Question: 1 . Daystream, Inc. is considering adding a new line of toys to its current product line. The new line will require an additional investment

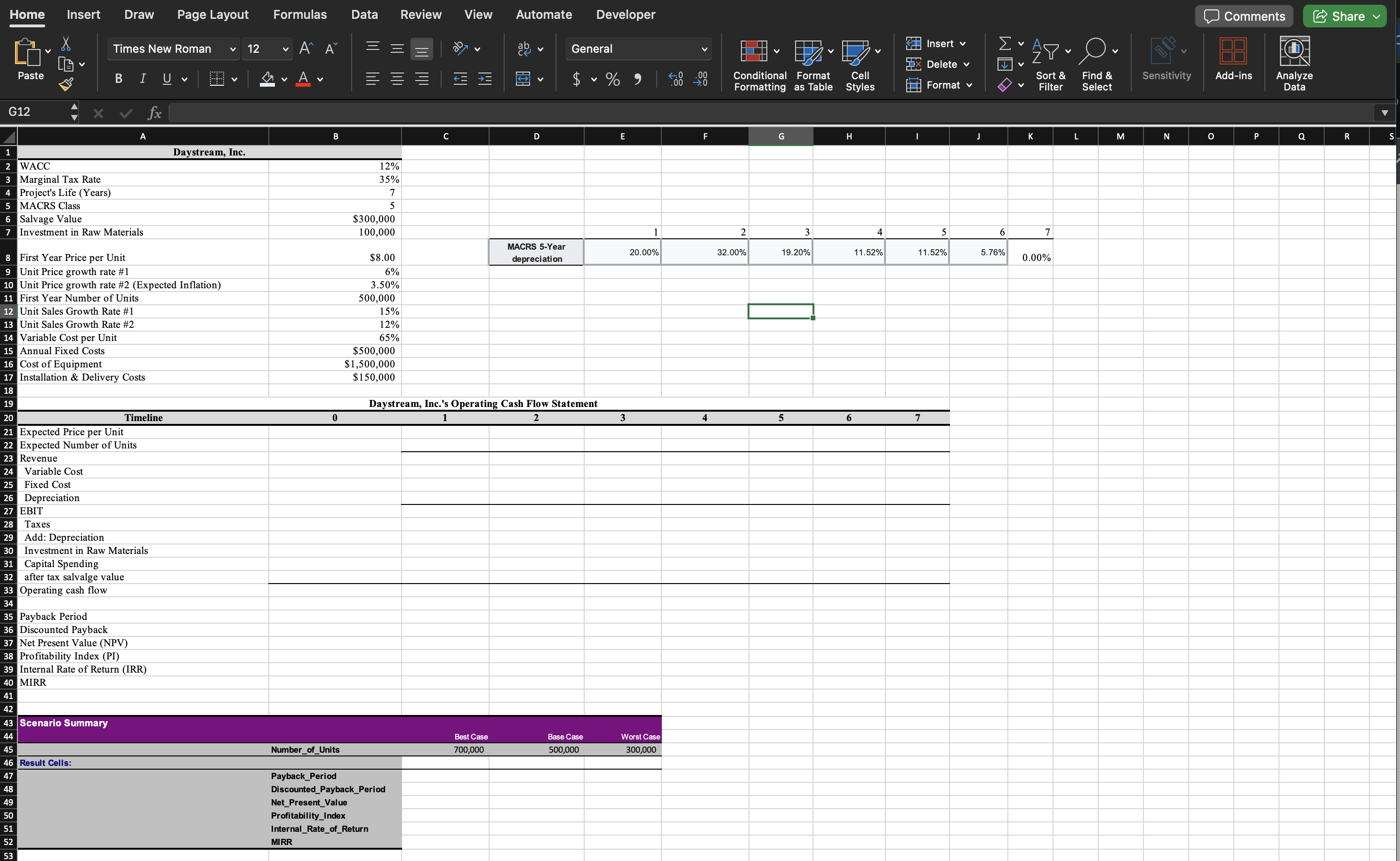

Daystream, Inc. is considering adding a new line of toys to its current product line. The new line will require an additional investment of $ in raw materials to produce the toys. The projects life is years and the firm estimates sales of packages at a price of $ per unit the first year; but this volume is expected to grow at for the next three years year ~year for the last three years of the project year ~year The price per unit is expected to grow at for the next four years year ~year and then at the historical average rate of inflation of for the last two years year ~year of the project. The variable costs will be of sales and the annual fixed costs will be $ The equipment required to produce the toys will cost $ and will require an additional $ to have it delivered and installed. This equipment has an expected useful life of years and will be depreciated using the MACRS year class life. After years, the equipment can be sold at a price of $ The cost of capital is and the firms marginal tax rate is aCalculate the initial investment, annual aftertax cash flows for each year, and the terminal cash flow. points bDetermine the payback period, discounted payback period, NPV PI IRR, and MIRR of the new line of toys. points cThe firm is considering three scenarios for the new line of toys. Under the best, base, and worst case scenario the firm will sell and packages the first year with the same expected growth rates in units and price described in the problem. What are the payback period, discounted payback period, NPV PI IRR, and MIRR under each of these scenarios. points MACRS Year depreciation

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock