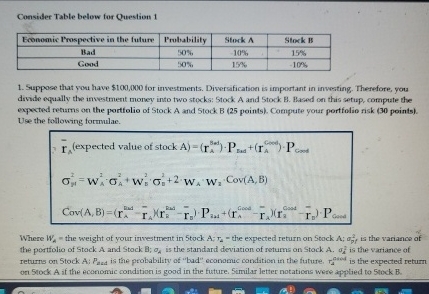

Question: Consider Table below for Question 1 Suppose that wou have $ 1 0 0 , 0 0 0 for investments. Diversification is important in investing.

Consider Table below for Question

Suppose that wou have $ for investments. Diversification is important in investing. Thesefore, you

divide equally the investment money into two stocks: Stock. A and Stock. B Based on this setup, compute the

expected retiams on the portfolio of Stock A and Stock B points Compute yotar portfolio risk points

Use the following formulas.

expected value stockA

Cov

Where the weight of your investment in tock ; the expected return on tockA; ; is the variance of

the portfolio of Stock A and Stock is the standard deviation of returns on Stock is the variance of

returns on Stock A: is the problability of "bad" economuc condition in the future, is the expected return

on Stock A if the economic condition is good in the future. Similar letter notations were applied to tock B

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock