Question: 1. Define current liability and identify examples of current liabilities. 2. Define unearned revenue and identify the type of account it is. 3. Record

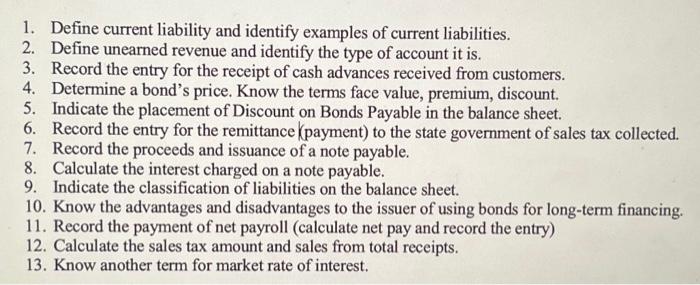

1. Define current liability and identify examples of current liabilities. 2. Define unearned revenue and identify the type of account it is. 3. Record the entry for the receipt of cash advances received from customers. 4. Determine a bond's price. Know the terms face value, premium, discount. 5. Indicate the placement of Discount on Bonds Payable in the balance sheet. 6. Record the entry for the remittance (payment) to the state government of sales tax collected. 7. Record the proceeds and issuance of a note payable. 8. Calculate the interest charged on a note payable. 9. Indicate the classification of liabilities on the balance sheet. 10. Know the advantages and disadvantages to the issuer of using bonds for long-term financing. 11. Record the payment of net payroll (calculate net pay and record the entry) 12. Calculate the sales tax amount and sales from total receipts. 13. Know another term for market rate of interest.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts