Question: 1 continue continue continue Question This is full question its ok don't solve THANKS QUESTION Question 1 of 5 Dec. 31 (To record EFT payments

1

continue

continue

continue

Question

This is full question

its ok don't solve THANKS

QUESTION

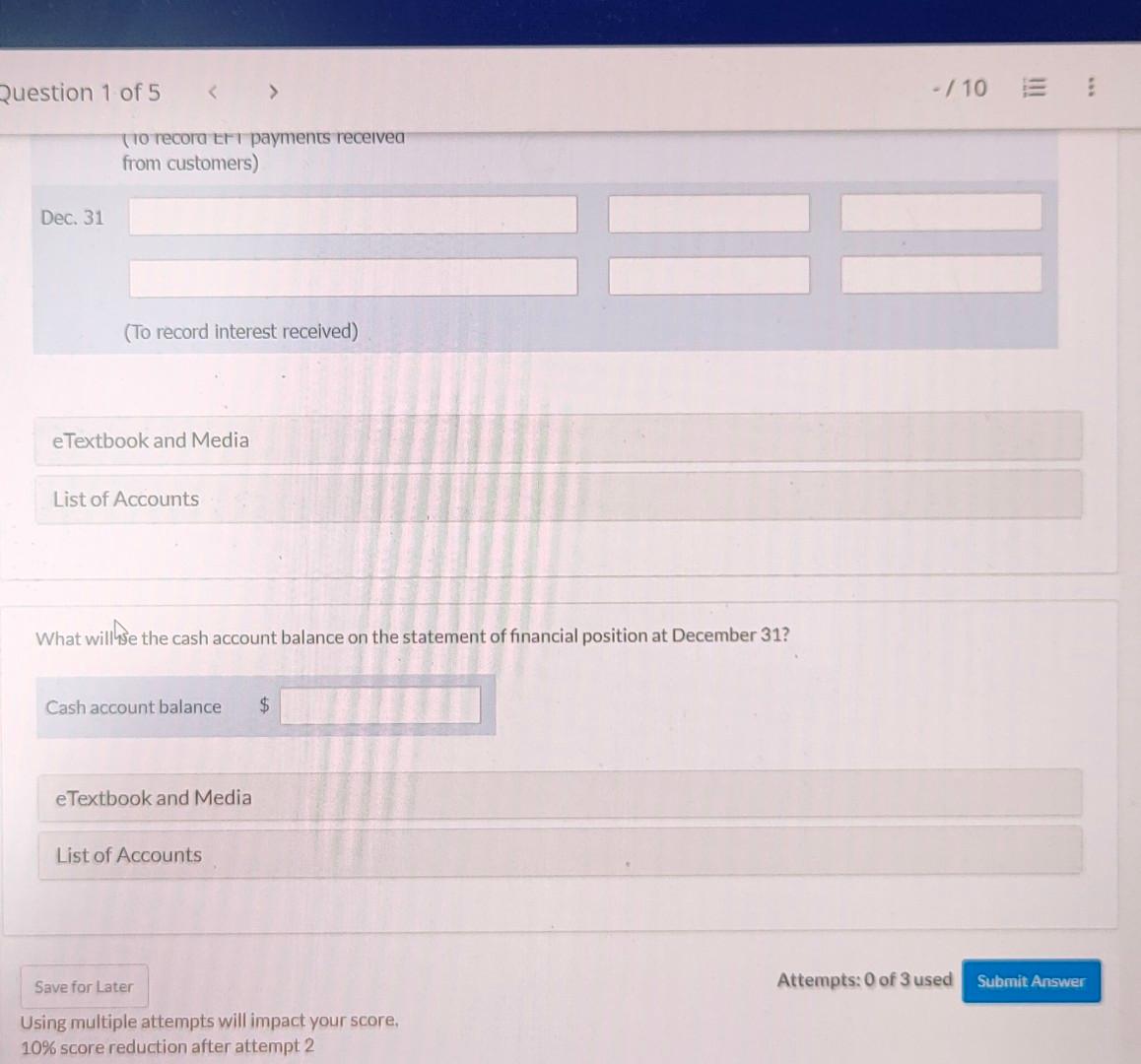

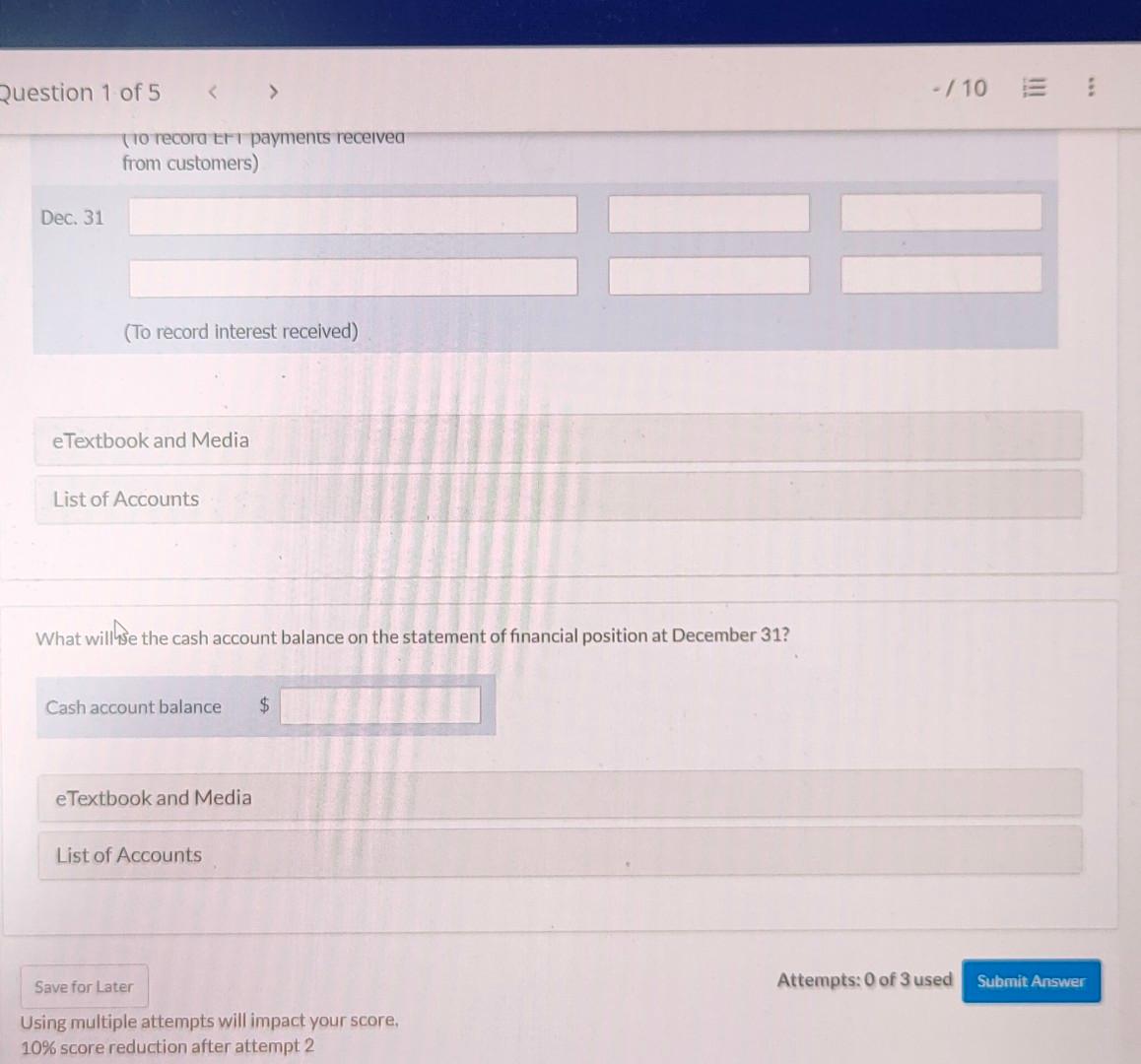

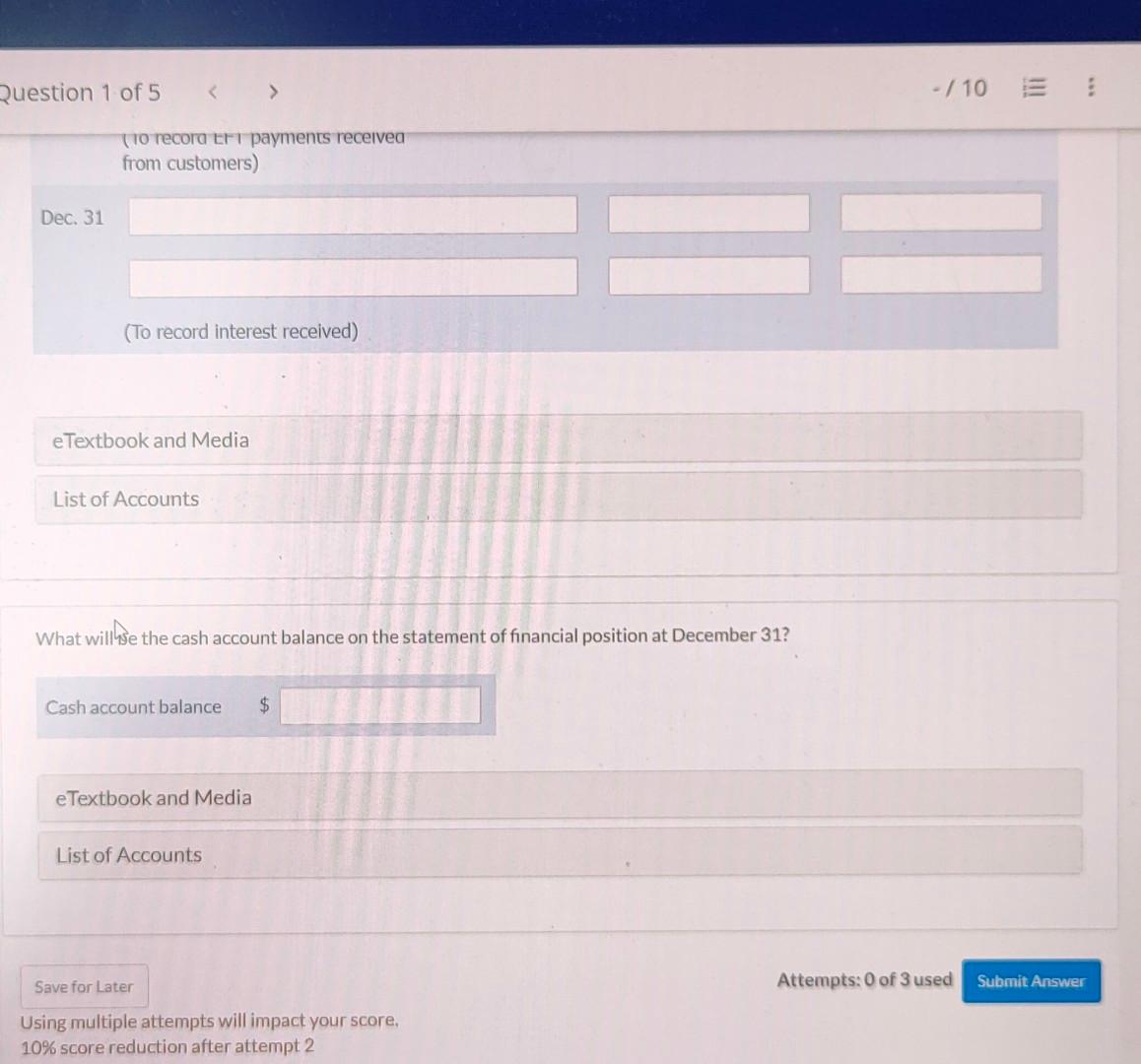

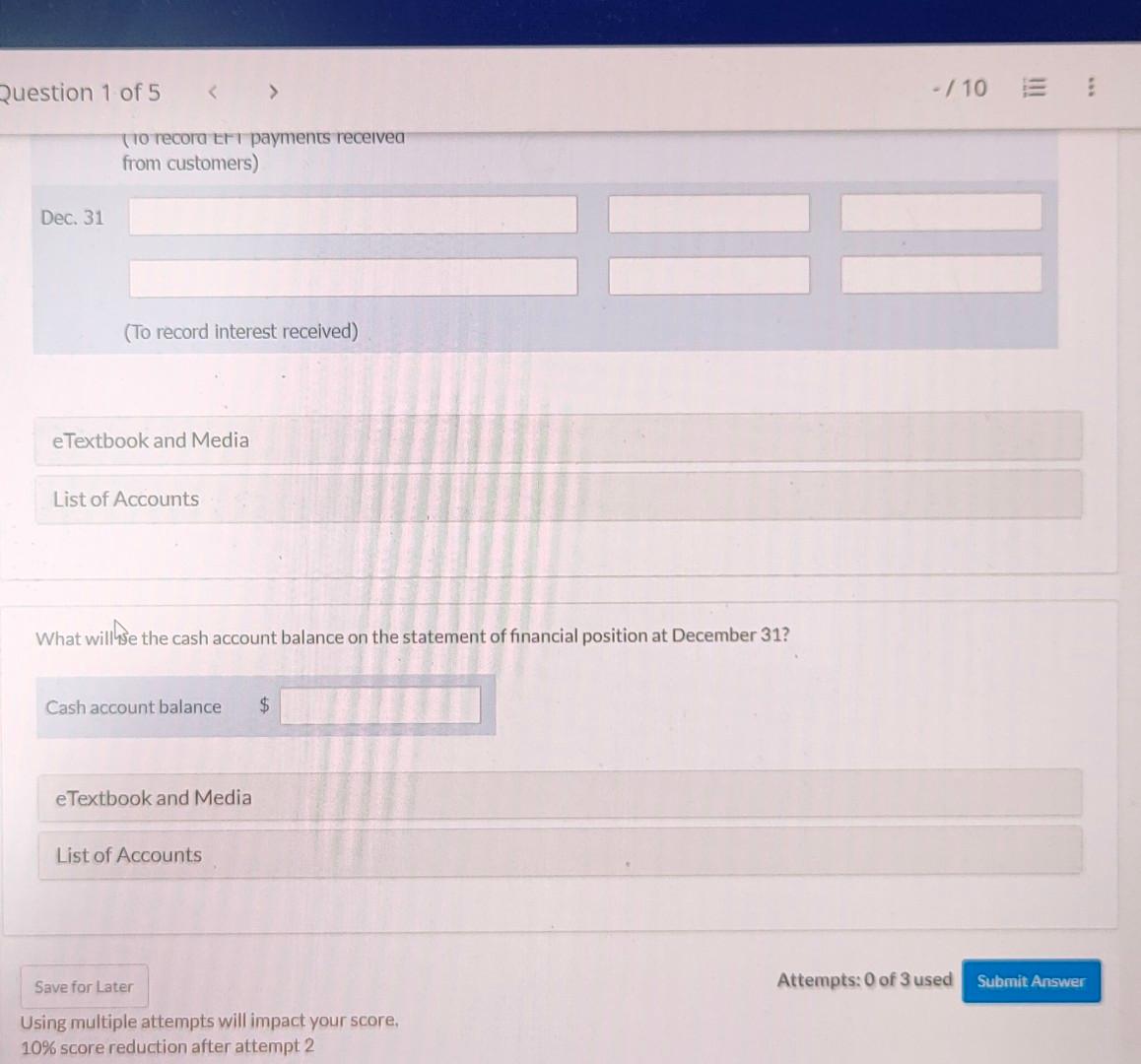

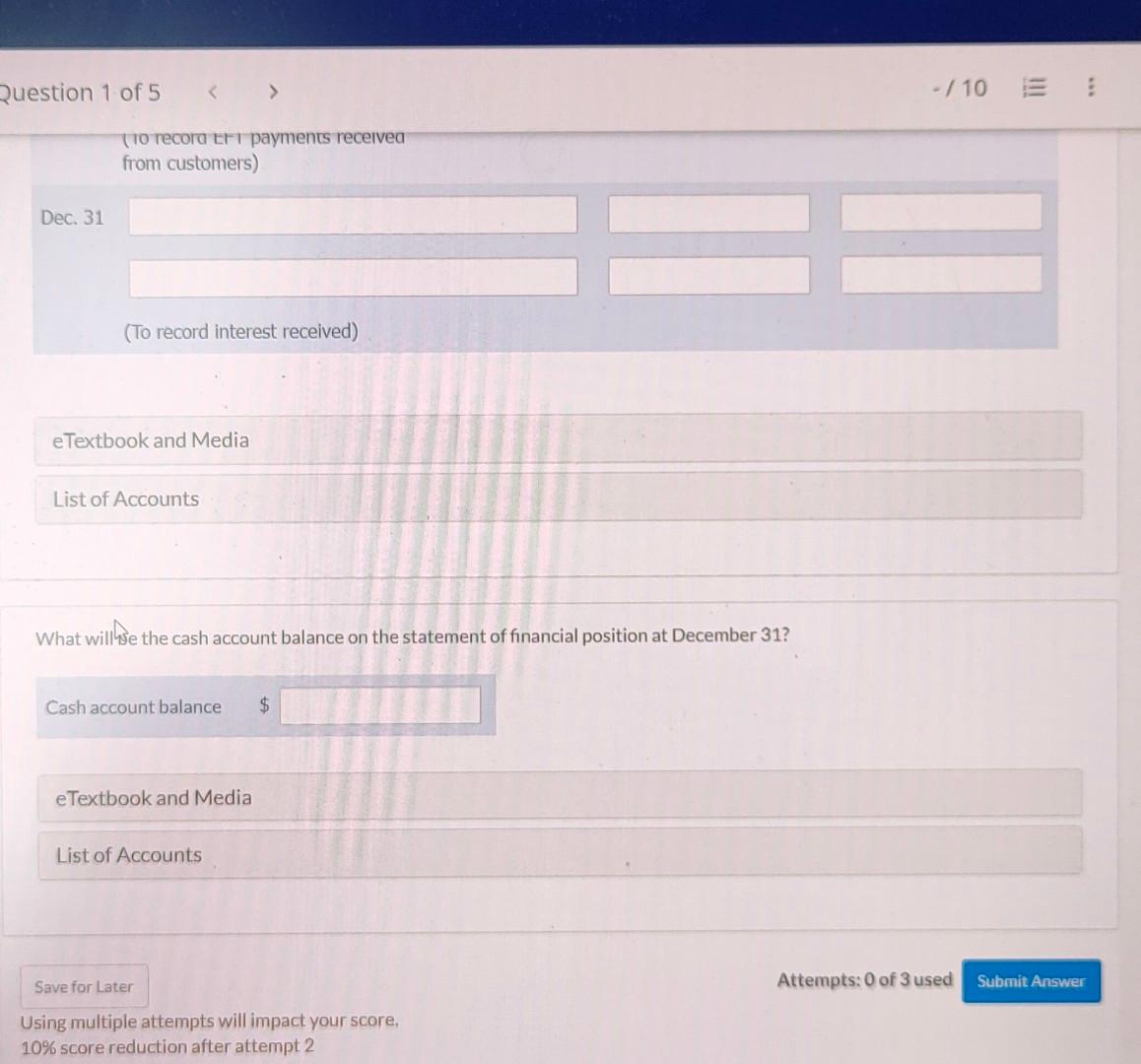

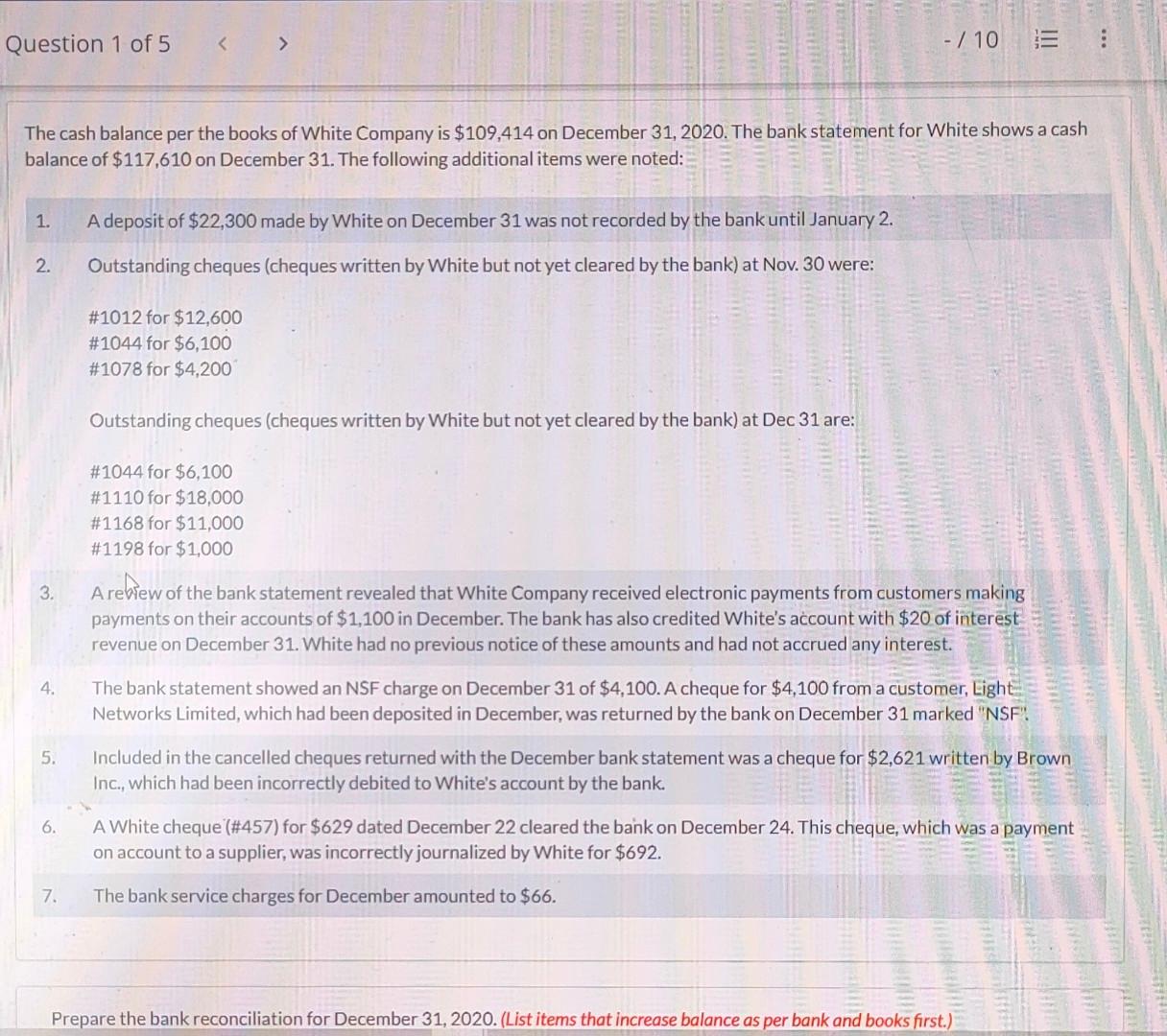

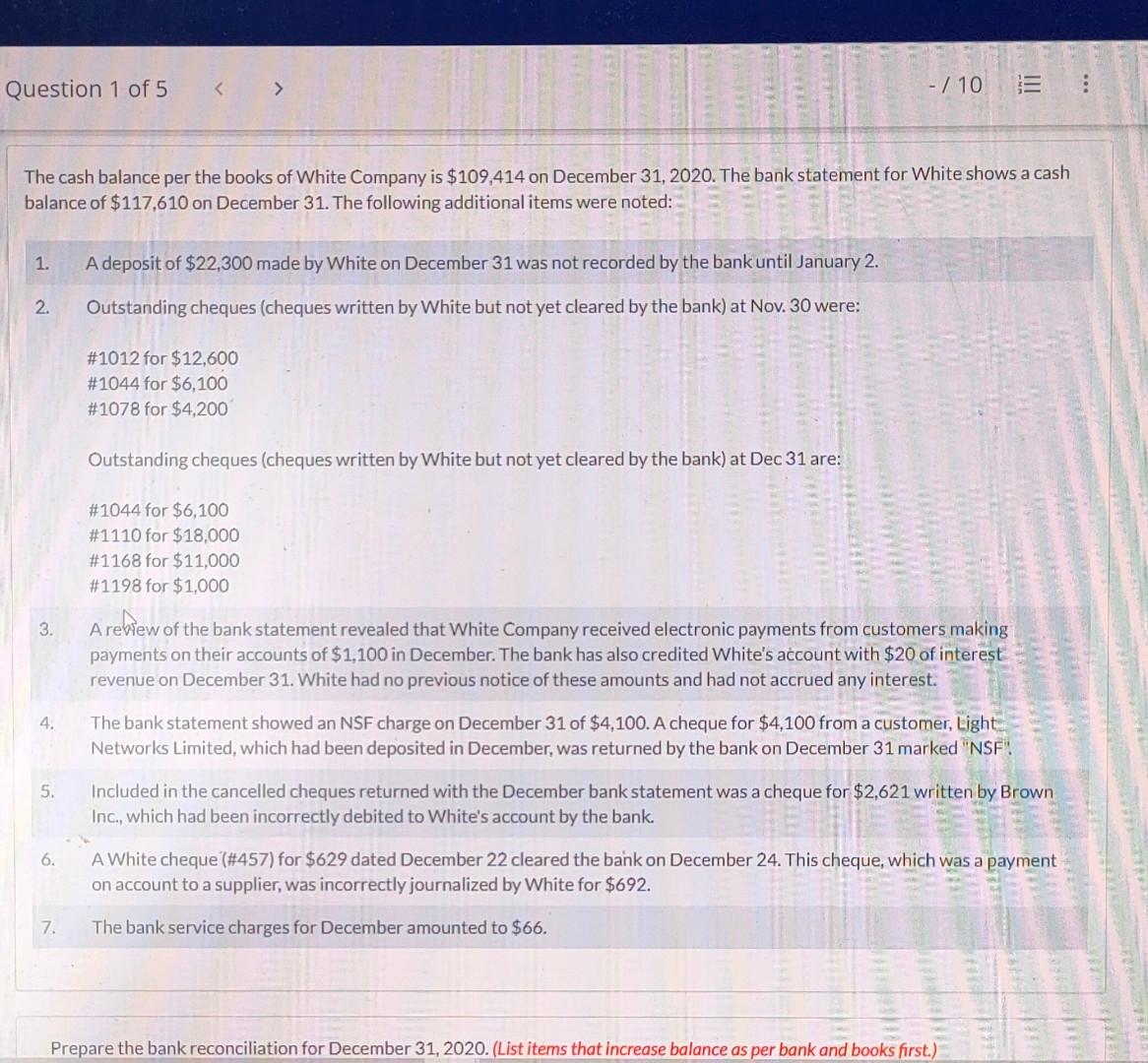

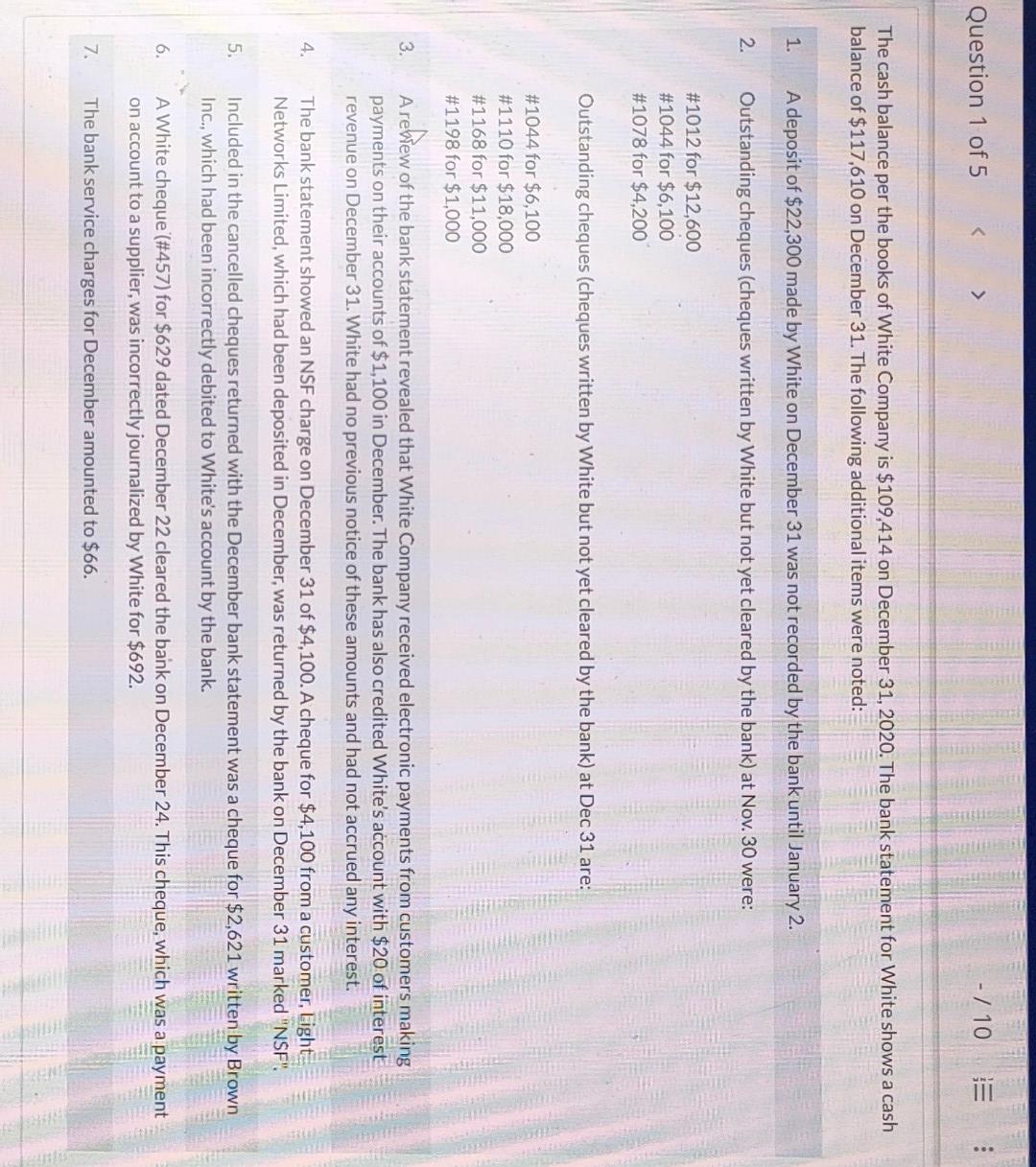

Question 1 of 5 Dec. 31 (To record EFT payments received from customers) (To record interest received) eTextbook and Medial List of Accounts What will use the cash account balance on the statement of financial position at December 31? Cash account balance $ eTextbook and Media List of Accounts Save for Later Using multiple attempts will impact your score, 10% score reduction after attempt 2 -/10 Attempts: 0 of 3 used E Submit Answer Question 1 of 5 Dec. 31 (To record EFT payments received from customers) (To record interest received) eTextbook and Medial List of Accounts What will use the cash account balance on the statement of financial position at December 31? Cash account balance $ eTextbook and Media List of Accounts Save for Later Using multiple attempts will impact your score, 10% score reduction after attempt 2 -/10 Attempts: 0 of 3 used E Submit Answer Question 1 of 5 Dec. 31 (To record EFT payments received from customers) (To record interest received) eTextbook and Medial List of Accounts What will use the cash account balance on the statement of financial position at December 31? Cash account balance $ eTextbook and Media List of Accounts Save for Later Using multiple attempts will impact your score, 10% score reduction after attempt 2 -/10 Attempts: 0 of 3 used E Submit Answer Question 1 of 5 Dec. 31 (To record EFT payments received from customers) (To record interest received) eTextbook and Medial List of Accounts What will use the cash account balance on the statement of financial position at December 31? Cash account balance $ eTextbook and Media List of Accounts Save for Later Using multiple attempts will impact your score, 10% score reduction after attempt 2 -/10 Attempts: 0 of 3 used E Submit Answer Question 1 of 5 Dec. 31 (To record EFT payments received from customers) (To record interest received) eTextbook and Medial List of Accounts What will use the cash account balance on the statement of financial position at December 31? Cash account balance $ eTextbook and Media List of Accounts Save for Later Using multiple attempts will impact your score, 10% score reduction after attempt 2 -/10 Attempts: 0 of 3 used E Submit Answer III Question 1 of 5 - / 10 The cash balance per the books of White Company is $109,414 on December 31, 2020. The bank statement for White shows a cash balance of $117,610 on December 31. The following additional items were noted: 1. A deposit of $22,300 made by White on December 31 was not recorded by the bank until January 2. 2. Outstanding cheques (cheques written by White but not yet cleared by the bank) at Nov. 30 were: # 1012 for $12,600 #1044 for $6,100 # 1078 for $4,200 Outstanding cheques (cheques written by White but not yet cleared by the bank) at Dec 31 are: #1044 for $6,100 #1110 for $18,000 #1168 for $11,000 #1198 for $1,000 3. A review of the bank statement revealed that White Company received electronic payments from customers making payments on their accounts of $1,100 in December. The bank has also credited White's account with $20 of interest revenue on December 31. White had no previous notice of these amounts and had not accrued any interest. 4. The bank statement showed an NSF charge on December 31 of $4,100. A cheque for $4,100 from a customer, Light Networks Limited, which had been deposited in December, was returned by the bank on December 31 marked "NSF"! 5. Included in the cancelled cheques returned with the December bank statement was a cheque for $2,621 written by Brown Inc., which had been incorrectly debited to White's account by the bank. 6. A White cheque (#457) for $629 dated December 22 cleared the bank on December 24. This cheque, which was a payment on account to a supplier, was incorrectly journalized by White for $692. 7. The bank service charges for December amounted to $66. Prepare the bank reconciliation for December 31, 2020. (List items that increase balance as per bank and books first.) .. III Question 1 of 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts