Question: The one sheet did not print the excel lines or boxes. I need help with the form to fill in the spaces on the columns

The one sheet did not print the excel lines or boxes. I need help with the form to fill in the spaces on the columns going down and across and also up by the top left corner and top right corner.

This is the third time I have posted this question at different time. When it uploads sometime it comes up blurry and I don't know why. Hopefully these photos will help

if anyone could help me with this and the formulas to go with it. I know its a lot if time so i truly appreciate anyones help with it!

if anyone could help me with this and the formulas to go with it. I know its a lot if time so i truly appreciate anyones help with it!

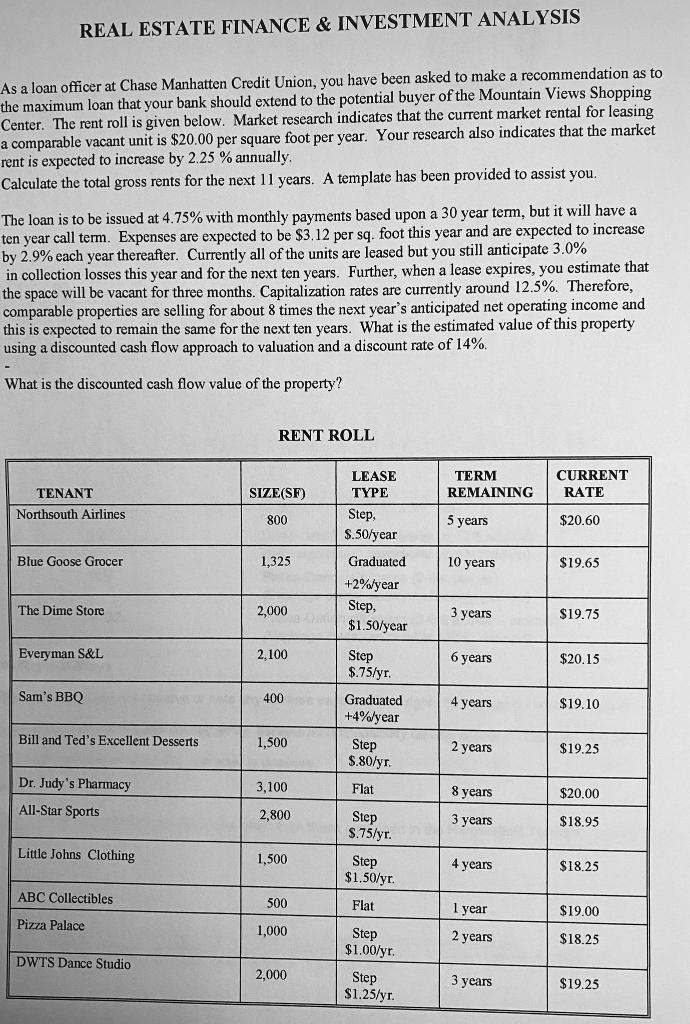

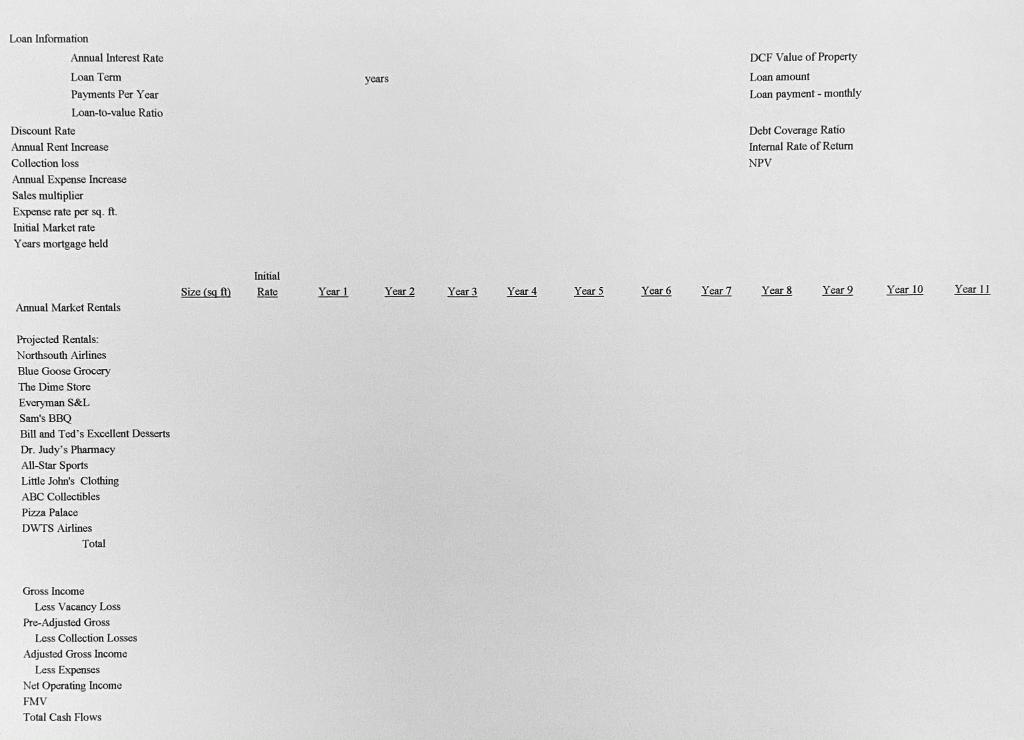

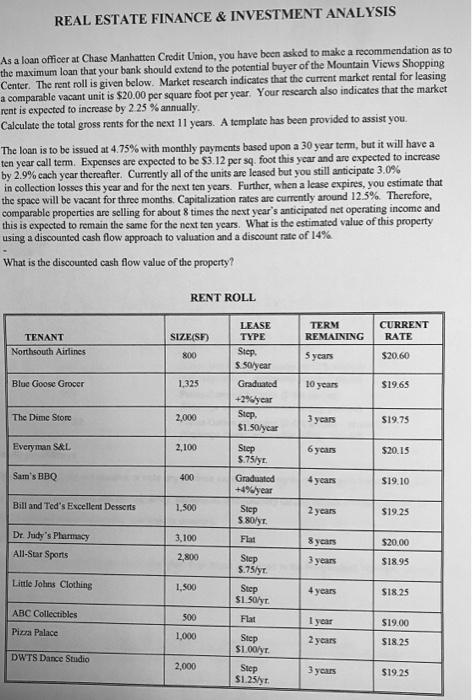

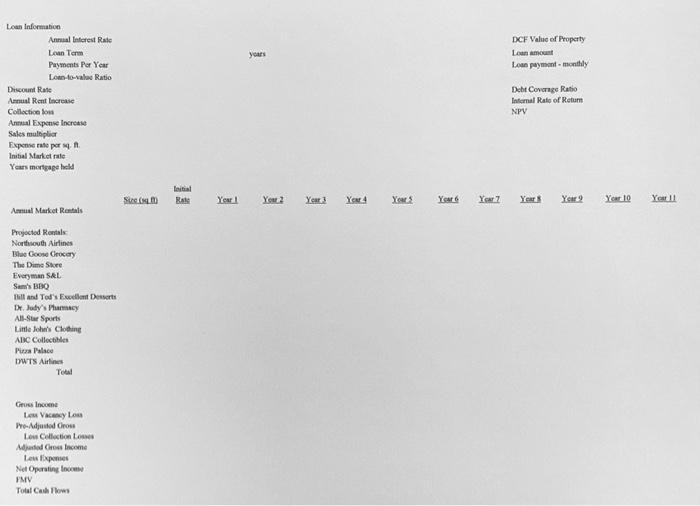

REAL ESTATE FINANCE & INVESTMENT ANALYSIS As a loan officer at Chase Manhatten Credit Union, you have been asked to make a recommendation as to the maximum loan that your bank should extend to the potential buyer of the Mountain Views Shopping Center. The rent roll is given below. Market research indicates that the current market rental for leasing a comparable vacant unit is $20.00 per square foot per year. Your research also indicates that the market rent is expected to increase by 2.25 % annually. Calculate the total gross rents for the next 11 years. A template has been provided to assist you. The loan is to be issued at 4.75% with monthly payments based upon a 30 year term, but it will have a ten year call term. Expenses are expected to be $3.12 per sq. foot this year and are expected to increase by 2.9% each year thereafter. Currently all of the units are leased but you still anticipate 3.0% in collection losses this year and for the next ten years. Further, when a lease expires, you estimate that the space will be vacant for three months. Capitalization rates are currently around 12.5%. Therefore, comparable properties are selling for about 8 times the next year's anticipated net operating income and this is expected to remain the same for the next ten years. What is the estimated value of this property using a discounted cash flow approach to valuation and a discount rate of 14%. - What is the discounted cash flow value of the property? RENT ROLL TERM REMAINING CURRENT RATE SIZE(SF) TENANT Northsouth Airlines LEASE TYPE Step, $.50/year 800 5 years $20.60 Blue Goose Grocer 1,325 10 years $19.65 Graduated +2%/year Step, $1.50/year The Dime Store 2,000 3 years $19.75 Everyman S&L 2.100 Step $.75/yr. 6 years $20.15 Sam's BBQ 400 Graduated +4%/year 4 years $19.10 Bill and Ted's Excellent Desserts 1,500 Step $.80/yr. 2 years $19.25 3,100 Flat Dr. Judy's Pharmacy All-Star Sports 8 years $20.00 2,800 Step $.75/yr. 3 years $18.95 Little Johns Clothing 1,500 Step $1.50/yr. 4 years $18.25 ABC Collectibles 500 Flat 1 year $19.00 Pizza Palace 1,000 Step $1.00/yr. 2 years $18.25 DWTS Dance Studio 2,000 Step $1.25/yr. 3 years $19.25 years DCF Value of Property Loan amount Loan payment - monthly Loan Information Annual Interest Rate Loan Term Payments Per Year Loan-to-value Ratio Discount Rate Annual Rent Increase Collection loss Annual Expense Increase Sales multiplier Expense rate per sq. ft. Initial Market rate Years mortgage held Debt Coverage Ratio Internal Rate of Return NPV Initial Rate Size (sq ft) Year 1 Year 1 Year 2 Year 2 Year 3 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Year 11 (ear 11 Annual Market Rentals Sam's BBQ Projected Rentals: Northsouth Airlines Blue Goose Grocery The Dime Store Everyman S&L DO Bill and Ted's Excellent Desserts Dr. Judy's Pharmacy All-Star Sports Little John's Clothing ABC Collectibles Pizza Palace DWTS Airlines Total Gross Income Less Vacancy Loss Pre-Adjusted Gross Less Collection Losses Adjusted Gross Income Less Expenses Net Operating Income FMV Total Cash Flows REAL ESTATE FINANCE & INVESTMENT ANALYSIS As a loan officer at Chase Manhatten Credit Union, you have been asked to make a recommendation as to the maximum loan that your bank should extend to the potential buyer of the Mountain Views Shopping Center. The rent roll is given below. Market research indicates that the current market rental for leasing a comparable vacant unit is $20.00 per square foot per year. Your research also indicates that the market rent is expected to increase by 2 25 % annually. Calculate the total gross rents for the next 11 years. A template has been provided to assist you. The loan is to be issued at 4.75% with monthly payments based upon a 30 year term, but it will have a ten year call term. Expenses are expected to be 53.12 per sq. foot this year and are expected to increase by 2.9% cach year thereafter. Currently all of the units are leased but you still anticipate 3.0% in collection losses this year and for the next ten years. Further, when a lease expires, you estimate that the space will be vacant for three months. Capitalization rates are currently around 12.5%. Therefore, comparable properties are selling for about 8 times the next year's anticipated net operating income and this is expected to remain the same for the next ten years. What is the estimated value of this property using a discounted cash flow approach to valuation and a discount rate of 14% What is the discounted cash flow value of the property? RENT ROLL TERM REMAINING CURRENT RATE SIZE(SE) TENANT NorthSouth Airlines 800 5 years $20.60 LEASE TYPE Step 5.50/year Graduated +29/year Step $1.50/year Blue Goose Grocer 1,325 10 years $19.65 The Dime Store 2,000 3 years $19.75 Everyman S&L 2,100 6 years $20.15 Sam's BBO Step 5.75ly Graduated +4%/year 400 $19.10 Bill and Ted's Excellent Desserts 1,500 Step $ 80yr 2 years $19.25 Dr. Judy's Plamacy All-Sur Sports Flat 8 years $20.00 3.100 2,800 Step 5.75lyr. 3 years $18.95 Little Jolins Clothing 1,500 Step $1.50yr. 4 years $18.25 ABC Collectibles 500 Flat 1 year $19.00 Piura Palace 1.000 2 years $18.25 DWTS Dance Studio Step $1.00lyr. Step $1.25tyr. 2,000 3 years $19.25 years DCF Value of Property Loan amount Lom payment monthly Loan Information Annual Inforest Rate Len Term Payments Por Year Low-to-value Ratio Discount Rate Annual Rent Increase Collection Annual Expense Increase Sales multiplier Expense rate por 1 Initial Market rate Years mortgage like Debt Coverage Ratio Infomal Rate of Return NPV Intel Ste ( Yes 2 Year Yer 4 Years Years Yox Years Year 2 Your 10 Year 11 Annual Market Rentals Proyected as Northsouth Airlines Blue Goose Geocary The Dime Store Everyman SRL Sam's BBQ Holland Tod's Exo Desserts Dr. Jody my All-Star Sports Little John's Clothing ABC Collectibles PuraPalace DWTS Airlines To Gross Income Le Voy Low ProAutodrom Low Collection Le Address Income Le lips Net Operating In PMY Total Cash REAL ESTATE FINANCE & INVESTMENT ANALYSIS As a loan officer at Chase Manhatten Credit Union, you have been asked to make a recommendation as to the maximum loan that your bank should extend to the potential buyer of the Mountain Views Shopping Center. The rent roll is given below. Market research indicates that the current market rental for leasing a comparable vacant unit is $20.00 per square foot per year. Your research also indicates that the market rent is expected to increase by 2.25 % annually. Calculate the total gross rents for the next 11 years. A template has been provided to assist you. The loan is to be issued at 4.75% with monthly payments based upon a 30 year term, but it will have a ten year call term. Expenses are expected to be $3.12 per sq. foot this year and are expected to increase by 2.9% each year thereafter. Currently all of the units are leased but you still anticipate 3.0% in collection losses this year and for the next ten years. Further, when a lease expires, you estimate that the space will be vacant for three months. Capitalization rates are currently around 12.5%. Therefore, comparable properties are selling for about 8 times the next year's anticipated net operating income and this is expected to remain the same for the next ten years. What is the estimated value of this property using a discounted cash flow approach to valuation and a discount rate of 14%. - What is the discounted cash flow value of the property? RENT ROLL TERM REMAINING CURRENT RATE SIZE(SF) TENANT Northsouth Airlines LEASE TYPE Step, $.50/year 800 5 years $20.60 Blue Goose Grocer 1,325 10 years $19.65 Graduated +2%/year Step, $1.50/year The Dime Store 2,000 3 years $19.75 Everyman S&L 2.100 Step $.75/yr. 6 years $20.15 Sam's BBQ 400 Graduated +4%/year 4 years $19.10 Bill and Ted's Excellent Desserts 1,500 Step $.80/yr. 2 years $19.25 3,100 Flat Dr. Judy's Pharmacy All-Star Sports 8 years $20.00 2,800 Step $.75/yr. 3 years $18.95 Little Johns Clothing 1,500 Step $1.50/yr. 4 years $18.25 ABC Collectibles 500 Flat 1 year $19.00 Pizza Palace 1,000 Step $1.00/yr. 2 years $18.25 DWTS Dance Studio 2,000 Step $1.25/yr. 3 years $19.25 years DCF Value of Property Loan amount Loan payment - monthly Loan Information Annual Interest Rate Loan Term Payments Per Year Loan-to-value Ratio Discount Rate Annual Rent Increase Collection loss Annual Expense Increase Sales multiplier Expense rate per sq. ft. Initial Market rate Years mortgage held Debt Coverage Ratio Internal Rate of Return NPV Initial Rate Size (sq ft) Year 1 Year 1 Year 2 Year 2 Year 3 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Year 11 (ear 11 Annual Market Rentals Sam's BBQ Projected Rentals: Northsouth Airlines Blue Goose Grocery The Dime Store Everyman S&L DO Bill and Ted's Excellent Desserts Dr. Judy's Pharmacy All-Star Sports Little John's Clothing ABC Collectibles Pizza Palace DWTS Airlines Total Gross Income Less Vacancy Loss Pre-Adjusted Gross Less Collection Losses Adjusted Gross Income Less Expenses Net Operating Income FMV Total Cash Flows REAL ESTATE FINANCE & INVESTMENT ANALYSIS As a loan officer at Chase Manhatten Credit Union, you have been asked to make a recommendation as to the maximum loan that your bank should extend to the potential buyer of the Mountain Views Shopping Center. The rent roll is given below. Market research indicates that the current market rental for leasing a comparable vacant unit is $20.00 per square foot per year. Your research also indicates that the market rent is expected to increase by 2 25 % annually. Calculate the total gross rents for the next 11 years. A template has been provided to assist you. The loan is to be issued at 4.75% with monthly payments based upon a 30 year term, but it will have a ten year call term. Expenses are expected to be 53.12 per sq. foot this year and are expected to increase by 2.9% cach year thereafter. Currently all of the units are leased but you still anticipate 3.0% in collection losses this year and for the next ten years. Further, when a lease expires, you estimate that the space will be vacant for three months. Capitalization rates are currently around 12.5%. Therefore, comparable properties are selling for about 8 times the next year's anticipated net operating income and this is expected to remain the same for the next ten years. What is the estimated value of this property using a discounted cash flow approach to valuation and a discount rate of 14% What is the discounted cash flow value of the property? RENT ROLL TERM REMAINING CURRENT RATE SIZE(SE) TENANT NorthSouth Airlines 800 5 years $20.60 LEASE TYPE Step 5.50/year Graduated +29/year Step $1.50/year Blue Goose Grocer 1,325 10 years $19.65 The Dime Store 2,000 3 years $19.75 Everyman S&L 2,100 6 years $20.15 Sam's BBO Step 5.75ly Graduated +4%/year 400 $19.10 Bill and Ted's Excellent Desserts 1,500 Step $ 80yr 2 years $19.25 Dr. Judy's Plamacy All-Sur Sports Flat 8 years $20.00 3.100 2,800 Step 5.75lyr. 3 years $18.95 Little Jolins Clothing 1,500 Step $1.50yr. 4 years $18.25 ABC Collectibles 500 Flat 1 year $19.00 Piura Palace 1.000 2 years $18.25 DWTS Dance Studio Step $1.00lyr. Step $1.25tyr. 2,000 3 years $19.25 years DCF Value of Property Loan amount Lom payment monthly Loan Information Annual Inforest Rate Len Term Payments Por Year Low-to-value Ratio Discount Rate Annual Rent Increase Collection Annual Expense Increase Sales multiplier Expense rate por 1 Initial Market rate Years mortgage like Debt Coverage Ratio Infomal Rate of Return NPV Intel Ste ( Yes 2 Year Yer 4 Years Years Yox Years Year 2 Your 10 Year 11 Annual Market Rentals Proyected as Northsouth Airlines Blue Goose Geocary The Dime Store Everyman SRL Sam's BBQ Holland Tod's Exo Desserts Dr. Jody my All-Star Sports Little John's Clothing ABC Collectibles PuraPalace DWTS Airlines To Gross Income Le Voy Low ProAutodrom Low Collection Le Address Income Le lips Net Operating In PMY Total Cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts