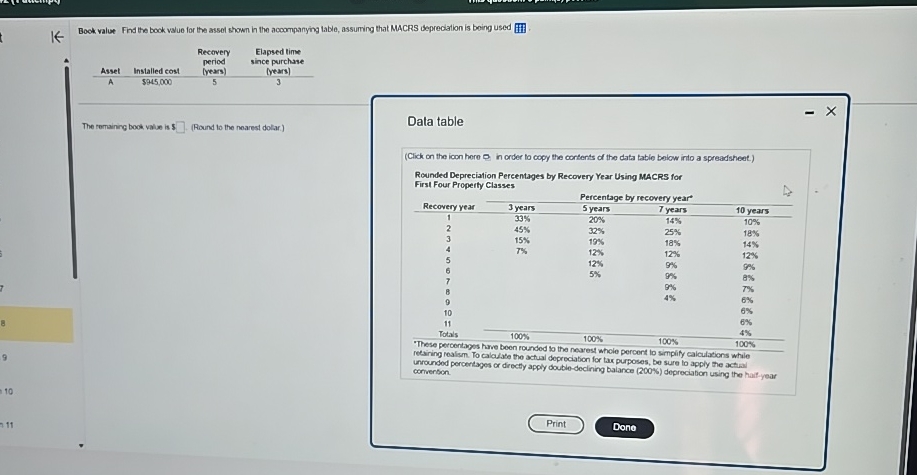

Question: Bock value Find the book value for the asset shown in the accompanying lable, assurving that MACRS depreciation is boing used . table [

Bock value Find the book value for the asset shown in the accompanying lable, assurving that MACRS depreciation is boing used

tableAssetInstalled cost,tableRecoveryperiodyearstableElapsed timesince purchaseyearsA$

The remaining book value is: Round to the nearest dolar.

Data table

Click on the icon here in order to copy the cortents of the data table below into a spreadsheet.

Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes

Percentage by recovery year

tableRecovery year, years, years, years, yearsTotals retairing realism. To calculate the achual depreciation for tax purposes, be sure to apply the actual unroundon. corvertages or drecty apply doubledeclining baiance depreciation using the haifyear corvertion.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock