Question: 1. DGJ is an equal partnership in which each partner has an outside basis and capital account balance of $1000. On January 1 of this

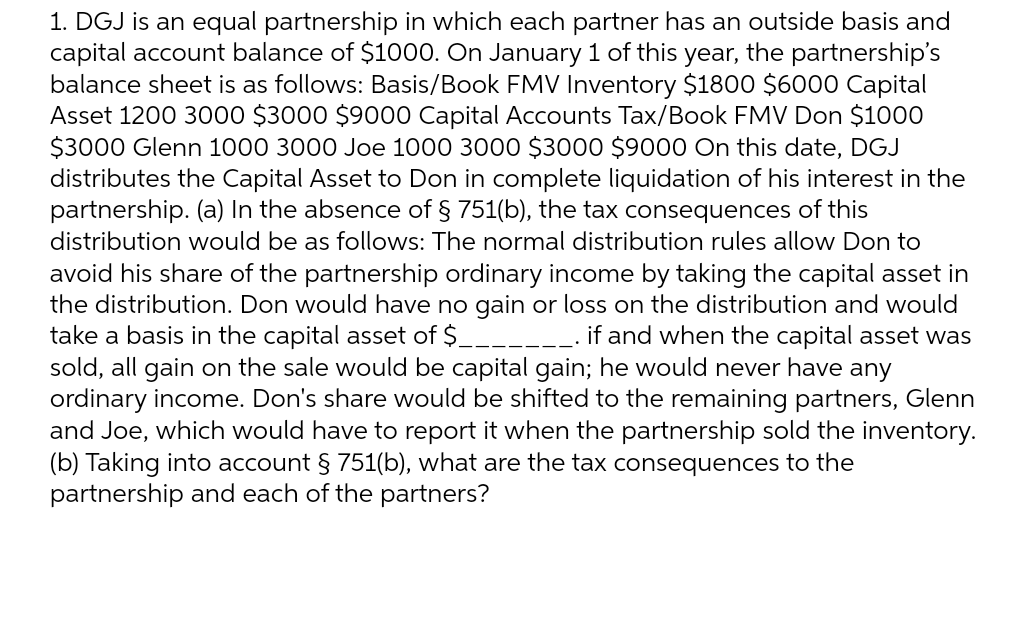

1. DGJ is an equal partnership in which each partner has an outside basis and capital account balance of $1000. On January 1 of this year, the partnership's balance sheet is as follows: Basis/Book FMV Inventory $1800 $6000 Capital Asset 1200 3000 $3000 $9000 Capital Accounts Tax/Book FMV Don $1000 $3000 Glenn 1000 3000 Joe 1000 3000 $3000 $9000 On this date, DGJ distributes the Capital Asset to Don in complete liquidation of his interest in the partnership. (a) In the absence of 751(b), the tax consequences of this distribution would be as follows: The normal distribution rules allow Don to avoid his share ofthe partnership ordinary income by taking the capital asset in the distribution. Don would have no gain or loss on the distribution and would take a basis in the capital asset of $ _______ . if and when the capital asset was sold, all gain on the sale would be capital gain; he would never have any ordinary income. Don's share would be shifted to the remaining partners, Glenn and Joe, which would have to report it when the partnership sold the inventory. (b) Taking into account 751(b), what are the tax consequences to the partnership and each of the partners

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts