Question: 1. Develop a spreadsheet model and use it to nd the project's NPV, IRR, and payback. Conduct a sensitivity analysis to determine the sensitivity of

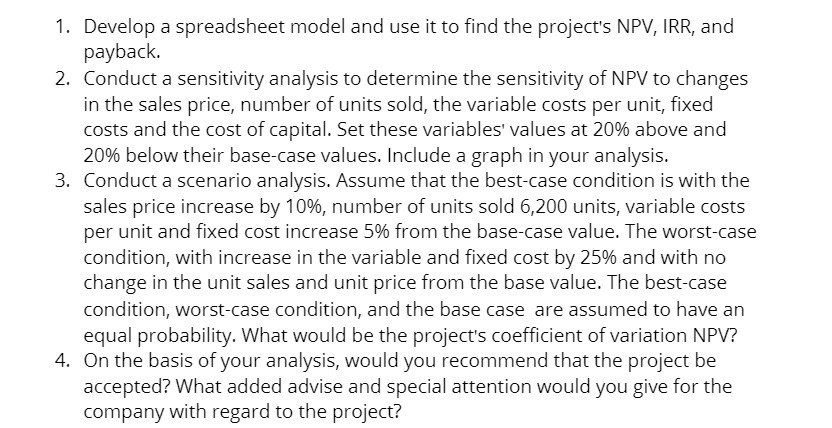

1. Develop a spreadsheet model and use it to nd the project's NPV, IRR, and payback. Conduct a sensitivity analysis to determine the sensitivity of NP'v' to changes in the sales price, number of units sold, the variable costs per unit, xed costs and the cost of capital. Set these variables' values at 20% above and 20% below their base-case values. Include a graph in your analysis. Conduct a scenario analysis. Assume that the bestcase condition is with the sales price increase by 10%, number of units sold 6,200 units, variable costs per unit and fixed cost increase 5% from the base-case value. The worst-case condition, with increase in the variable and fixed cost by 25% and with no change in the unit sales and unit price from the base value. The best-case condition, worstcase condition, and the base case are assumed to have an equal probability. What would be the project's coefficient of variation NPV? On the basis of your analysis, would you recommend that the project be accepted? What added advise and special attention would you give for the company with regard to the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts