Question: 1. Create an Excel workbook and turn it into the assignments tab. 1. Problem 9: A piece of equipment is purchased for $110,000 and has

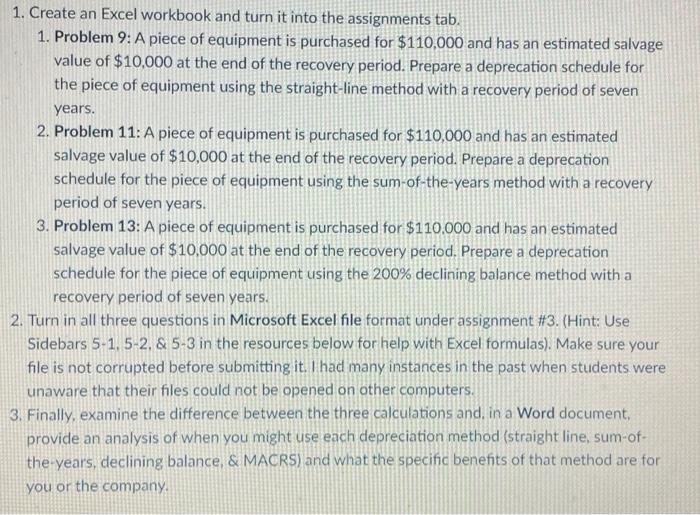

1. Create an Excel workbook and turn it into the assignments tab. 1. Problem 9: A piece of equipment is purchased for $110,000 and has an estimated salvage value of $10,000 at the end of the recovery period. Prepare a deprecation schedule for the piece of equipment using the straight-line method with a recovery period of seven years. 2. Problem 11: A piece of equipment is purchased for $110,000 and has an estimated salvage value of $10,000 at the end of the recovery period. Prepare a deprecation schedule for the piece of equipment using the sum-of-the-years method with a recovery period of seven years. 3. Problem 13: A piece of equipment is purchased for $110.000 and has an estimated salvage value of $10,000 at the end of the recovery period. Prepare a deprecation schedule for the piece of equipment using the 200% declining balance method with a recovery period of seven years. 2. Turn in all three questions in Microsoft Excel file format under assignment \#3. (Hint: Use Sidebars 5-1, 5-2, \& 5-3 in the resources below for help with Excel formulas). Make sure your file is not corrupted before submitting it. I had many instances in the past when students were unaware that their files could not be opened on other computers. Finally, examine the difference between the three calculations and in a Word document, provide an analysis of when you might use each depreciation method (straight line, sum-ofthe-years, declining balance, \& MACRS) and what the specific benefits of that method are for you or the company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts