Question: 1. Determine the equilibrium return based on the CAPM (Capital Asset Pricing Model) or SML (Security Market Line) for Home Depot stock price ($321.46). In

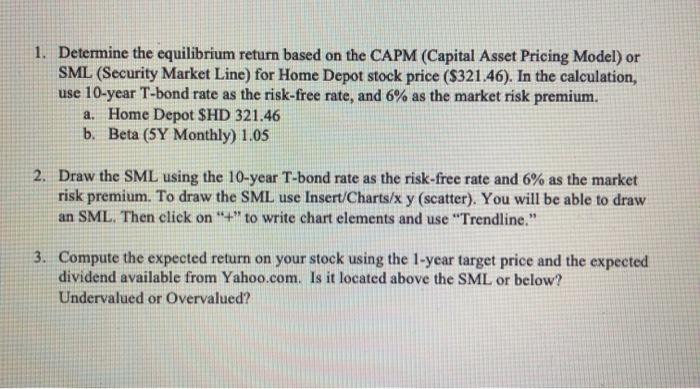

1. Determine the equilibrium return based on the CAPM (Capital Asset Pricing Model) or SML (Security Market Line) for Home Depot stock price ($321.46). In the calculation, use 10-year T-bond rate as the risk-free rate, and 6% as the market risk premium. a. Home Depot SHD 321.46 b. Beta (5Y Monthly) 1.05 2. Draw the SML using the 10-year T-bond rate as the risk-free rate and 6% as the market risk premium. To draw the SML use Insert/Charts/xy (scatter). You will be able to draw an SML. Then click on "*" to write chart elements and use "Trendline." 3. Compute the expected return on your stock using the 1-year target price and the expected dividend available from Yahoo.com. Is it located above the SML or below? Undervalued or Overvalued? 1. Determine the equilibrium return based on the CAPM (Capital Asset Pricing Model) or SML (Security Market Line) for Home Depot stock price ($321.46). In the calculation, use 10-year T-bond rate as the risk-free rate, and 6% as the market risk premium. a. Home Depot SHD 321.46 b. Beta (5Y Monthly) 1.05 2. Draw the SML using the 10-year T-bond rate as the risk-free rate and 6% as the market risk premium. To draw the SML use Insert/Charts/xy (scatter). You will be able to draw an SML. Then click on "*" to write chart elements and use "Trendline." 3. Compute the expected return on your stock using the 1-year target price and the expected dividend available from Yahoo.com. Is it located above the SML or below? Undervalued or Overvalued

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts