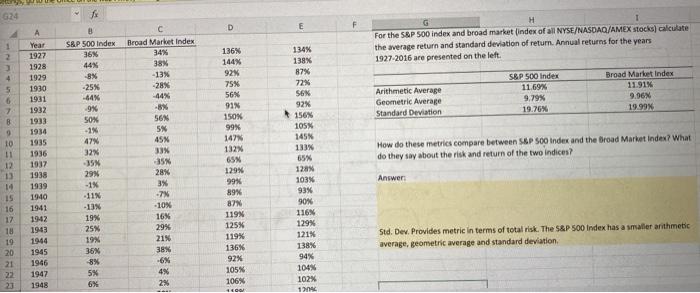

Question: 1 D E H 1 For the S&P 500 index and broad market index of all NYSE/NASDAQ/AMEX stocks) calculate the average return and standard deviation

1 D E H 1 For the S&P 500 index and broad market index of all NYSE/NASDAQ/AMEX stocks) calculate the average return and standard deviation of retum. Annual returns for the years 1927-2016 are presented on the left 1 S&P 500 Index 36% 44% -8% -25% -64% 9% 134% 138% 87% 72 S6 S&P 500 Index 11.69% 9.79% 19.76% Broad Market Index 11.91% 9.06% 19.99% Arithmetic Average Geometric Average Standard Deviation 92% 156 4 5 6 7 B 9 10 11 12 50% A Year 1927 1928 1929 1930 1931 1932 1933 1934 1935 1936 1937 1938 1939 1940 1941 1942 19:43 1944 1945 1946 1947 1948 136% 144% 92% 75% 56% 91N 150X 99% 147 132 65N 129% 99% Broad Market Index 34% 38% - 13% -28% -44% -BN 56N 5 45% 33% -35 28% 3% -7 -10% 16% 29% 21% 38% -6% 4% 2% How do these metrics compare between SAP SOO Index and the Broad Market Index? What do they say about the risk and return of the two indices? 105X 145 133% 65% 128% 103% 93% 90% Answer: 89% - 1% 47% 32x -35 29% -1% -11 - 13% 19% 25% 19% 36% -8% 5% 6% 14 15 16 17 116N 87 119N 125% 119% 136% 92% Std. Dev. Provides metric in terms of total risk. The S&P 500 Index has a smaller arithmetic average, geometric average and standard deviation 19 20 21 22 129% 1211 138% 94% 104 102% 12 105 106% 1 D E H 1 For the S&P 500 index and broad market index of all NYSE/NASDAQ/AMEX stocks) calculate the average return and standard deviation of retum. Annual returns for the years 1927-2016 are presented on the left 1 S&P 500 Index 36% 44% -8% -25% -64% 9% 134% 138% 87% 72 S6 S&P 500 Index 11.69% 9.79% 19.76% Broad Market Index 11.91% 9.06% 19.99% Arithmetic Average Geometric Average Standard Deviation 92% 156 4 5 6 7 B 9 10 11 12 50% A Year 1927 1928 1929 1930 1931 1932 1933 1934 1935 1936 1937 1938 1939 1940 1941 1942 19:43 1944 1945 1946 1947 1948 136% 144% 92% 75% 56% 91N 150X 99% 147 132 65N 129% 99% Broad Market Index 34% 38% - 13% -28% -44% -BN 56N 5 45% 33% -35 28% 3% -7 -10% 16% 29% 21% 38% -6% 4% 2% How do these metrics compare between SAP SOO Index and the Broad Market Index? What do they say about the risk and return of the two indices? 105X 145 133% 65% 128% 103% 93% 90% Answer: 89% - 1% 47% 32x -35 29% -1% -11 - 13% 19% 25% 19% 36% -8% 5% 6% 14 15 16 17 116N 87 119N 125% 119% 136% 92% Std. Dev. Provides metric in terms of total risk. The S&P 500 Index has a smaller arithmetic average, geometric average and standard deviation 19 20 21 22 129% 1211 138% 94% 104 102% 12 105 106%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts