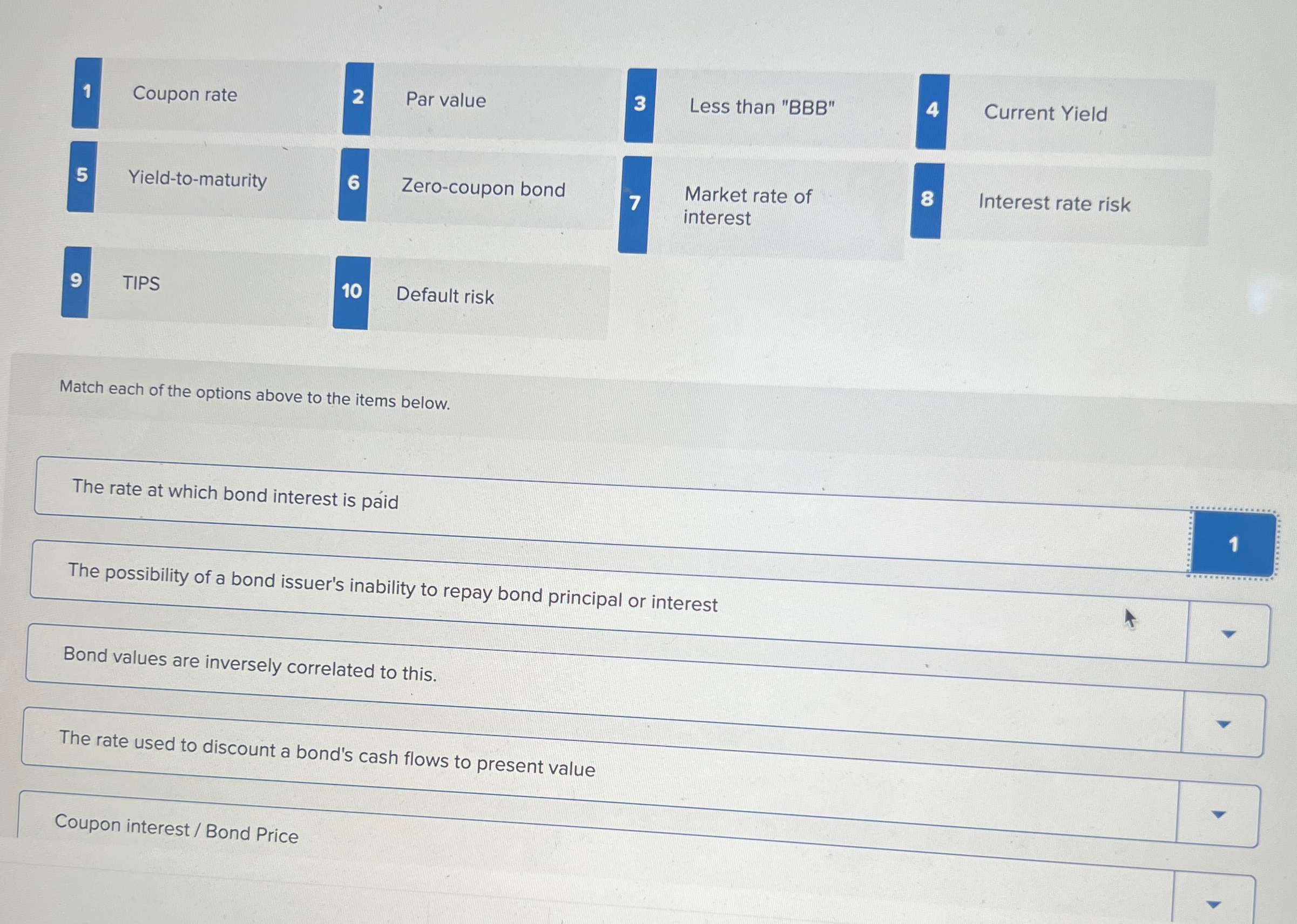

Question: 1 Coupon rate 2 Par value 3 Less than BBB 4 Current Yield 5 Yield - to - maturity 6 Zero - coupon

Coupon rate

Par value

Less than BBB

Current Yield

Yieldtomaturity

Zerocoupon bond

Market rate of

interest

Interest rate risk

TIPS

Default risk

Match each of the options above to the items below.

The rate at which bond interest is paid

The possibility of a bond issuer's inability to repay bond principal or interest

Bond values are inversely correlated to this.

The rate used to discount a bond's cash flows to present value

Coupon interest Bond Price

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock