Question: 1 Default Risk and Interest Rate Premium . Consider a two-period small open economy with a representative consumer. The economy is endowed with Y units

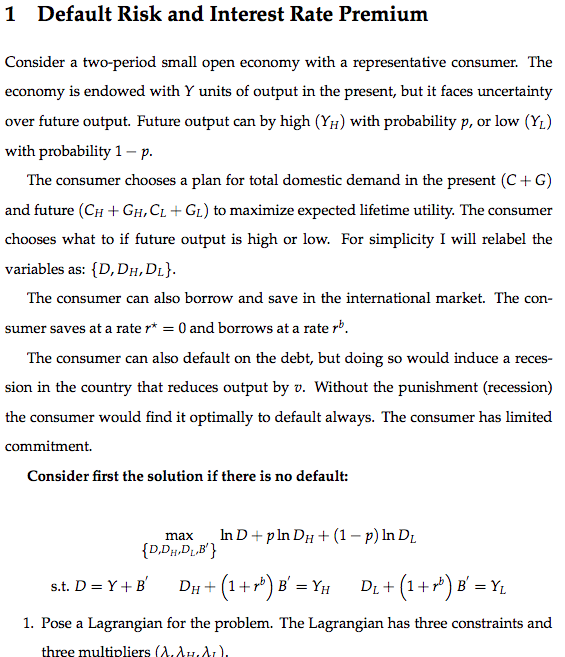

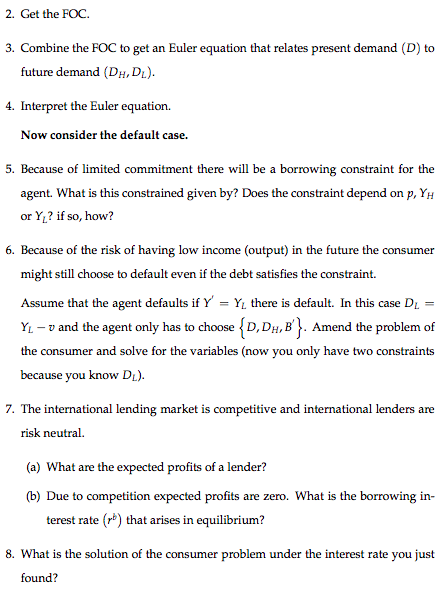

1 Default Risk and Interest Rate Premium . Consider a two-period small open economy with a representative consumer. The economy is endowed with Y units of output in the present, but it faces uncertainty over future output. Future output can by high (YH) with probability p, or low (YL) with probability 1 p. The consumer chooses a plan for total domestic demand in the present (C+G) and future (CH+GH,C_+GL) to maximize expected lifetime utility. The consumer chooses what to if future output is high or low. For simplicity I will relabel the variables as: {D, DH, DL}. The consumer can also borrow and save in the international market. The con- sumer saves at a rate r* = 0 and borrows at a rate pb. The consumer can also default on the debt, but doing so would induce a reces- sion in the country that reduces output by v. Without the punishment (recession) the consumer would find it optimally to default always. The consumer has limited commitment. Consider first the solution if there is no default: max = = In D+ pln DH + (1 - p) In DL {D,DHD_B'} s.t. D=Y+B DH+ (1+x") B' = YH B ++ (1+r) B = Y 1. Pose a Lagrangian for the problem. The Lagrangian has three constraints and three multipliers (2.2.2). a 2. Get the FOC. 3. Combine the FOC to get an Euler equation that relates present demand (D) to future demand (DH,DL). 4. Interpret the Euler equation. Now consider the default case. 5. Because of limited commitment there will be a borrowing constraint for the agent. What is this constrained given by? Does the constraint depend on p, YH or Y? if so, how? 6. Because of the risk of having low income (output) in the future the consumer might still choose to default even if the debt satisfies the constraint. Assume that the agent defaults if Y' = Y there is default. In this case D. = Yu v and the agent only has to choose {D, DH,B'}. Amend the problem of the consumer and solve for the variables (now you only have two constraints because you know DL). 7. The international lending market is competitive and international lenders are risk neutral. (a) What are the expected profits of a lender? (b) Due to competition expected profits are zero. What is the borrowing in- terest rate (r) that arises in equilibrium? 8. What is the solution of the consumer problem under the interest rate you just found? 1 Default Risk and Interest Rate Premium . Consider a two-period small open economy with a representative consumer. The economy is endowed with Y units of output in the present, but it faces uncertainty over future output. Future output can by high (YH) with probability p, or low (YL) with probability 1 p. The consumer chooses a plan for total domestic demand in the present (C+G) and future (CH+GH,C_+GL) to maximize expected lifetime utility. The consumer chooses what to if future output is high or low. For simplicity I will relabel the variables as: {D, DH, DL}. The consumer can also borrow and save in the international market. The con- sumer saves at a rate r* = 0 and borrows at a rate pb. The consumer can also default on the debt, but doing so would induce a reces- sion in the country that reduces output by v. Without the punishment (recession) the consumer would find it optimally to default always. The consumer has limited commitment. Consider first the solution if there is no default: max = = In D+ pln DH + (1 - p) In DL {D,DHD_B'} s.t. D=Y+B DH+ (1+x") B' = YH B ++ (1+r) B = Y 1. Pose a Lagrangian for the problem. The Lagrangian has three constraints and three multipliers (2.2.2). a 2. Get the FOC. 3. Combine the FOC to get an Euler equation that relates present demand (D) to future demand (DH,DL). 4. Interpret the Euler equation. Now consider the default case. 5. Because of limited commitment there will be a borrowing constraint for the agent. What is this constrained given by? Does the constraint depend on p, YH or Y? if so, how? 6. Because of the risk of having low income (output) in the future the consumer might still choose to default even if the debt satisfies the constraint. Assume that the agent defaults if Y' = Y there is default. In this case D. = Yu v and the agent only has to choose {D, DH,B'}. Amend the problem of the consumer and solve for the variables (now you only have two constraints because you know DL). 7. The international lending market is competitive and international lenders are risk neutral. (a) What are the expected profits of a lender? (b) Due to competition expected profits are zero. What is the borrowing in- terest rate (r) that arises in equilibrium? 8. What is the solution of the consumer problem under the interest rate you just found

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts