Question: 1. Discuss the two variables that must be considered whether you are using the present value of cash flow approach or the relative valuation ratio

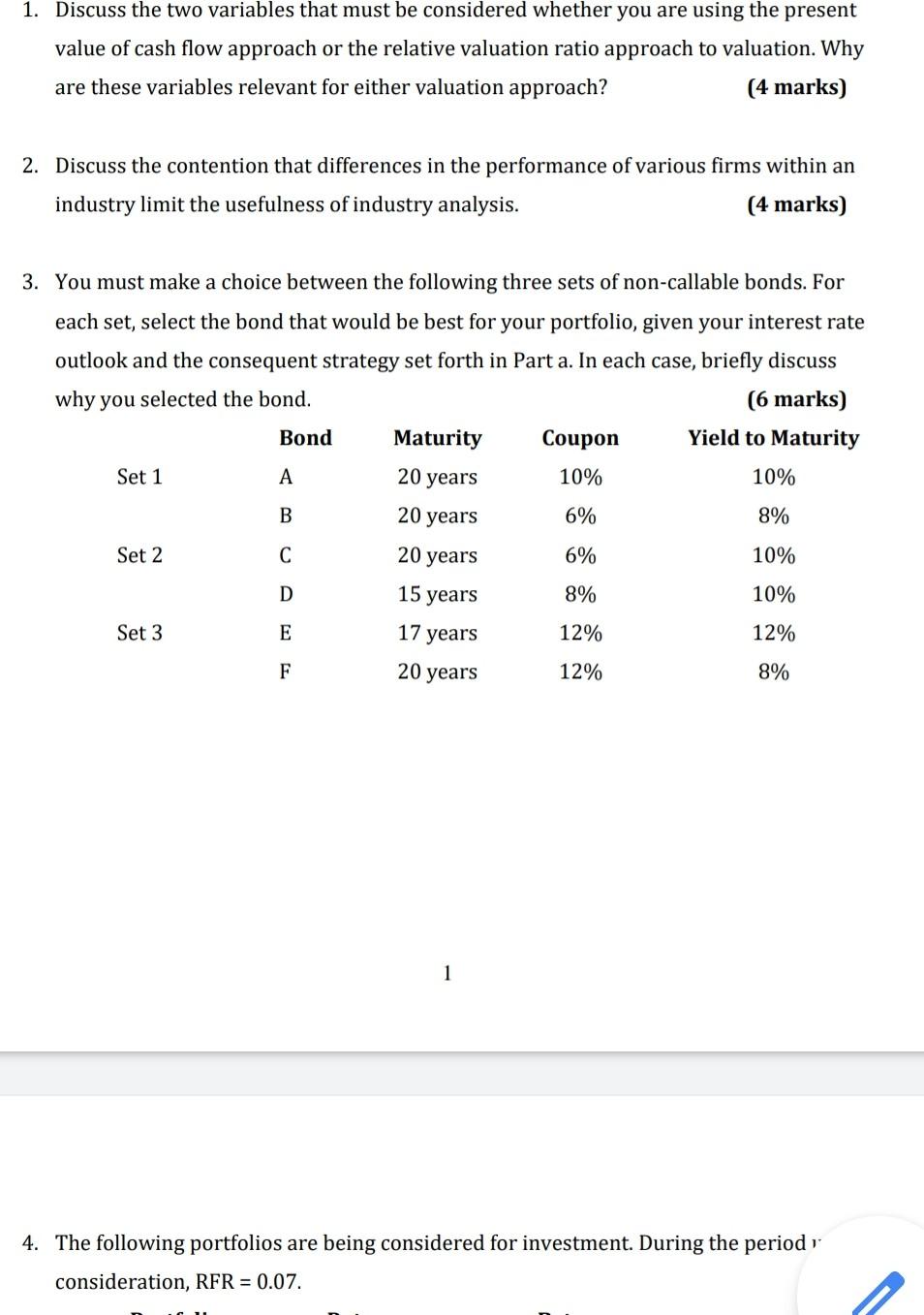

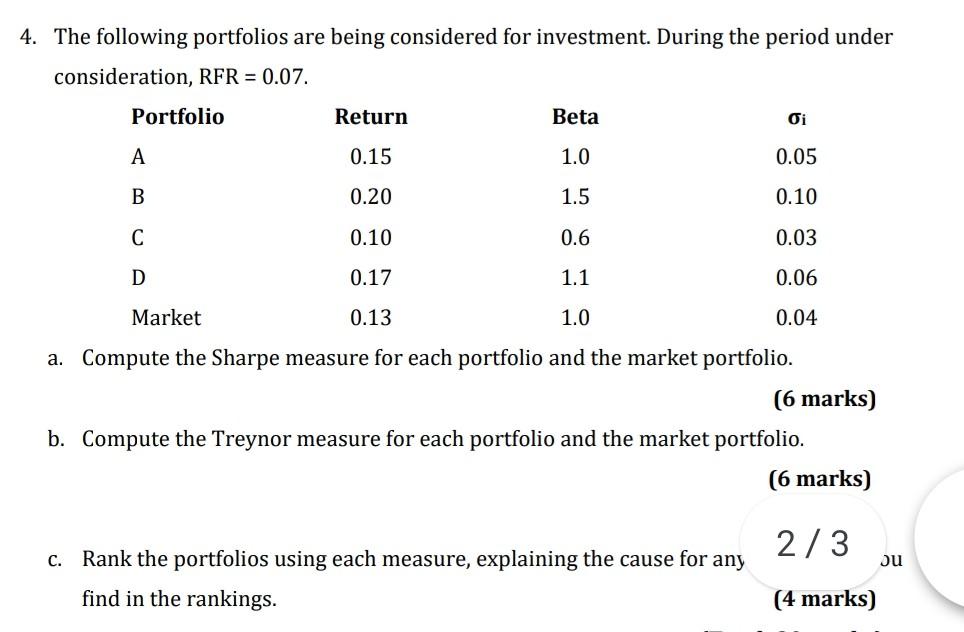

1. Discuss the two variables that must be considered whether you are using the present value of cash flow approach or the relative valuation ratio approach to valuation. Why are these variables relevant for either valuation approach? (4 marks) 2. Discuss the contention that differences in the performance of various firms within an industry limit the usefulness of industry analysis. (4 marks) 3. You must make a choice between the following three sets of non-callable bonds. For each set, select the bond that would be best for your portfolio, given your interest rate outlook and the consequent strategy set forth in Part a. In each case, briefly discuss why you selected the bond. (6 marks) Bond Maturity Coupon Yield to Maturity Set 1 A 10% 10% 20 years B 20 years 6% 8% Set 2 C 20 years 6% 10% D 15 years 8% 10% Set 3 E 17 years 12% 12% F 20 years 12% 8% 4. The following portfolios are being considered for investment. During the period consideration, RFR = 0.07. 4. The following portfolios are being considered for investment. During the period under consideration, RFR = 0.07. Portfolio Return Beta Oi A 0.15 1.0 0.05 B 0.20 1.5 0.10 0.10 0.6 0.03 D 0.17 1.1 0.06 Market 0.13 1.0 0.04 a. Compute the Sharpe measure for each portfolio and the market portfolio. (6 marks) b. Compute the Treynor measure for each portfolio and the market portfolio. (6 marks) 2/3 C. Ju Rank the portfolios using each measure, explaining the cause for any find in the rankings. (4 marks) 1. Discuss the two variables that must be considered whether you are using the present value of cash flow approach or the relative valuation ratio approach to valuation. Why are these variables relevant for either valuation approach? (4 marks) 2. Discuss the contention that differences in the performance of various firms within an industry limit the usefulness of industry analysis. (4 marks) 3. You must make a choice between the following three sets of non-callable bonds. For each set, select the bond that would be best for your portfolio, given your interest rate outlook and the consequent strategy set forth in Part a. In each case, briefly discuss why you selected the bond. (6 marks) Bond Maturity Coupon Yield to Maturity Set 1 A 10% 10% 20 years B 20 years 6% 8% Set 2 C 20 years 6% 10% D 15 years 8% 10% Set 3 E 17 years 12% 12% F 20 years 12% 8% 4. The following portfolios are being considered for investment. During the period consideration, RFR = 0.07. 4. The following portfolios are being considered for investment. During the period under consideration, RFR = 0.07. Portfolio Return Beta Oi A 0.15 1.0 0.05 B 0.20 1.5 0.10 0.10 0.6 0.03 D 0.17 1.1 0.06 Market 0.13 1.0 0.04 a. Compute the Sharpe measure for each portfolio and the market portfolio. (6 marks) b. Compute the Treynor measure for each portfolio and the market portfolio. (6 marks) 2/3 C. Ju Rank the portfolios using each measure, explaining the cause for any find in the rankings. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts