Question: really need major help on this Answer each question independently Read the requirements. Requirement 1. A restaurant made cash sales of $9.000 subject to a

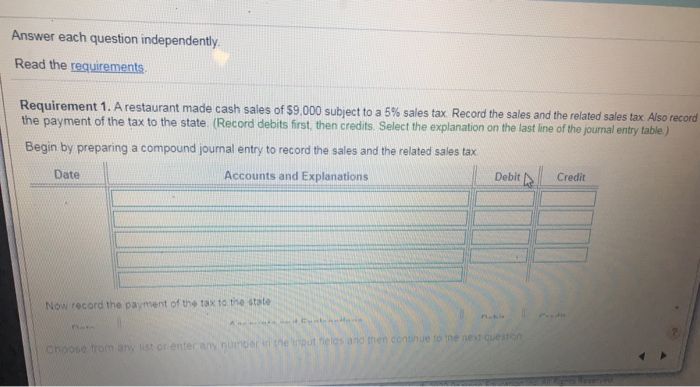

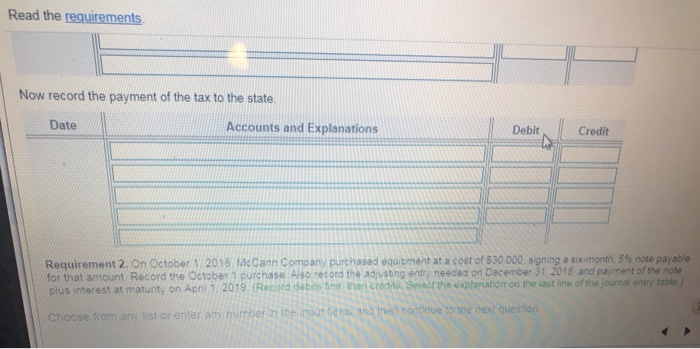

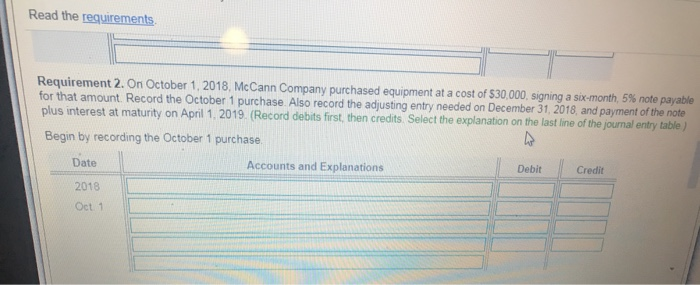

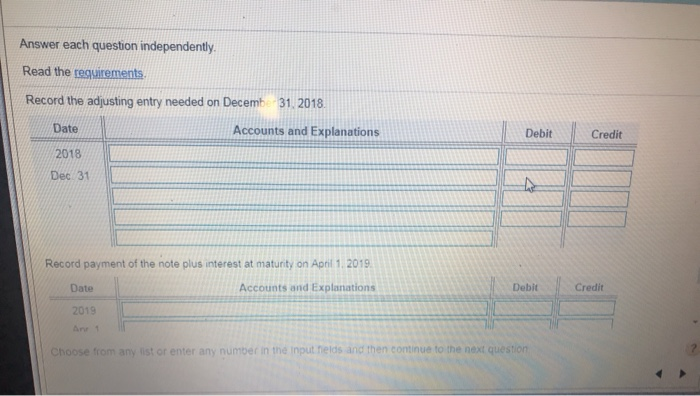

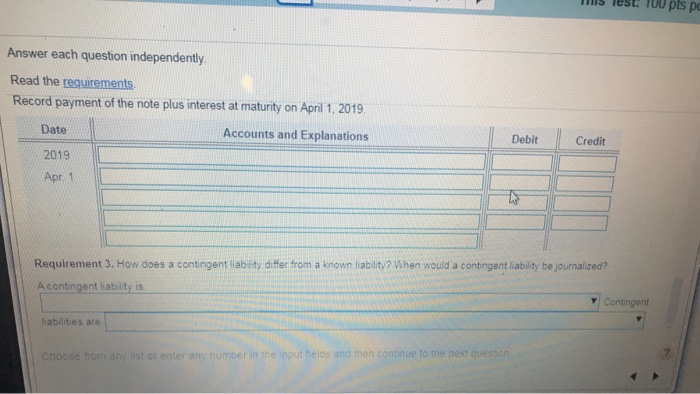

Answer each question independently Read the requirements. Requirement 1. A restaurant made cash sales of $9.000 subject to a 5% sales tax Record the sales and the related sales tax Also record the payment of the tax to the state. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Begin by preparing a compound journal entry to record the sales and the related sales tax Date Accounts and Explanations Debit Credit Now record the payment of the tax to the state onance from any listor antaran nimbol in the cout Melds and then continue to the next cuestion. Read the requirements. Now record the payment of the tax to the state. Date Accounts and Explanations Credit Requirement 2. On October 1, 2018 McCann Company purchased equipment at a cost of $30 000 signing a six-month. 59 note payable for that amount Record the October 1 purchase. Also record the adjusting entry needed on December 31 2018 and payment of the note plus interest at maturity on April 1. 2019. Record debits first then credito. Solact the explanation on the last line of the journal ontry table) Choose from any list or enter any number in the posnelds and then continue to the next question Read the requirements Requirement 2. On October 1, 2018, McCann Company purchased equipment at a cost of $30,000, signing a six-month, 5% note payable for that amount. Record the October 1 purchase. Also record the adjusting entry needed on December 31, 2018, and payment of the note plus interest at maturity on April 1, 2019. (Record debits first, then credits. Select the explanation on the last line of the journal entry table) Begin by recording the October 1 purchase Date Accounts and Explanations Debit Credit 2018 Oct 1 Answer each question independently. Read the requirements Record the adjusting entry needed on Decembe 31, 2018 Date Accounts and Explanations Credit 2018 Dec 31 Record payment of the note plus interest at maturity on April 1, 2019 Date Accounts and Explanations Debit Credit 2019 And Choose from any list or enter any number in the input helds and then continue to the next question Mis Test: 100 pls po Answer each question independently. Read the requirements Record payment of the note plus interest at maturity on April 1, 2019. Date Accounts and Explanations Debit Credit 2019 Apr 1 Requirement 3. How does a contingent liability differ from a known labuity? When would a contingent liability be journalized? A contingent liability is Contingent liabilities are Choose from any list or enter any number in the input fields and then continue to the next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts