Question: 1. Covariance, correlation, and diversification Consider two stocks: stock A and stock B. Suppose that these two stocks that generally have similar monthly returns each

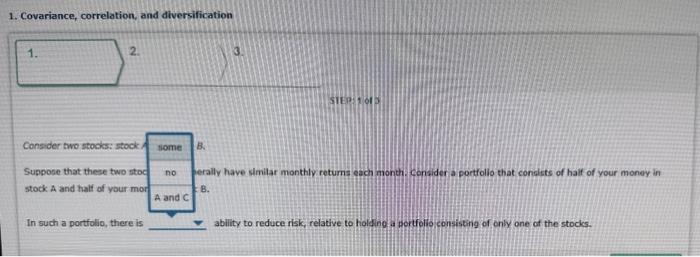

1. Covariance, correlation, and diversification Consider two stocks: stock A and stock B. Suppose that these two stocks that generally have similar monthly returns each month. Consider a portfolio that consists of half of your money in stock A and half of your money in stock B. In such a portfolio, there is ability to reduce risk, relative to holding a portfolio consisting of only one of the stocks. 1. Covariance, correlation, and diversification 2. 3. siepirifin Consider two stock: stock: Suppose that these two sto irally have similar monthly cetums cach month. Censider a portfolio that conalets of half of your money in stock A and half of your mi B. In such a portfolio, there is ability to reduce risk, relative to holfing a portfolio consiseng of only one of the stocks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts