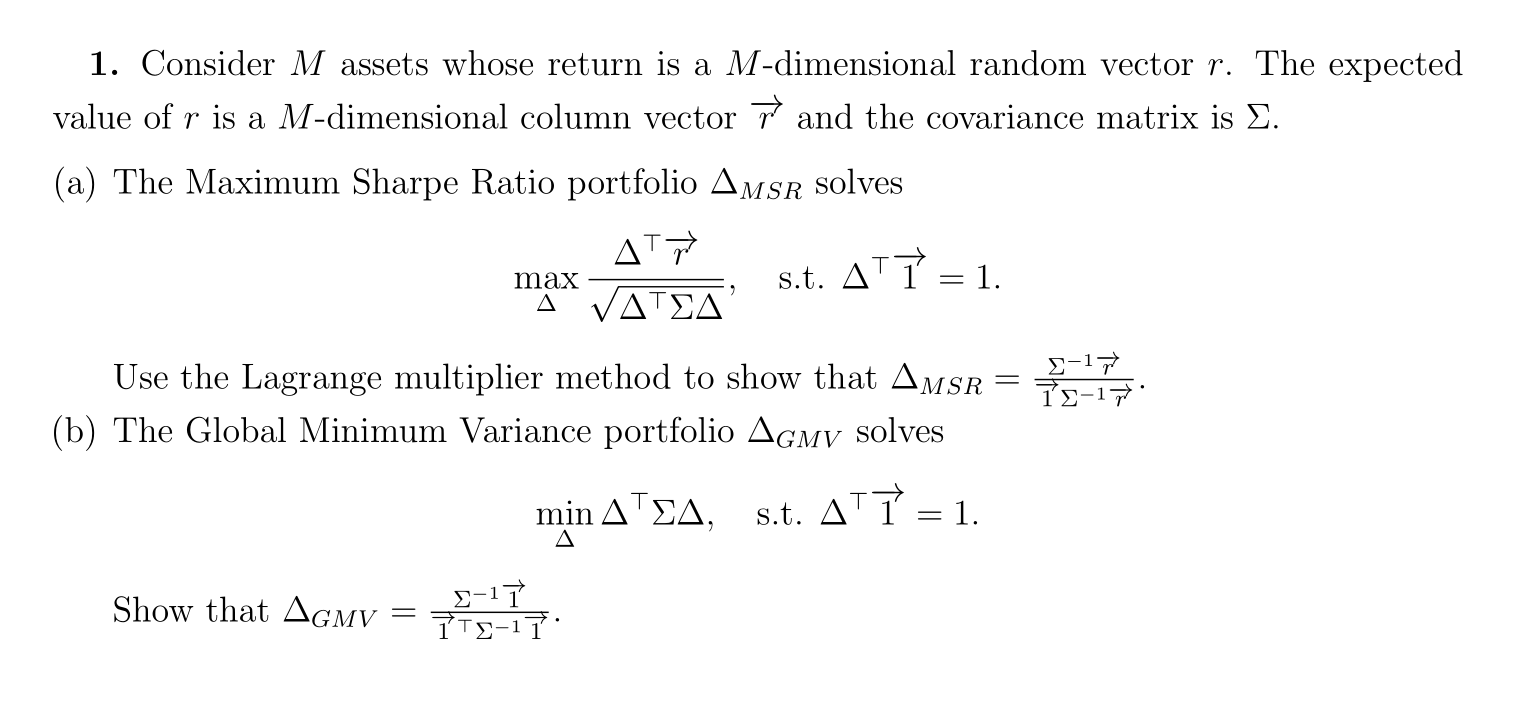

1. Consider M assets whose return is a M-dimensional random vector r. The expected value of r is a M-dimensional column vector pl and the covariance matrix is 2. (a) The Maximum Sharpe Ratio portfolio Amst solves max ATEA s.t. ATT = 1. Use the Lagrange multiplier method to show that AMSR 2-17 = . T :-17 (b) The Global Minimum Variance portfolio Agmy solves min ATEA, S.t. ATT = 1. Show that AGMV 5-17 TT9-17 1. Consider M assets whose return is a M-dimensional random vector r. The expected value of r is a M-dimensional column vector pl and the covariance matrix is 2. (a) The Maximum Sharpe Ratio portfolio Amst solves max ATEA s.t. ATT = 1. Use the Lagrange multiplier method to show that AMSR 2-17 = . T :-17 (b) The Global Minimum Variance portfolio Agmy solves min ATEA, S.t. ATT = 1. Show that AGMV 5-17 TT9-17

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts