Question: 1. Consider two risky stocks, A and B, with expected returns of 21% and 7%, respectively. Stock A has a standard deviation of 19%; Stock

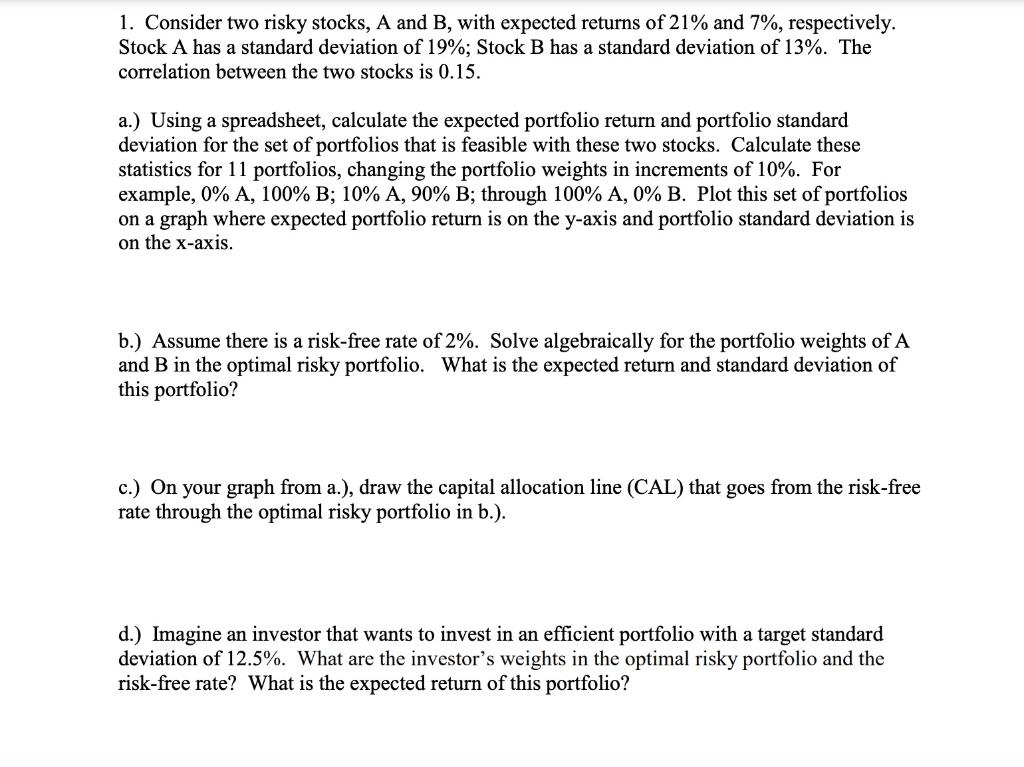

1. Consider two risky stocks, A and B, with expected returns of 21% and 7%, respectively. Stock A has a standard deviation of 19%; Stock B has a standard deviation of 13%. The correlation between the two stocks is 0.15. a.) Using a spreadsheet, calculate the expected portfolio return and portfolio standard deviation for the set of portfolios that is feasible with these two stocks. Calculate these statistics for 11 portfolios, changing the portfolio weights in increments of 10%. For example, 0% A, 100% B; 10% A, 90% B; through 100% A, 0% B. Plot this set of portfolios on a graph where expected portfolio return is on the y-axis and portfolio standard deviation is on the x-axis. b.) Assume there is a risk-free rate of 2%. Solve algebraically for the portfolio weights of A and B in the optimal risky portfolio. What is the expected return and standard deviation of this portfolio? c.) On your graph from a.), draw the capital allocation line (CAL) that goes from the risk-free rate through the optimal risky portfolio in b.). d.) Imagine an investor that wants to invest in an efficient portfolio with a target standard deviation of 12.5%. What are the investor's weights in the optimal risky portfolio and the risk-free rate? What is the expected return of this portfolio? 1. Consider two risky stocks, A and B, with expected returns of 21% and 7%, respectively. Stock A has a standard deviation of 19%; Stock B has a standard deviation of 13%. The correlation between the two stocks is 0.15. a.) Using a spreadsheet, calculate the expected portfolio return and portfolio standard deviation for the set of portfolios that is feasible with these two stocks. Calculate these statistics for 11 portfolios, changing the portfolio weights in increments of 10%. For example, 0% A, 100% B; 10% A, 90% B; through 100% A, 0% B. Plot this set of portfolios on a graph where expected portfolio return is on the y-axis and portfolio standard deviation is on the x-axis. b.) Assume there is a risk-free rate of 2%. Solve algebraically for the portfolio weights of A and B in the optimal risky portfolio. What is the expected return and standard deviation of this portfolio? c.) On your graph from a.), draw the capital allocation line (CAL) that goes from the risk-free rate through the optimal risky portfolio in b.). d.) Imagine an investor that wants to invest in an efficient portfolio with a target standard deviation of 12.5%. What are the investor's weights in the optimal risky portfolio and the risk-free rate? What is the expected return of this portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts